What is a Crypto SIP?

Systematic Investment Plans (SIPs) in Cryptocurrency

The investment environment with its extreme volatility has led to changes in traditional investment approaches because more people want to invest in cryptocurrencies.

The Systematic Investment Plan (SIP) enables users to create digital assets through scheduled investments which reduces potential risks.

This also explains – How it Differs from Traditional SIPs in Mutual Funds?

Investors who put fixed amounts of money into their investments at scheduled times can benefit from pound-cost averaging which helps them buy assets at lower prices throughout a specific period.

The strategy works to create stable investment patterns which will help investors benefit from compound growth.

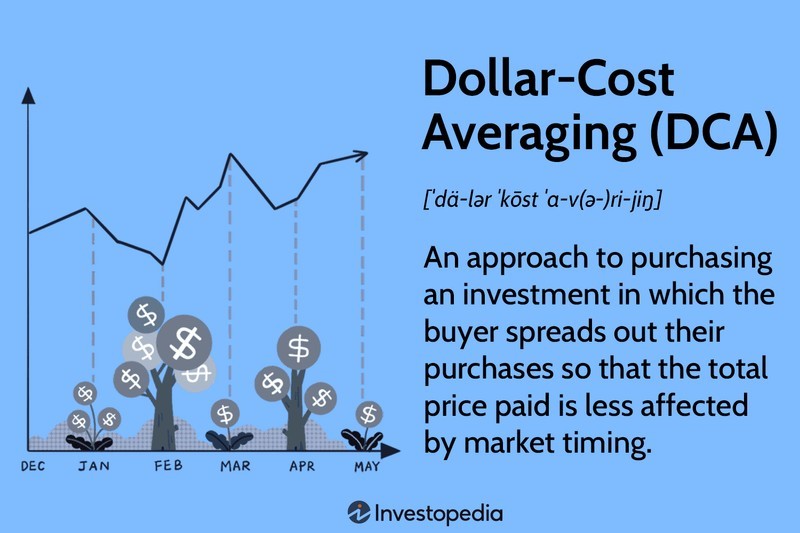

The automated nature of Crypto SIPs makes them different from regular investment products because investors do not need to handle market timing emotions according to [cited] which shows how investment value changes can be used for pound-cost averaging.

The unpredictable cryptocurrency market does not prevent investors from using Crypto SIPs to create long-term wealth through their automated investment program.

The two investment plans share periodic investment principles yet they operate with different risk levels and investment structures.

| Aspect | Mutual Fund SIP | Crypto SIP |

| Asset Type | Stocks, bonds, or hybrid funds | Digital currencies like BTC, ETH, etc. |

| Regulation | SEBI-regulated | Unregulated or partially regulated |

| Volatility | Moderate | High |

| Returns | 8–12% annually (average) | Highly variable (can exceed 100% or more) |

| Liquidity | Subject to fund terms | 24/7 access and instant liquidity |

Crypto SIPs provide investors with access to high-risk investment opportunities which offer potential large returns through extended investment periods and market stability tolerance.

How Crypto SIPs Work: Understanding the Mechanics of Crypto SIPs

The growing complexity of cryptocurrency markets requires new investment methods which enable investors to handle market instability and their security worries.

Systematic Investment Plans (SIPs) serve as effective solutions which enable investors to manage these particular market challenges. The data demonstrates that most cases prove how organized investment plans create major long-term advantages.

Users can create fixed investment amounts through Crypto SIPs to develop digital asset portfolios which help them avoid market timing risks and impulsive decisions.

This approach makes use of the well-established principles behind rupee cost averaging, where units are acquired at prices that vary; this enables investors to accumulate assets in greater numbers during downturns and fewer during peaks.

The automated system of Crypto SIPs helps investors follow a scheduled investment plan which makes it easy for new investors to start investing despite market fluctuations. Investors need to understand these mechanisms because they represent essential knowledge for achieving maximum cryptocurrency investment returns during current market volatility.

Step-by-Step Process: Choosing a Cryptocurrency Exchange or Platform

- Users need to select exchanges that maintain trustworthiness because CoinDCX and WazirX and Mudrex and Binance and Coinbase offer SIP support.

- Complete KYC Verification: Your identity needs to pass the verification process which matches exchange requirements.

- Link Payment Methods: Add your bank account, UPI, or debit card for automated deductions.

- Check Platform Security: The exchange requires two-factor authentication (2FA) and cold wallet storage as its security protocols.

Selecting the Crypto Assets

The safest long-term investment choice should be established cryptocurrencies which include Bitcoin (BTC) and Ethereum (ETH).

Diversify: The investment portfolio should include Solana (SOL) and Cardano (ADA) and Polygon (MATIC) as well as other promising altcoins.

Study Fundamentals: Select coins which have practical value and active developer teams and sustainable development plans.

Avoid Meme Coins: Investors need to stay away from tokens which exist solely because of social media hype.

Tip: Diversify across 3–5 quality projects instead of going all-in on one.

Setting the Investment Amount and Frequency

- Start Small: The first investment should begin at ₹500–₹2,000 per month to understand market patterns.

- Select Frequency: The standard investment frequency for SIPs is monthly but investors can also choose to invest weekly or bi-weekly.

- Adjust Over Time: Your SIP amount should rise when your income level or investment tolerance expands.

- A Crypto SIP achieves success through consistent execution rather than the exact moment of execution.

Automatic Purchase Mechanism

- Once your SIP is active, the platform’s auto-debit system:

- Deductsthe chosen amount automatically.

- Purchases your selected crypto at current market prices.

- The system enables direct wallet fund transfers.

- The system operates automatically for investment management while eliminating the requirement for ongoing surveillance.

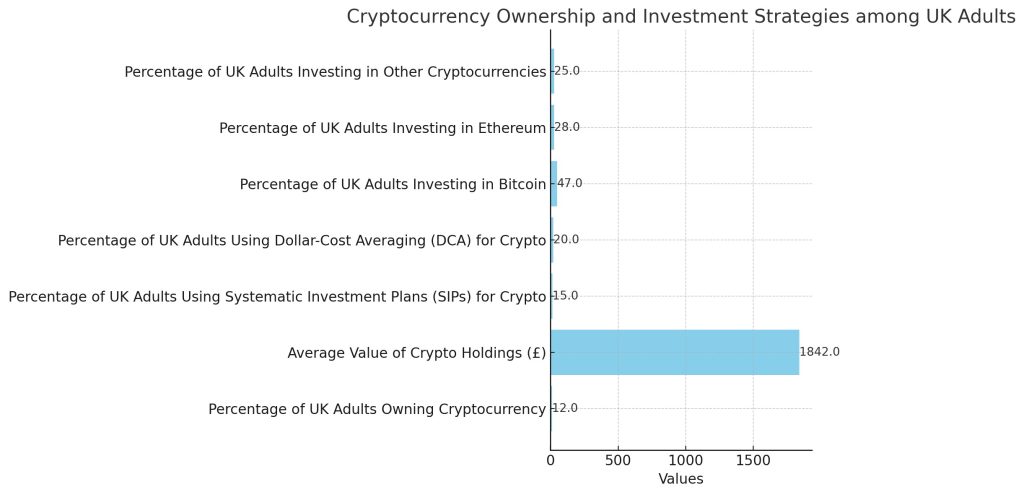

The chart shows how UK adults use their cryptocurrencies for ownership and investment purposes. It highlights that 12% own cryptocurrency, with an average holding value of £1842. The survey results indicate Bitcoin attracts 47% of investors but Ethereum attracts 28% and alternative cryptocurrencies attract 25% of investors. The majority of adults do not use systematic investment plans because only 15% of them do and dollar-cost averaging methods because only 20% of them do.

Evaluating the Benefits and Risks of Crypto SIPs

A particularly useful characteristic of Crypto SIPs is how they provide a systematic way of handling the volatility that is just part and parcel of investing in cryptocurrencies.

If you regularly put money in, you can take advantage of what’s known as pound cost averaging – that is, you end up buying more when prices are low and less when they go up.

The method enables investors to reduce market volatility risks through deliberate investment growth at a stable rate.

Risks and Challenges

Nevertheless, whilst there’s the chance of making good money, there are also considerable risks to consider, for example, regulatory issues and really big price swings.

The statement about digital transactions being easy to use yet risky for crypto asset investments demonstrates how unpredictable situations can lead people to make impulsive choices.

The visual data from [cited] demonstrates how investors can minimize market risks through pound-cost averaging to create long-term investment value during unstable market conditions.

Investors must assess all potential benefits against potential risks before they can choose an investment opportunity.

- The value of cryptocurrencies shows daily price fluctuations which result in market volatility that reaches between 10% and 20% daily.

- Regulatory Uncertainty: Changing global policies may affect market accessibility.

- Exchange Vulnerabilities: The platforms face ongoing security risks because hackers continue to attack them and some exchanges must shut down operations.

- Emotional Panic Selling: Investors may stop SIPs during market dips, negating benefits.

Tip: The risk can be reduced through asset distribution across different investments and by using hardware wallets for asset storage.

Benefits of Crypto SIPs

| Benefit | Description |

| Potential for High Returns | Crypto assets have experienced significant price appreciation, offering investors the possibility of substantial gains. For instance, the total market capitalization of crypto assets increased from approximately $132 billion in January 2019 to $3 trillion in November 2021. However, this rapid growth was followed by a 60% decline to $1.2 trillion by April 2023, highlighting the market’s volatility. |

| High Volatility | The crypto market is known for its extreme price fluctuations, which can lead to significant financial losses. The U.S. Department of Labor has expressed concerns about the prudence of exposing retirement plans to direct investments in cryptocurrencies due to their speculative nature and extreme price volatility. |

| Lack of Consumer Protections | Unlike traditional financial products, crypto assets are not insured by government agencies. The Consumer Financial Protection Bureau (CFPB) has highlighted that consumers have reported issues such as fraud, theft, account hacks, and scams related to crypto-assets. |

| Potential for Scams and Fraud | The crypto space has been associated with various fraudulent activities, including ‘pump-and-dump’ schemes, where the price of a cryptocurrency is artificially inflated to attract investors, only to be sold off by perpetrators, leaving investors with losses. |

| Environmental Impact | Cryptocurrency mining requires substantial energy consumption, contributing to environmental concerns. The U.S. Energy Information Administration estimated that in 2023, Bitcoin mining could account for 0.6–2.3% of all U.S. electricity demand, enough to power between three to six million homes. |

Benefits and Risks of Crypto Systematic Investment Plans (SIPs)

Choosing the Right Platform for Crypto SIP

When selecting a platform:

- Verify Security Standards: End-to-end encryption, 2FA, and proof-of-reserves.

- The platform needs to charge only small fees for all platform transactions and withdrawal operations.

- User Interface: The platforms Mudrex and CoinDCX provide dashboards which are designed for new users to access easily.

- Automation Tools: Check for recurring buy or auto-invest options.

- Research exchange reviews and regulatory compliance before making any decisions.

As new players enter the crypto market, the benefits of a well-thought-out investment plan simply can’t be emphasised enough.

The Crypto SIP system enables investors to select from risk-free and high-risk investment choices which help them understand financial planning and market unpredictability management.

The combination of modern technology with traditional investment methods through Crypto SIPs enables investors to achieve strategic benefits which help both new and experienced digital asset investors succeed.

Tips for Successful Crypto SIPs

- Stay Consistent: Don’t pause investments during market crashes.

- Diversify Portfolio: Combine stable and growth-focused assets.

- Rebalance Periodically: Adjust holdings every 6–12 months.

- Secure Storage: Move all long-term holdings to cold wallets.

Stay Updated: Follow crypto news, policy updates, and token performance.

The path to crypto investing success requires patients who stick to established methods instead of attempting to forecast market movements or making risky investments.

Conclusion

In conclusion, the promise of Crypto SIPs as a method for steering through the often-stormy seas of cryptocurrency investment is becoming ever more apparent.

Investors who aim to create stable wealth need to establish a planned investment strategy which involves regular funding and average cost investment to protect their money from emotional decisions and market volatility.

The concept of dollar-cost averaging, as illustrated in the image, rather nicely exemplifies the underlying principle of this strategy. The method shows that putting particular funds at specific times will generate superior outcomes in the long run.

Image1. Concept of Dollar-Cost Averaging in Investment Strategies

References:

- Olena Danchenko. ‘Information Technology for Education, Science, and Technics.’ Proceedings of ITEST 2022, Emil Faure, Springer Nature, 6/17/2023

- Alan B. Johnston. ‘SIP: Understanding the Session Initiation Protocol, Fourth Edition.’ Artech House, 11/1/2015

- Mittal, Nitin. ‘Quantum AI and its Applications in Blockchain Technology.’ Ananth, Christo, IGI Global, 12/31/2024

More References & Attributions

- Binance Academy – “How Crypto SIPs Work for Long-Term Investors,” 2024

- CoinDCX Learn – “Beginner’s Guide to Systematic Crypto Investments,” 2025

- CoinTelegraph – “Crypto SIPs: The New Frontier of Smart Investing,” 2025

- Mudrex Insights – “How Automated Crypto SIPs Simplify Investment,” 2024

- Forbes Crypto – “The Rise of Crypto SIPs in 2025,” 2025

Image References:

- Image: Concept of Dollar-Cost Averaging in Investment Strategies, Accessed: 2025. https://www.investopedia.com/thmb/4HAKzkL446Dw8p_bn9iYrBqO39g=/1500×0/filters:no_upscale():max_bytes(150000):strip_icc()/Dollar-Cost-Averaging-DCA-f79fcd89eaa34bb7adad3dacc3129798.png

You need to login in order to Like

Leave a comment