Where is crypto tax-free in 2025?

The worldwide excitement about cryptocurrency is really taking off, and so is the search for places where the rules, especially about taxes, are nice and easy to deal with. Several nations have emerged as top destinations for crypto enthusiasts who seek maximum financial benefits while minimizing tax obligations during the upcoming 2025 period.

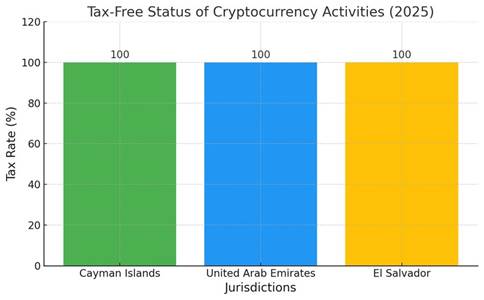

The Cayman Islands together with the United Arab Emirates (UAE) and El Salvador have established rules that draw both traditional investors and crypto companies. The Cayman Islands stands out because it does not impose taxes on income or investment profits or corporate earnings.

The location provides an excellent environment for cryptocurrency trading and staking and profit extraction. The UAE stands out as a favourable location because it does not tax personal income and it offers free zones that are beneficial for crypto businesses.

El Salvador’s adoption of Bitcoin as legal tender established a unique tax-free jurisdiction. The strategic moves enable new concepts to flourish while attracting foreign capital which positions these nations as tax-free crypto havens for 2025.

The chart shows that Cayman Islands, United Arab Emirates and El Salvador have a tax rate of 0% on cryptocurrency transactions as of 2025. These jurisdictions are attractive to cryptocurrency investors and businesses because of their tax-free status. (sandbox:/mnt/data/crypto_tax_chart.png)

Overview of the Cayman Islands as a Crypto Tax Haven

Countries with no crypto tax in 2025

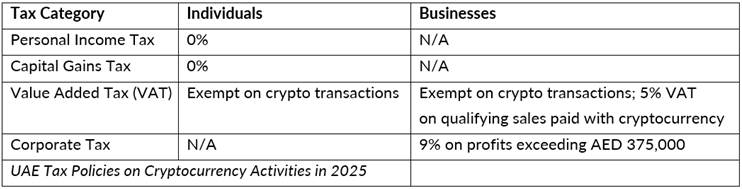

The Cayman Islands have emerged as the top destination for crypto investors who want to minimize their tax burden through digital expansion. The islands offer an attractive proposition to both individual crypto holders and businesses because they do not impose income taxes or capital gains taxes or corporate taxes.

The favourable digital asset environment enables investors and entrepreneurs to conduct tax-free trading and staking and mining and profit realization activities which attracts numerous investors and entrepreneurs. As noted, the absence of corporate tax, a key feature, firmly establishes the Cayman Islands as a haven for crypto-related businesses. But it’s not just about taxes; the islands are also building a regulatory structure specifically designed for virtual asset service providers.

The goal is to promote innovation and protect investors through a supportive regulatory framework. The Cayman Islands stand as a top crypto-friendly tax haven because of their undeniable tropical charm and their position for 2025 in general.

Further details from [cited] will highlight the specific tax rules that set these islands apart from other places.

Crypto-friendly Tax Havens 2025 List

Image1. Global Crypto Tax Rankings 2022

The United Arab Emirates: A Hub for Tax-Free Crypto Activities

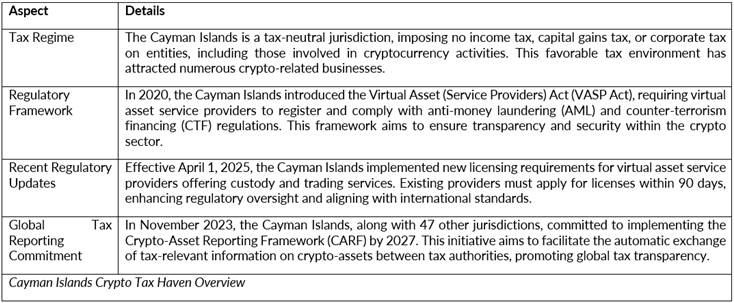

The United Arab Emirates (UAE) has become a key spot for those in the cryptocurrency world looking for good tax situations. Because there are no income or capital gains taxes on crypto stuff—like trading, staking, and even NFTs—the UAE really stands out.

Plus, the creation of Free Zones makes it even more appealing, with very low corporate tax rates and simple rules for crypto. This clear regulation helps new ideas grow and pulls in investments from other countries, making the UAE a popular place to be when talking about tax-free crypto spots in 2025.

The importance of the UAE as a place with friendly taxes is also pointed out in [cited], which shows how different tax situations around the world are related, putting it up there with other places that like crypto, such as the Cayman Islands and El Salvador.

Overall, the UAE’s smart approach not only grows a lively crypto community but also mirrors a trend where countries try to make their economies more diverse through digital money.

Top Countries with Zero Crypto Tax Laws 2025

Image2. Table of Countries with Unique Crypto Tax Features

El Salvador’s Unique Position on Bitcoin and Tax Exemption

Nations with no capital gains tax on crypto 2025

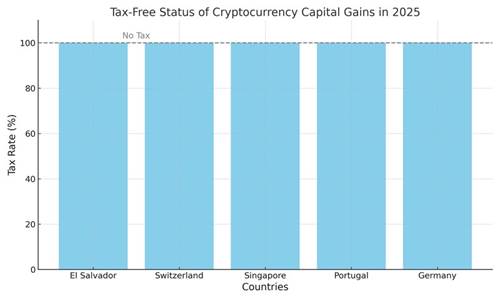

El Salvador presents a really interesting case when we look at how cryptocurrency is changing things, mainly because they’ve decided to make Bitcoin legal tender. This big move doesn’t just put Bitcoin right in the middle of the country’s money system, it also shows they’re really open to new digital ideas.

They’ve set up a whole system where you don’t have to pay taxes on crypto transactions, which means no capital gains or income tax for anything to do with Bitcoin. This is all meant to bring in investors from other countries and help the economy grow by making things good for innovation and tech. Plus, if you’re a crypto investor from abroad, you might like the idea of getting to live there if you get involved in their Bitcoin economy.

Tax-free Bitcoin countries 2025

This makes El Salvador even more appealing as a place for crypto. So, the country is a major player in the talk about places with good tax laws, and it’s a big reason why there are more tax-free Bitcoin countries in 2025. [Image showing Bitcoin adoption in El Salvador].

The bar chart illustrates the tax-free status of cryptocurrency capital gains in El Salvador, Switzerland, Singapore, Portugal, and Germany as of 2025. All five countries impose no taxes on crypto capital gains, making them attractive destinations for crypto investors and businesses.

Conclusion

It’s clear that as the cryptocurrency world keeps changing, picking the right place to do business is super important. Looking at countries like the Cayman Islands, the United Arab Emirates, El Salvador, Germany, and Singapore, which have good tax rules, shows there are lots of chances for investors to work their way through this tricky area.

Each of these countries has its own tax perks. For instance, the Cayman Islands doesn’t tax income or capital gains at all, and the UAE’s special business areas are very appealing. El Salvador’s decision to accept Bitcoin as real money also shows it wants to help crypto grow. Germany and Singapore also make things easy with tax breaks on investments held for a long time and on capital gains, generally speaking.

So, it’s really important for crypto investors to check out these places, in most cases; knowing about these tax-friendly spots can really shape how they invest later on. The map that goes with this text, [cited], gives a good visual of these global hotspots, adding to our talk about where might be good to set up shop in 2025.

Image3. Global Cryptocurrency Adoption: A Geographical Overview

References:

• Alexia Maddox. ‘Insider and Outsider Cultures in Web3.’ Data Ownership, Transparency and Privacy, Emerald Group Publishing, 11/25/2024

• Mateusz Mach. ‘Crypto Millionaires.’ Blockchain: A Chance for All?, CRC Press, 7/19/2024

• Jean Franco Fernández Clark. ‘Bitcoin Tax Havens.’ An Introduction To Cryptocurrency Tax Planning, Jean Franco Fernández Clark, 6/19/2021

• OECD. ‘Standard for Automatic Exchange of Financial Account Information in Tax Matters, Second Edition.’ OECD Publishing, 3/27/2017

Image References:

Global Crypto Tax Rankings 2022, Accessed: 2025. http://coincub.com/wp-content/uploads/2022/09/infographic-coincub-crypto-tax-ranking-2022.png

Table of Countries with Unique Crypto Tax Features, Accessed: 2025. https://www.cryptopolitan.com/wp-content/uploads/2024/07/Screenshot-2024-07-03-at-14.07.44.png

Global Cryptocurrency Adoption: A Geographical Overview, Accessed: 2025.https://altsignals.io/wp-content/uploads/2025/07/best-crypto-tax-free-countries-2025.png

You need to login in order to Like

Leave a comment