“Crypto infrastructure wins, Coinbase begins.”

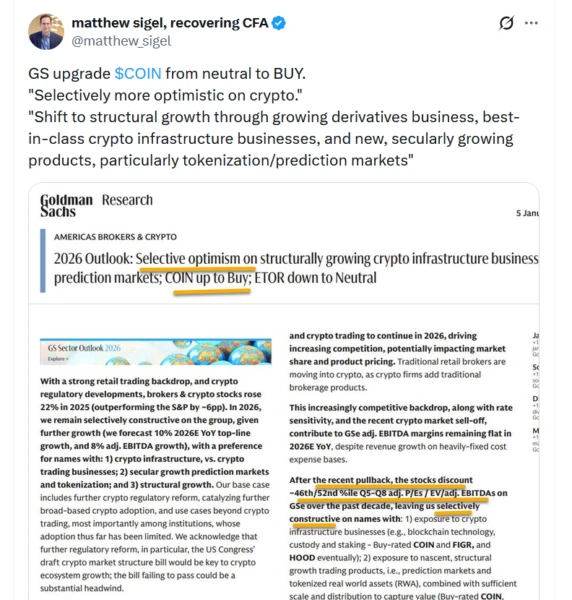

Goldman Sachs upgraded the stock from “neutral” to “buy” and increased its 12-month price objective to $303, which caused Coinbase Global shares to rise by almost 8%.

Wall Street’s increasing confidence in Coinbase’s long-term role in the cryptocurrency business, particularly as a major provider of crypto infrastructure, is indicated by this action.

Coinbase’s stock finished at about $255 after the upgrade, making it one of the day’s best-performing large-cap cryptocurrency stocks. Strong growth projections through 2026 are highlighted by Goldman Sachs’ increased price target, which indicates an upside of almost 18% from present levels.

Coinbase’s transition away from pure cryptocurrency trading, according to Goldman Sachs, is driving the upgrade. Coinbase is creating a larger cryptocurrency ecosystem rather than just depending on transaction fees.

This entails growing its stablecoin operations, making tokenisation investments, and assisting with novel use cases like prediction markets.

The investment bank also identified Base, Coinbase’s Ethereum layer-2 network, as a key growth engine. Base is intended to help Coinbase expand its infrastructure footprint by attracting developers, lowering expenses, and scaling blockchain applications.

Goldman Sachs analyst James Yaro stated that the bank is selectively bullish about companies that promote long-term crypto growth over short-term trading cycles. The company claims that Coinbase is in a strong position to profit as blockchain technology spreads and institutional usage of cryptocurrencies increases.

Goldman Sachs thinks that over time, clarity will increase despite the continued regulatory ambiguity in the cryptocurrency industry. The bank anticipates that stablecoins, tokenisation, and crypto infrastructure will be crucial to the next stage of industry expansion.

You need to login in order to Like

Leave a comment