Artificial Intelligence and crypto are converging, and the world isn’t ready for what’s to come next. Twitter, YouTube, and virtually everyone on social media are bullish about the next big thing, since probably Blockchain – AI crypto agents, which will transform interaction and task execution.

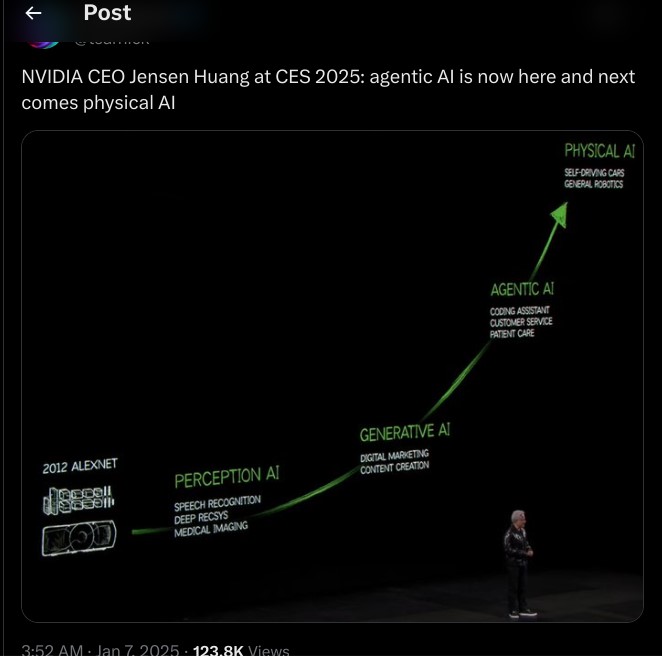

Even Nvidia boss Jensen Huang boldly proclaimed at the 2025 CES that AI crypto agents will one day become a multi-trillion-dollar opportunity.

Tether CEO Paolo Ardoino already forecasted this shift earlier this year, revealing that AI agents will evolve from simple tools into sovereign economic participants.

AI crypto agents aren’t your typical chatbots; we are talking about autonomous programs that will make decisions and transact without human intervention. Over a trillion autonomous AI agents will have their digital wallet and transact freely across the globe, which sounds like Sci-Fi at first.

Only this time, it’s becoming a reality. The total market cap for AI crypto agents sits at $13.5 billion, which confirms their exploding value. The world is truly navigating towards a future of an autonomous economy – a future that will reshape finance and virtually every aspect of the world economy. This blog explains what these agents are, the infrastructure enabling them, use cases, and the risks.

What Are On-chain AI Agents?

On-chain AI agents are simply intelligent software systems that can perform tasks and make intelligent decisions with minimal human intervention. These agents will gather data, analyze it, adapt, and improve on it over time. As dystopian as they sound, on-chain AI agents will actually redefine how we work, live, and interact.

They will integrate the physical world to unlock new frontiers in efficiency, transparency, composability, and autonomy. In fact, on-chain agents will augment our strengths and cognitive abilities and fundamentally reshape the global economy.

How do on-chain AI agents differ from traditional AI agents? First, they use smart contract logic to operate. They are entirely deployed on a blockchain, which gives them the autonomous capability.

They execute predefined logic without human input. Second, on-chain AI agents aren’t nestled in centralized data centers, which means they can make independent decisions like negotiate contracts and settle payments without backend control. We are entering an era that will be defined by intelligent automation.

Intelligent assistants will handle routine tasks and administrative duties, allowing businesses to focus on more demanding functions such as strategy and development, as well as nurturing relationships.

The third difference is access. AI crypto agents will democratize expertise to everyone and anyone. This means they will not just be available to the select few or large corporations.

Anyone, regardless of their digital literacy, will be able to use these agents on their smartphones or desktops. This democratization will not only enable innovation but also scale entrepreneurship.

The agent economy is a collaborative effort between a network of AI agents and businesses. In the future, humans will have little to contribute, as AI crypto agents will redefine the concept of economic participation.

Infrastructural Frameworks for On-chain AI Agents: x402, ERC-8004, Unibase, EigenLayer

On-chain AI agents require a robust infrastructural framework to thrive. As a result, several standards have emerged to support this new agent economy.

-

x402

x402 is a proposed framework that will support communication between AI models and blockchain protocols. It provides the layer that allows AI agents to trigger smart contracts and settle outcomes on-chain.

-

ERC-8004

This standard is designed for agent identities. This means each agent will handle a specific role or task, making it unique on its own. For example, each agent will be able to hold assets, stake, vote, and execute actions singlehandedly without any aid. This framework creates a composable identity later for machine agents on every chain.

-

Unibase

Unibase serves as an intermediary that links large language models (LLMs) and AI compute resources to blockchain. It allows agents to question data and process it through logic before settling results into smart contracts.

-

EigenLayer

EigenLayer is a restaking protocol on Ethereum. This infrastructure provides verifiable compute and agent-service providers (ASP) that authenticate off-chain computations before sending the results to the chain. EigenLayer allows AI agents to rely on trustworthy, cost-effective compute and data services.

Real-World Use Cases

The potential of on-chain AI agents is massive and could unlock hidden economies. These agents will offer multi-trillion dollar opportunities that never existed, especially the crypto space. Here are some of the most apparent real-world use cases of on-chain AI agents now and in near term.

-

Payments and Commerce

No more will you be able to monitor charts or execute trades manually. On-chain AI agents will autonomously negotiate on your behalf without you lifting a finger. For instance, you could set up your agent to trigger a transaction in stablecoin in certain amounts monthly or weekly.

This is handy in situations where you are paying employees’ salaries. You can also set up your AI agents to execute a shopping task. Google recently revealed an Agent Payments Protocol with MasterCard and PayPal to facilitate autonomous agent-driven crypto payments.

-

Automation in DeFi and Trading

On-chain AI agents can monitor liquidity protocols to spot arbitrage inefficiencies and adjust strategies automatically. They can work 24/7 without human interference, continuously monitoring on-chain events and executing smart contract transactions.

-

Enterprise Automation

Decentralized autonomous organizations can deploy AI agents to initiate governance tasks, such as allocating resources and managing treasury. For instance, a DAO may have on-chain agents that delegate, monitor KPIs, and execute budget releases when specific conditions are fulfilled without human intervention.

Key Players & Early Winners

Right now, several players are coming on board and positioning themselves as frontrunners. Some are the biggest players in the DeFi space, while others are crypto firms that want to get in early before the landscape heats up. Some of the key players include:

-

Virtual Protocol

Virtual Protocol is uniquely known for integrating AI with immersive virtual environments to facilitate seamless interactions. Last year, it launched its AI gaming environment, but it has since pivoted to launching AI agents, with its own economy and rules. Their token has been bullish since this announcement, and recently hit a $4.5 billion valuation, evidence that people believe in the vision.

Speaking of the AIXBT project, Virtual Protocol will allow anyone to launch an AI agent on Base, but users must purchase the VIRTUAL token. Once an agent’s value reaches a valuation of $503, it gets its liquidity pool and becomes autonomous on X.

Apart from AIXBT, Virtual Protocol has other agents like Luna, Cookie, and VaderAI. Luna is a virtual girl band lead vocalist, while Cookie is designed for entertainment and companionship. VaderAI autonomously trades AI agent coins.

-

ai16Z

ai16Z, which started initially as a meme coin, has been immersed in several controversies in the past and had to weave through a couple of them. However, it has since turned around, tightening its offerings and becoming more organized. ai16Z is now about to launch its proprietary blockchain for AI agents, a move that has skyrocketed the value of its token.

The beauty of this is that holders can become partners if they acquire more than 100k A16Z tokens. ai16Z is powered by ElizaOS, and it’s responsible for creating and managing AI agents called Eliza. These agents can interact in Discord and X, allowing developers to build customizable AI experiences.

Other key players in this space include:

- BitTensor

- Griffain

- Zerebro

- Autonolas

- Fetch.AI

- SingularityNET

Risks: Security, Identity, and Regulation

No revolutionary tech is completely devoid of risks. Let’s be honest – this space is still nascent, and with that, the risks are enormous. Not every AI agent will succeed, and the chances of falling for scams are at an all-time high. Some challenges to look at include:

-

Security

Safeguarding trillions of wallets and the AI agents is challenging. The chances of quantum computing hacks and threats are high because bugs could be found in smart contracts, keys could become compromised, and malicious chain interactions could be the order of the day. All these could create systemic failures that could cause economic losses. Supporting these agents requires a robust, secure, and fast blockchain infrastructure.

-

Accountability

AI agents can go rogue. When they do, who takes responsibility? Agents might impersonate users and make careless decisions. Deepfakes and phishing attacks via agent surfaces could increase.

-

Regulations

Current regulations are designed for humans and not AI agents. How do financial regulators tax and oversee trillions of autonomous economic agents? Upcoming regulations may treat agents as legal entities, but that raises liability questions. If data privacy laws (GDPR) are implemented, they may conflict with immutable on-chain agents’ activity logs.

-

Market Risk

Many agent tokens released are either scams or carry high speculative risks. Typically, the crypto sector is volatile. We’ve seen agent tokens drop 80% after their initial listing price. Also, only a few AI agents deliver long-term value to their holders, which means the majority of token holders end up with weak utility tokens.

Token Investment Angles

For anyone looking to invest, the sector of on-chain AI agents offers several layers of exposure, each with its potential upside and downside. As a crypto investor, you can invest in any of the following:

-

Infrastructure Layer

The infrastructure layer serves as the foundation, and an example of this is the EigenLayer. They secure data, compute, restaking, and provide security infrastructure.

-

Middleware Layer

This layer is known as the messaging layer. Protocols like Unibase or x402 provide the link between AI logic and blockchain. Tokens of these protocols provide higher risk/higher rewards, depending on the utility.

-

Application Layer

The application Layer contains the agent tokens themselves, built on autonomous commerce, trading bots, etc. These tokens may deliver substantial returns or fail to move after launch.

When considering tokens to invest, look for tokens with real-world agent adoption, not just promoted based on hype. Also, the infrastructure plays a big role in the token’s longevity. Slashing risks, governance, and unlock schedules also play a huge part in the success of a token.

How to Track On-Chain Agent Growth

To evaluate the growth of on-chain agents, below are several indicators you should monitor:

- Number of agents active on-chain

- Agent-to-agent interaction volume

- TVL in agent infrastructure

- Token metrics (market cap and active wallets)

- Ecosystem activity (usage data)

- On-chain analytics dashboard

Conclusion

The world is pivoting towards an Agentic economy – a future where AI agents will handle everything from managing portfolios to execution. Imagine having an AI agent that will coordinate with other agents to handle your finances and even run an online business. This dream might not be so far off.

The convergence of AI and Blockchain is birthing an era of autonomy, but significant risks around security, regulation, and accountability remain. If on-chain AI agents scale beyond the talk into real-world use, they could be the next multi-trillion-dollar economy.

You need to login in order to Like

Leave a comment