Will Bitcoin Reach $200k in the Future?

Expert Bitcoin Price Predictions for 2025 and beyond

The future direction of Bitcoin from 2025 onward depends on multiple elements which will determine its path. The 2024 halving event will create a supply shortage that will increase prices because institutions will show more interest and regulatory clarity will emerge.

The market expects Bitcoin prices to reach between $120,000 and $180,000 during 2025 because spot Bitcoin ETFs will create a price increase. The market faces potential instability because multiple market elements exist in the current market situation. The market predictions will change when economic conditions shift or when new regulations emerge.

The technical analysis section shows Bitcoin market behavior by identifying key support and resistance levels which traders use to predict future market directions.

Bitcoin will achieve $200,000 success only if it continues to follow its past patterns which depend on institutional market entry and investor trust growth.

Image1. Technical Analysis of Bitcoin Price Movements Using Candlestick Charts and Fibonacci Retracements

BTC Price Forecast 2025, 2026, 2030 Analysis

Key Drivers:

- The price of Bitcoin will experience exponential growth because of three main factors which include ETF adoption rates and macro interest rates and dollar liquidity cycles.

- The post-halving mining economics and global crypto regulation environment and corporate and sovereign adoption will also impact Bitcoin’s price.

Factors Influencing Bitcoin’s Potential to Reach $200K

The direction of Bitcoin depends on market fundamentals which determine how supply and demand interact with each other. The market potential of Bitcoin remains strong because its total supply will never exceed 21 million coins.

The 2024 halving event has exposed Bitcoin’s restricted supply to more investors. The supply side experiences unexpected shocks during these events which result in price increases during subsequent years. Major financial institutions now view Bitcoin as a standard asset class which continues to draw market interest.

The current high profitability levels in the market could lead to short-term market stabilization while experts discuss the possibility of Bitcoin reaching $200,000 in 2025. The combination of institutional investment and positive economic factors and expanding worldwide adoption makes it more likely for Bitcoin to reach $200,000.

The technical analysis in [cited] delivers complete market projections and vital indicators which visual data demonstrates will lead to a positive market direction.

Bitcoin Price Prediction 2025 to 2030

The Stock-to-Flow (S2F) model together with logarithmic growth curves and on-chain accumulation trends indicate Bitcoin will experience long-term price growth.

2025 Prediction

- The price of Bitcoin will stay between $120,000 and $180,000 during this year.

- The market will experience a supply shock after the halving event while institutional investors will start buying Bitcoin through spot BTC ETFs.

2026 Prediction

- The market will experience a price correction between $90,000 and $150,000 during this year.

- The market will experience a price correction during 2026 because investors will process the gains from 2025.

2027–2028 Prediction

- The Bitcoin price will stay between $150,000 and $220,000 throughout this time period.

- The market shows price appreciation before the halving event because investors begin acquiring Bitcoin for future storage needs.

2029–2030 Prediction

The market will experience substantial growth because Bitcoin will become accepted worldwide while its supply remains limited and sovereign wealth funds begin using it for their investments.

Analysis of Long-Term Trends and Market Cycles

The analysis of Bitcoin price fluctuations becomes easier to understand through studying historical market data and how investors behave in the market. The 2024 halving event will produce major price fluctuations which will continue to affect the market throughout 2025 and into future years.

The market follows a basic four-year pattern which serves as its core behavioral structure. The process consists of three distinct stages which start with accumulation followed by bullish expansion and then end with market corrections. The established pattern from past events enables us to forecast upcoming market developments.

The post-halving period typically brings substantial price increases because of decreasing supply and growing institutional investment. The Bitcoin forecast which predicts $200,000 or higher value by 2025 shows promising potential through its analysis of standard market trends and macroeconomic factors that include liquidity control and regulatory shifts.

The supply and demand system which controls Bitcoin value formation keeps Bitcoin functioning as a macro asset instead of a speculative instrument. [Image below]

Long Term Bitcoin Price Predictions and Trends

Bitcoin price growth receives support from these five long-term factors.

- Organizations maintain their long-term investment of Bitcoin reserves

- Businesses have adopted Bitcoin as their main payment choice.

- The investment portfolios of retirement funds now include Bitcoin as an investment option.

- CBDCs create market standards which decentralized financial systems need to function properly.

- Digital assets attract more users from younger generations

AI-based trading systems and risk management tools create market liquidity when they start operating.

Bitcoin has evolved into a macro asset which extends beyond its status as a digital currency for speculation.

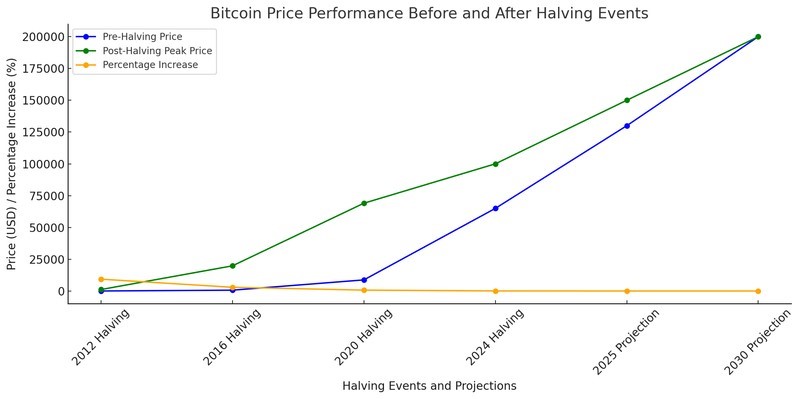

The chart displays Bitcoin price data from 2012 until 2025 and 2030 projections showing its behavior before and after each halving event. The chart demonstrates that Bitcoin prices rise substantially following each halving event yet the price growth rate decreases with each subsequent event. The market value predictions show Bitcoin will achieve prices between $130,000 and $150,000 during late 2025 and will reach $200,000 by 2030.

Bitcoin Halving Impact on Price Predictions

The halving process occurred in 2012 and 2016 and 2020 and 2024 to reduce miner rewards which led to market scarcity that has consistently produced two effects:

- The market reached its highest point since its first day of operation.

- Institutional investors began to enter the market in greater numbers.

- The supply of Bitcoin decreased because miners started selling less due to reduced rewards.

The 2024 halving process will produce market effects that align with previous events which indicates a positive price outlook for 2025.

Bitcoin Market Cycle Prediction for Next Bull Run

The Bitcoin market follows a predictable four-year pattern which consists of:

- The market becomes stable during the year following halving which allows investors to accumulate assets.

- The price began to rise rapidly after the halving period started a bull market that followed a parabolic pattern.

- The market experiences growth until it reaches its peak before starting a period of decline.

- Investors can establish their market positions through the pre-halving period which leads to the upcoming market cycle.

Experts predict that:

- The peak of the bull market will occur during 2025.

- The market will experience a major correction during 2026.

- The market will enter a new accumulation period which will span from 2027 to 2028.

- The market will experience another bull run from 2029 to 2030 which will drive prices above $250K.

Bitcoin Price Forecast After 2025 Halving

The Bitcoin price prediction indicates a positive direction after the 2025 halving event.

The post-halving market period usually brings about:

The Bitcoin price experienced major increases throughout a 12–18-month period.

- Big investors begin acquiring Bitcoin ETFs and spot market assets simultaneously.

- Corporations and treasuries start using Bitcoin at a large scale

The current market conditions show that BTC will reach $150K–$200K before it experiences any major price decline.

How High Can Bitcoin Go by 2030?

The maximum Bitcoin value prediction for 2030 has not been established.

Experts provide a wide range:

- Conservative estimate: $200K–$300K

- Moderate estimate: $350K–$500K

- Aggressive estimate (ARK Invest): $1M+

Factors influencing 2030 valuation:

- Regulatory clarity

- Institutional adoption

- Bitcoin functions as a reserve asset.

- Limited supply vs. rising global demand

- The public has lost faith in traditional fiat currency systems.

- Mining decentralization

Future of Bitcoin Price in the Next 5 to 10 Years

The upcoming ten years will establish what will become of Bitcoin value.

The future of Bitcoin will be determined by events which will occur during the next ten years.

Bullish Scenario

- The world will establish Bitcoin as their digital gold standard.

- The regulatory environment worldwide will become supportive for Bitcoin.

Major financial institutions together with hedge funds will achieve complete integration of Bitcoin into their operations.

Bitcoin will gain popularity for making international transactions.

- Price Range: $300K–$1M+

- Neutral Scenario

The market will experience slow growth because multiple alternative solutions exist.

- The market value will experience regular price fluctuations while showing an overall increase.

- Price Range: $150K–$350K

The 21st century financial sector will remember Bitcoin as its most influential development.

Conclusion

Bitcoin continues to move through the financial system while demonstrating its role extends beyond transaction processing. The financial industry now views Bitcoin as a full macro asset which will transform investment strategies.

The upcoming decade will see Bitcoin reach or exceed $200,000 because of normal market behavior and institutional investor expansion.

The current market trends of Bitcoin show increasing value because multiple factors affect its present market trends. The 2024 halving event creates supply limitations which affect the market. The growing acceptance of Bitcoin in traditional financial systems becomes evident through rising ETF popularity which uses long-term projections.

The technical analysis shows bullish market predictions which indicate a positive trend and high price targets. The market will experience short-term price fluctuations but Bitcoin shows signs of becoming a standard financial asset because of its limited supply and expanding adoption.

Image2. Bitcoin Price Trends and Projections (2019-2030)

References:

- Gregory L. Morris. ‘Investing with the Trend.’ A Rules-based Approach to Money Management, John Wiley & Sons, 12/31/2013

- Yhlas Sovbetov. ‘Factors Influencing Cryptocurrency Prices.’ Evidence from Bitcoin, Ethereum, Dash, Litcoin, and Monero, SSRN, 1/1/2018

Image References:

- Image: Technical Analysis of Bitcoin Price Movements Using Candlestick Charts and Fibonacci Retracements, Accessed: 2025. https://investinghaven.com/wp-content/uploads/2025/11/BTCUSD_2025-11-12_15-55-35-scaled.png

- Image: Bitcoin Price Trends and Projections (2019-2030), Accessed: 2025. https://investinghaven.com/wp-content/uploads/2025/11/BTCUSD_2025-11-12_16-12-12-scaled.png

You need to login in order to Like

Leave a comment