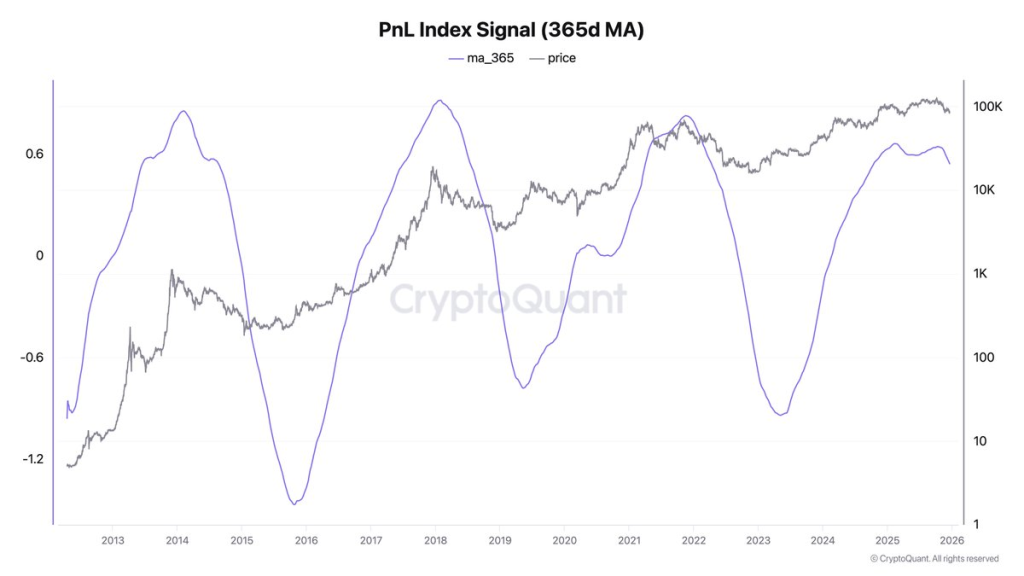

“When on-chain demand weakens after a long growth period, history shows markets often turn defensive.”

Bitcoin’s long-term demand growth is slowing after nearly 2.5 years of continuous rise, according to CryptoQuant CEO Ki Young Ju. The current Bitcoin market cycle appears to have entered a new, more cautious phase, according to the most recent CryptoQuant Crypto Weekly Report.

Since early October 2025, demand growth for Bitcoin has lagged below its long-term trend, according to on-chain data. This deceleration follows a number of robust rallies powered by demand that have kept prices stable since 2023.

The introduction of U.S. spot Bitcoin ETFs, optimism surrounding the U.S. presidential election, and increasing interest from Bitcoin Treasury Companies were the primary drivers of these rallies.

But according to CryptoQuant, the majority of these beneficial catalysts are now completely priced into the market.

An important source of price support has been eliminated as a result of the decline in fresh demand.

Regardless of occurrences like Bitcoin halving cycles, such demand slowdowns have historically frequently signalled the conclusion of bullish episodes.

Additionally, institutional action is exhibiting red flags. In the fourth quarter of 2025, U.S. spot Bitcoin ETFs switched from purchasing to selling, with net holdings falling by about 24,000 BTC.

This stands in stark contrast to late 2024, when ETFs were a significant factor in price increases.

Large holders, including addresses with between 100 and 1,000 BTC, are increasing more slowly than usual, according to on-chain data. This pattern is compared by CryptoQuant to late 2021, which was followed by the bear market of 2022.

This notion is supported by futures data. Permanent futures funding rates have declined to their lowest points since December 2023, indicating that traders are less willing to take on risk.

You need to login in order to Like

Leave a comment