“From DeFi to daily payments, USDC keeps digital dollars moving.”

Are stablecoins entering a new era as Q4 transactions hit a massive $11 trillion? In 2025, stablecoin transactions hit a record high, demonstrating how quickly digital currencies are integrating into the world’s financial system.

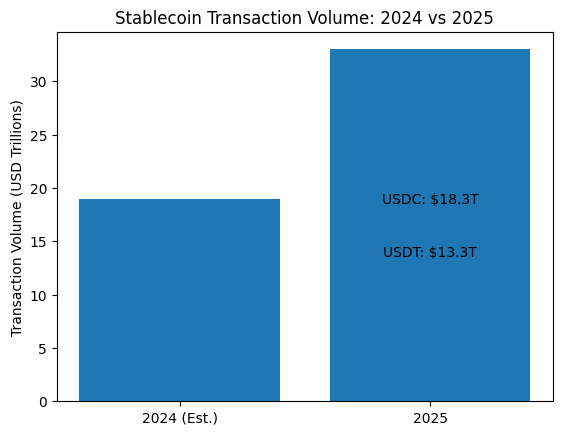

Stablecoin transactions hit $33 trillion in 2025 led by USDC

According to data from Artemis Analytics, the total amount of stablecoin transactions increased 72% year over year to $33 trillion. With $18.3 trillion in transactions, Circle’s USDC led the surge, surpassing rival stablecoin USDT with $13.3 trillion.

The rate of increase picked up towards the conclusion of the year. Stablecoin transactions alone reached a record $11 trillion in the fourth quarter, up from $8.8 trillion in the third. With global stablecoin payment flows expected to exceed $56 trillion by 2030, analysts anticipate that this pace will continue.

Cryptocurrencies that have the goal to maintain a constant value, often similar to the US dollar, are known as stablecoins. A more crypto-friendly legal environmental in the US and more specific regulations under the July-passed Genius Act helped fuel their expansion in 2025.

Institutions and big businesses investigating stablecoin payments and settlements felt more confident as a result of these regulations.

USDC is currently in charge of transaction activity, even though USDT is still the biggest stablecoin by market value at over $187 billion. In decentralised finance (DeFi), where money often moves between lending, trading, and liquidity pools, USDC is widely employed.

Increased transaction volumes are a result of this high turnover. In contrast, USDT has less movement because it is frequently utilised for long-term holding or payments.

You need to login in order to Like

Leave a comment