Bitcoin is in existential shock, with lots of uncertainties and tense feelings dominating the atmosphere. On-chain data says it all; price action is literally screaming it, but one notable plunge is the flash crash that occurred on November 21.

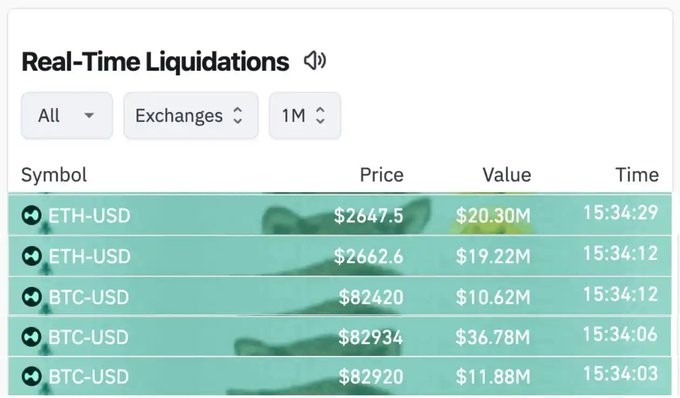

BTC dropped $3k within a minute on Hyperliquid, plunging from $83k to $80k, only to rebound to $83k. Five accounts worth more than $10 million were liquidated, with the largest single liquidation reaching $36.78 million, according to BlockPulse.

However, the flash crash is a brutal reality check of the broader crypto market that all isn’t well with the world’s most popular cryptocurrency.

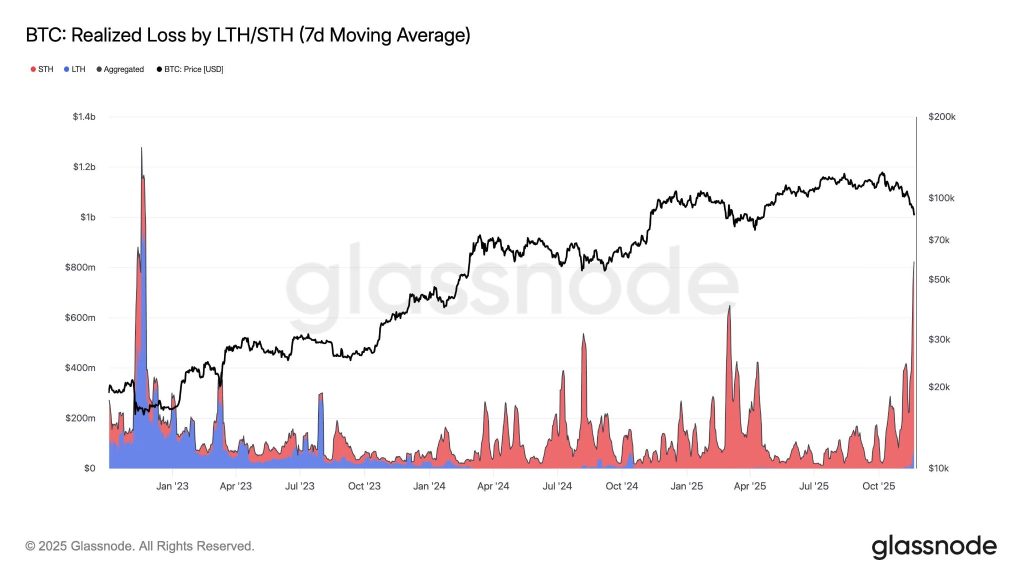

Just six weeks after hitting a record high of $126,000, the volatile asset has plummeted over 26%, erasing all the gains for the year 2025. Bitcoin currently trades below $89k, its lowest in seven months, a level many didn’t expect to see again this year. Glassnode data shows losses incurred in the bear cycle match the level last seen during the 2022 FTX collapse.

This marks one of the most fragile moments of the Bitcoin cycle. The recent flash crash raises lots of concerns, prompting lots of Bitcoin believers to ask the question, “Is the Bull cycle over? Will this dip continue to prevail? This article will answer these questions and explain why Bitcoin is in the dip and what is next for the OG coin.

Why the Flash Crash Happened

Before we dive into the main reasons why Bitcoin is plummeting generally, let’s talk about the November 21 flash crash. A typical Bitcoin flash crash is caused by excessive leverage and liquidity problems.

Open interests across major exchanges had hit a 6-month high before the crash. Following Bitcoin’s weak price at key resistance levels, liquidations were triggered. Long positions worth billions were liquidated.

Additionally, order books were thinner, with few market makers holding fewer resting bids. This created a phenomenon called “price air pockets,” where small sell orders cause disproportionately large price drops.

As for the broader crypto market, experts point to macro pressure, such as the fading rate-cut hopes, as a major cause for Bitcoin’s downfall. Since late October, it seemed cutting the Fed interest rate in December was off the table, fuelling uncertainties around crypto and even the stock market.

Last Wednesday, the CME Fedwatch futures index said the probability of a rate cut is 30%. JPMorgan predicted that a rate cut would happen in January instead.

The result? Bitcoin has been on a sell-off since then. Adding to the pressure on BTC, long-term holders are liquidating their positions to lock in profits gained over the years due to the uncertainty around Fed policy.

Although BTC is gradually rebounding following new hopes of a rate cut next month, it’s uncertain if Bitcoin will rally after that finally happens.

Experts Also Blame October 10 Flash Crash, Market Manipulation for Bitcoin’s Bearish Drop

Another factor to be blamed is the October 10 flash crash, ignited by Donald Trump’s trade war with China and a technical failure regarding an exchange’s stablecoin pricing feed. In the case of the latter, Tom Lee, Chairman of BitMine, without calling out the exchange, said a stablecoin’s price on the exchange varied from others, dropping to $0.65. He attributed the error to an automation flaw tied to Auto-Deleveraging Liquidation.

In his opinion, the current situation is an “echo” of that malfunction, with almost 2 million accounts being wiped. Although Lee refused to name names, many believe he was talking about the USDe malfunction on Binance, a synthetic dollar created by Ethena Labs. Screenshots in October showed that it dropped to $0.65 on Binance, creating a widespread fear of depeg.

Following Trump’s unexpected tariff announcement, over $19 billion worth of crypto was wiped out in a single day, marking it as one of the largest single-day losses in crypto history.

This figure is yet to be recovered to this day. Both situations triggered forced liquidations for traders, especially those holding USDe-backed positions. For a lot of traders, especially long-term holders, these were more than enough reasons to exit the crypto market completely. That left Bitcoin susceptible to volatility, creating a snowball effect.

However, Bitcoin Analyst and founder of Alpine Fox LP, Mike Alfred, thinks otherwise, as to the main reason Bitcoin is plummeting. He describes the plummet as deliberate pressure.

He argues that institutional players are pushing Bitcoin lower through derivatives, perps, and futures in a bid to manipulate price and intimidate investors into selling.

Mike, on X, wrote, “a mysterious force was pulling out all the stops to try to manipulate Bitcoin lower using perps and futures, and other derivatives. They are working overtime to try to scare people out of their corn.”

Mike’s statement might have some elements of truth, considering that more than 61% of total open interest was concentrated in perpetual futures. Tom Lee backed Mike’s accusation and even reposted his Tweet.

What Comes Next for Bitcoin?

Bitcoin flash crashes usually stem from structural failures, liquidity, and macro shocks. It happened in the 2020 Covid-19 period, 2021, and even 2022 during the FTX collapse.

If we are to go by history, you’ll realize that Bitcoin came back stronger and more stable. For instance, after the March 2020 liquidation, BTC gained over 1,400% over the next 18 months.

BTC hit a new all-time high six months after the May 2021 crash. It’s safe to say that a flash crash serves as rocket fuel for a Bitcoin rally. 10% of past crashes have led to new highs for BTC, marking a perfect recovery record.

So, that brings us to the question, “Will Bitcoin end?” The answer is impossible. Panic resurfaces after every bullish cycle, but it never signals the end.

Historically, Bitcoin has survived global recessions, major exchange collapses like FTX, mining bans in countries like China, regulatory crackdowns, and several flash crashes.

Not only did Bitcoin survive – it beat every traditional asset class over the decade, including gold. It’s a fact that Bitcoin experiences a massive drawdown in every crash event, like when it experienced -76% in 2022 during the FTX saga and -40% during the China blanket ban.

However, it took Bitcoin barely a year to recover from both events (45 days for the China ban and 11 months for the FTX crash).

Key points also strengthen Bitcoin’s legitimacy as a long-term asset. For example, Bitcoin’s supply-demand structure continues to tighten after every halving.

The 2024 halving reduced BTC issuance by 0.83%, making Bitcoin scarcer than ever. Also, global retail and institutional adoption is rising significantly.

Global crypto users have surpassed 600 million; major publicly listed companies like Strategy, Metaplanet, and BlackRock all hold a significant amount of Bitcoin in their portfolio. This shows a real economic usage.

Conclusion

Bitcoin is very much alive, despite recent statistics. Not even a structural failure, sentiments, or a flash crash can end the world’s largest cryptocurrency because of its strong fundamentals.

Bitcoin, throughout its lifespan, has survived through turbulent periods, but it emerged stronger each time. The bigger picture is that Bitcoin supply is shrinking, institutional adoption is expanding, and the unshaken, long-term holders are still accumulating.

Therefore, Bitcoin is only evolving and expanding, not the other way around.

You need to login in order to Like

Leave a comment