“BITCOIN MAY FLY, BUT RETIREMENT SAVINGS CAN’T RELY.”

Can a crypto asset that jumps 65% in months be trusted for retirement? Senator Elizabeth Warren of the United States has cautioned that integrating Bitcoin and other digital assets into 401(k) retirement plans might seriously jeopardise the savings of American workers.

Warren cited the extreme fluctuations in Bitcoin’s price as a major worry. Bitcoin saw a price swing of around 65% in just a few months in 2025, starting at about $76,000 in April and rising to almost $126,000 in October.

According to her, such significant fluctuations render digital assets inappropriate for retirement plans that are supposed to be steady and predictable.

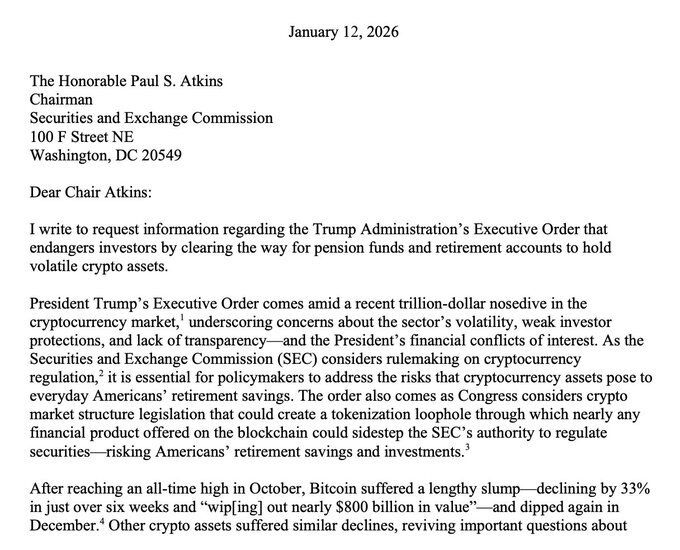

Warren stated that the majority of Americans rely on their 401(k) plans for long-term retirement security rather than for taking significant financial risks in a public letter to the US Securities and Exchange Commission (SEC).

She maintained that families preparing for retirement could suffer significant losses due to the extreme volatility of their digital asset holdings.

Supporters of digital assets, however, disagree. According to Matt Hougan, Chief Investment Officer at Bitwise, Bitcoin ought to be handled similarly to other investment assets. Some well-known stocks, he pointed out, are even more erratic.

As an example, Nvidia shares saw an almost 120% decline, falling to roughly $94 in April 2025 and rising to $207 by October.

The discussion stems from an executive order signed by US President Donald Trump in 2025, requesting that the Labour Department examine restrictions on alternative investments in 401(k) plans. This action may make it possible to invest in digital assets in retirement funds.

You need to login in order to Like

Leave a comment