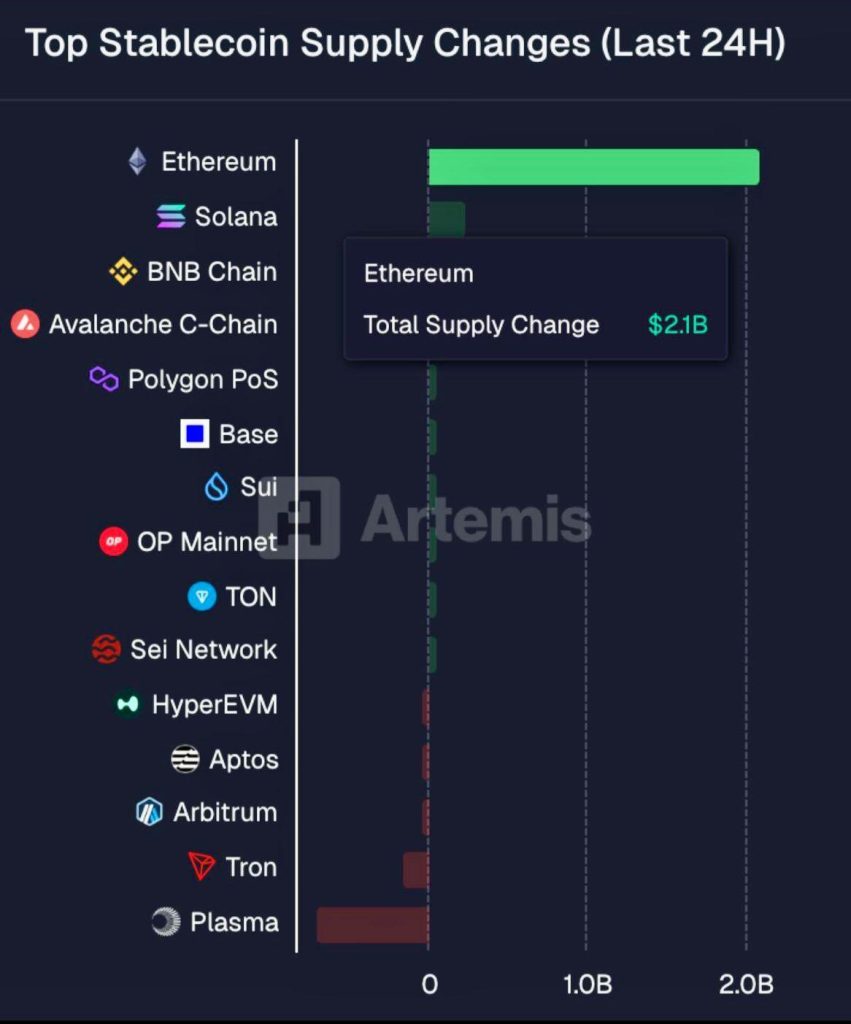

According to data from Artemis, Ethereum recently recorded a massive surge in stablecoin inflows around $2.1 billion in a single day, making it the leading network for stablecoin activity.

This metric refers to the amount of dollar-pegged assets such as USDT and USDC being transferred or minted on the Ethereum blockchain.

A spike of this scale typically signals rising liquidity and investor interest, as stablecoins often serve as the “dry powder” for trading, DeFi participation, and on-chain investment.

In practical terms, it suggests that large holders and institutions are moving funds onto Ethereum, potentially in anticipation of increased market activity or price movements.

The inflow also reinforces Ethereum’s dominant position as the primary settlement layer for stablecoins and decentralized finance, highlighting its continued strength in the broader crypto ecosystem.