“Wallets are moving on-chain, and so is the next wave of wealth. Advisors who embrace crypto will win; those who resist will be left behind.”

A recent study by Zerohash and the research firm Centiment shows a significant change in the way young investors select their financial advisors. According to the survey, 33% of investors between the ages of 18 and 40 have changed advisors because they were not given cryptocurrency options, demonstrating how important digital assets are to contemporary wealth management.

The survey indicates that this change is neither minor nor symbolic. Almost 26% of young investors transferred assets between $500,000 and $1 million, and 34% transferred funds between $250,000 and $500,000 from advisors who neglected to provide cryptocurrency access.

Traditional wealth managers should take note of this: neglecting digital assets now results in actual revenue loss.

According to the report, cryptocurrency is now expected rather than optional. Advisors may increase wallet share, improve retention, and experience long-term growth by incorporating digital assets into their offerings.

Competitors who are aware of the new needs of young, wealthy investors are outperforming those that aren’t.

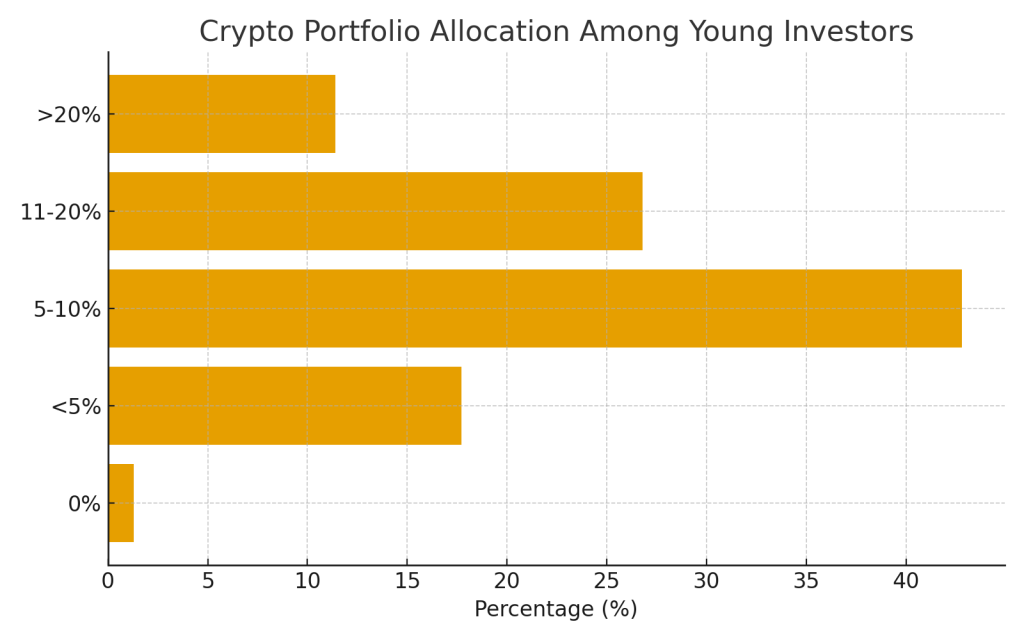

The results also reveal that 61% of young, wealthy investors currently own cryptocurrency, with many of them dedicating 5% to 20% of their portfolios to digital assets.

For this group, cryptocurrency is essential to long-term strategy, diversification, and wealth accumulation. The statistics make one thing quite clear: young investors are gaining control of their financial future, and cryptocurrency is at the heart of it.

It’s clear that traditional advisors are having difficulty keeping up with the 76% of cryptocurrency holders between the ages of 18 and 40 who invest on their own.

Strong conviction is also evident in their portfolios, as most of them allocate between 5% and 20% to digital assets. Understanding and accepting digital assets is now essential to wealth management’s future.

You need to login in order to Like

Leave a comment