SECURE BY CORE, BITGO OPENS THE NYSE DOOR

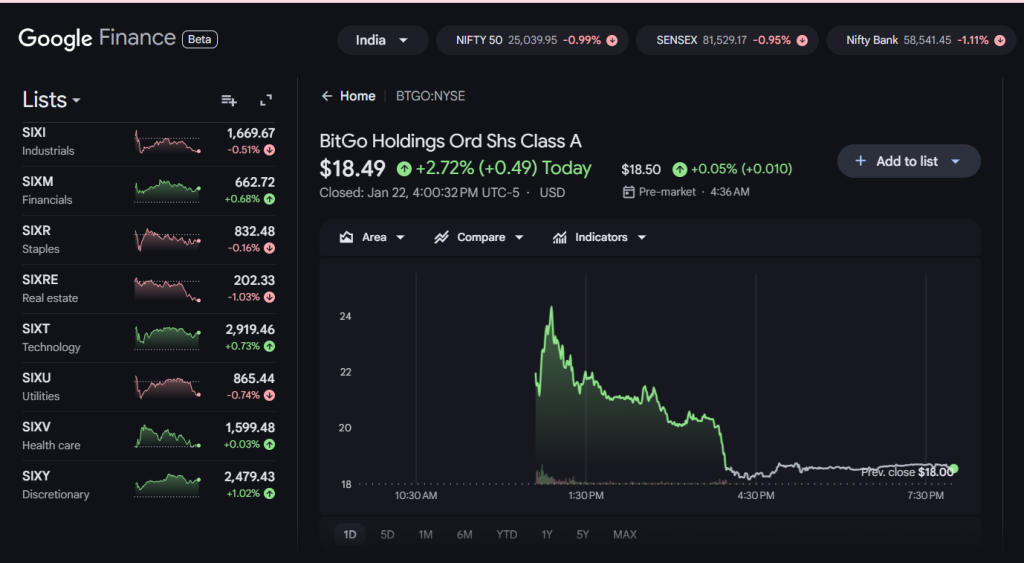

Are investors in the digital currency market turning their attention from enthusiasm to security? BitGo shares climbed sharply on their first day of trading as the digital asset custody service debuted on the New York Stock Exchange (NYSE) on January 22, 2026.

The company is now trading under the ticker name BTGO, which is a significant development for the cryptocurrency infrastructure industry.

BitGo priced its first public offering higher than expected, generating huge investor demand when trading began. As an indication of confidence in its market debut, the company’s shares increased steadily.

The strategic investment made by YZi Labs, an investment business connected to Binance founder Changpeng Zhao, was one of the IPO’s main highlights.

According to YZi Labs, the decision indicates confidence in institutional-grade, U.S.-regulated digital asset infrastructure, which it believes will be essential as more institutions enter the digital asset market.

| Company | BitGo |

| IPO Price | $18 per share |

| Expected Range | $15–$17 per share |

| Funds Raised | $212.8 million |

| Valuation | $2+ billion |

| Strategic Investor | YZi Labs (affiliated with Changpeng Zhao) |

| Security Record | 10+ years with zero breaches |

Is BitGo’s IPO a turning point for crypto companies focused on security and compliance? Participants in the market view BitGo’s successful listing as encouraging for upcoming crypto-related initial public offerings (IPOs), particularly for businesses that prioritise infrastructure above speculation.

The investment is also seen as a strategic alliance, fusing the worldwide reach of the Binance and BNB ecosystem with BitGo’s security technology.

You need to login in order to Like

Leave a comment