Why Create Your Own Crypto Token?

The increasing popularity of blockchain technology and its applications leads more people to explore token creation opportunities. The process of creating your own cryptocurrency token has become a major point of interest for many people. Tokens serve as essential components for numerous applications.

The DeFi application space and NFTs and gaming sectors and ICOs and IDOs for fundraising purposes all utilize tokens. The guide provides beginners with a complete understanding of token creation through detailed step-by-step instructions. The process of token creation provides financial potential while enabling users to support innovative blockchain initiatives.

Digital asset creation and token development serves as a dual-purpose activity which enables personal development while advancing technological progress. Most people who enter this field will experience both their own growth and technological advancement.

How to Create Crypto Token?

The creation of crypto tokens happens through blockchain technology which operates on Ethereum and Binance Smart Chain platforms. Developers create smart contracts that establish all token-related rules and supply limits and operational capabilities. The token becomes part of the blockchain network after deployment and users can perform transfers and trades and execute applications with it.

Cryptocurrency Token Tutorial

Digital money exists as cryptocurrency because it operates without traditional bank verification systems.

The system enables users to conduct transactions and investments through its platform.

The blockchain system operates as an unalterable database which validates and records transactions between assets and deals.

Before acquiring cryptocurrency, you need to understand its operational principles and available usage options.

What’s cryptocurrency?

Digital payment systems called cryptocurrencies function as cashless alternatives to traditional money systems. People use cryptocurrency for online deals but it also functions as a payment method for physical transactions. The market offers bitcoin through multiple companies but government-printed money remains exclusive to official institutions.

The value of fungible cryptocurrencies remains constant during all transactions including buying and selling and swapping between users. The value of NFTs (non-fungible tokens) fluctuates independently from cryptocurrency. The value of crypto dollars remains constant at one dollar but NFT dollars change based on the digital asset they represent.

The lack of government oversight does not prevent bitcoin from being subject to taxation. The HM Revenue and Customs agency demands users to submit their profit and loss statements.

How are cryptocurrencies made?

The process of cryptocurrency creation happens through mining operations. The process of mining verifies transactions and generates new bitcoin for cryptocurrency users. The blockchain network accepts new transactions through specialized equipment and software during the mining process.

Not all cryptocurrencies are mined. The process of mining does not apply to unspendable cryptocurrencies because developers handle them differently. The process of hard forking results in the creation of new currency. The blockchain network generates new chains through the process of hard forks. The two blockchain forks operate through separate paths after the split. The majority of investors choose to purchase non-minable cryptocurrency.

Traditional currency vs. cryptocurrency

The government produces paper money and coins which people can use for carrying or banking purposes. The system allows users to make cash deals and perform other financial operations. The government supports traditional currency but cryptocurrency operates without official oversight.

Digital wallets serve as the storage solution for bitcoins instead of traditional bank accounts. The protection of bank account funds rests with banks but crypto users have no access to financial recovery options.

The benefits of cryptocurrency?

- The foremost benefit of cryptocurrency compared to traditional money lies in its capability to guard user privacy.

- The progression of buying bitcoin does not necessitate users to provide any personal details.

- Your anonymity functions as a protection mechanism against identity theft and other types of scams.

- Your investment remains safe from any changes in government policies.

- The worldwide availability of bitcoin eliminates the requirement to calculate or pay international exchange rates.

- Bitcoin operates freely in countries where it is banned because it does not face the same restrictions as traditional bank accounts do with ATM withdrawal limits.

Types of Cryptocurrencies

- Coins and tokens are cryptocurrencies.

- The blockchain-based assets known as tokens differ from currencies which exist as virtual or digital or physical assets.

- The digital coins function similarly to conventional money because they operate through blockchain technology.

- A token exists on an existing blockchain network and functions as either payment currency or proof of asset ownership.

- Bitcoin stands as the most widely used cryptocurrency since it was the first to enter the market.

- The Ethereum network supports complex operations and maintains the second position in cryptocurrency value rankings.

- The most well-known alternative cryptocurrencies include Cardano and Solana and Dogecoin and XRP.

Getting started with cryptocurrency requires the following these steps.

- Start your cryptocurrency journey by selecting either a broker or exchange platform.

- Users can access cryptocurrency trading through online platforms which serve as exchanges.

- The interface between brokers and exchanges exists as a separate entity.

- The exchange platform allows users to trade without needing a third-party intermediary.

- Users who select exchange platforms need to find separate bitcoin buyers.

- Your broker will handle this process. The following steps may help you trade cryptocurrency.

- Open and fund your account

- After selecting your broker or exchange platform you should create an account.

- Some platforms require identification verification so users should prepare their identification documents in advance.

- The verification process for your identification will enable you to fund your account.

- Your crypto account will need several days to receive funds from your chosen payment method.

- Buy crypto

- You can purchase your first bitcoin after your account verification process is complete. Many choices exist. You may buy more or less.

- Select your preferred option before entering the ticker symbol and quantity for purchase.

- The extremely widespread and common cryptocurrencies in India include Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB), Solana (SOL), Ripple (XRP) and Dogecoin (DOGE).

- Decide on storage

- You need a wallet to store your bitcoin funds. The storage options for crypto assets might be restricted by certain broker platforms.

- Users who purchase on an exchange platform have the option to select between hot wallets and cold wallets.

Hot Wallets

Hot wallets enable users to store their assets through internet connections on their PC and mobile devices and tablets. Hot wallets store data online but remain more susceptible to cyber threats than cold wallets. [Link]

Understanding Cryptocurrency Tokens vs Coins

The crypto industry creates confusion between coins and tokens because these assets function differently from one another. The blockchain-based home currency Bitcoin and Ethereum function as payment systems and value storage solutions. Tokens exist on external blockchains which operate under specific standards such as ERC-20 for Ethereum and BEP-20 for BNB Chain. The current system enables developers to create tokens more efficiently.

Creating your own blockchain requires minimal resources because you can skip building it from the ground up. The growing blockchain interest requires basic knowledge of these concepts for anyone who wants to participate in digital currency activities.

The process of launching a crypto project becomes simpler when developers understand token and coin functionality and operation principles which enables them to select appropriate first tokens for their development work.

| Value |

| Tokens |

| Built on existing blockchains using smart contracts |

| Examples include Tether (USDT), Uniswap (UNI), and Chainlink (LINK) |

| Serve various purposes such as utility, security, and governance within specific ecosystems |

Cryptocurrency Coins vs Tokens: Key Differences

How to Create Your First Cryptocurrency Token?

The cryptocurrency sector experiences continuous transformation while numerous developers attempt to create their own digital assets.

Your first decision should be to select between Ethereum or BNB Smart Chain as your blockchain platform. The selection of blockchain platform determines all operational aspects of your token.

The selection of token standard depends on your needs because ERC-20 works for standard tokens yet ERC-721 serves NFTs. The selection of token standard determines how well your token functions with external systems. [cited]

The selection of tokenomics requires careful consideration because it determines the token’s name and symbol and total supply and creation and destruction mechanisms. The token functions as intended after this step is completed.

Launch Crypto Token

The process of creating a smart contract demands programming skills using Solidity or Rust to establish token functionality. The main network launch requires testing on a testnet to identify and resolve any system errors.

The process of creating a cryptocurrency demands advanced technical knowledge because launching a token requires complex development work. New creators who lack experience should consider two options for token development: they can either work with professional developers or use no-code platforms to simplify the process.

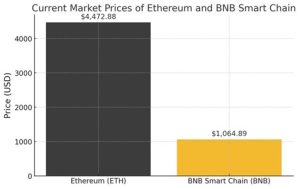

The chart displays the current market prices of Ethereum (ETH) and BNB Smart Chain (BNB). The price of Ethereum is significantly higher at $4,472.88, while BNB is priced at $1,064.89. [Download the chart] (sandbox:/mnt/data/market_prices_chart.png)

Tools to Make Your Own Crypto Token

The development of your own cryptocurrency token necessitates vital tools to achieve smooth development and enhanced security.

The Ethereum blockchain allows users to create and deploy smart contracts through Remix IDE which provides an easy-to-use interface for beginners.

The development process becomes more efficient through Truffle and Hardhat frameworks because they enable better local testing and development which results in improved token quality before launch. [cited]

OpenZeppelin provides prebuilt smart contract templates which enhance security by reducing the number of vulnerabilities that custom code might introduce.

The no-code platforms TokenMint and CoinTool provide users with fast token deployment options through their platforms which eliminate the need for extensive coding.

The selection of development tools by crypto token creators determines their project success in the fast-moving cryptocurrency market.

| Tool Name | Description |

| Bitcoin Cash SLP (Simple Ledger Protocol) | A protocol that allows users to create unique and secure digital tokens on the Bitcoin Cash blockchain. It is known for its simplicity and affordability, enabling users to produce tokens in a short time frame. [Source: https://uits.iu.edu/video/TBSHBpdRspj.html] |

| Ethereum ERC-20 Token Standard | A widely adopted standard for creating tokens on the Ethereum blockchain. It provides a set of rules that all Ethereum tokens must follow, ensuring compatibility and interoperability within the Ethereum ecosystem. |

| Binance Smart Chain BEP-20 Token Standard | A token standard on Binance Smart Chain that is similar to Ethereum’s ERC-20. It allows for the creation of tokens that can be used within the Binance Smart Chain ecosystem. |

| NISTIR 8301: Blockchain Networks—Token Design and Management Overview | A comprehensive guide by the National Institute of Standards and Technology (NIST) that provides a high-level technical overview and conceptual framework of token designs and management methods. It covers various aspects of token creation and management, including security and privacy considerations. [Source: https://csrc.nist.gov/pubs/ir/8301/final] |

Tools for Creating Cryptocurrency Tokens

Conclusion – Your First Step in Web3 Creation

The first step into cryptocurrency development involves creating your own token. Developers and entrepreneurs can now easily understand how to create their first cryptocurrency token because numerous development tools and guides are available in the market.

The technical knowledge of token creation requires additional focus on security measures and purpose definition and community trust establishment. The success of a token launch depends on its performance in the competitive Web3 market rather than its initial deployment.

The process of creating your own cryptocurrency token requires basic knowledge which will help you develop innovative solutions and establish relationships with others in the future.

The correct implementation of cryptocurrency token creation enables the development of new applications which people desire to use thus expanding the decentralized economy.

References:

- Julian Xavier Bennett . ‘Cryptocurrency Investing: How to Build a Profitable Portfolio in 2025.’ Gabriel Mensah, 7/1/2025

- Dr. Hidaia Mahmood Alassouli. ‘Creation and Deployment of Smart Contracts On Ethereum Blockchain.’ Dr. Hidaia Mahmood Alassouli, 4/2/2020

- Nicky Huys. ‘Cryptocurrency For Beginners.’ Nicky Huys Books, 11/27/2024

- Goran Karlic. ‘Build Your Own Blockchain.’ A Practical Guide to Distributed Ledger Technology, Daniel Hellwig, Springer Nature, 5/2/2020

- Link

You need to login in order to Like

Leave a comment