“HIGHER BITCOIN PRICE, MARKET MOOD TURNS NICE.”

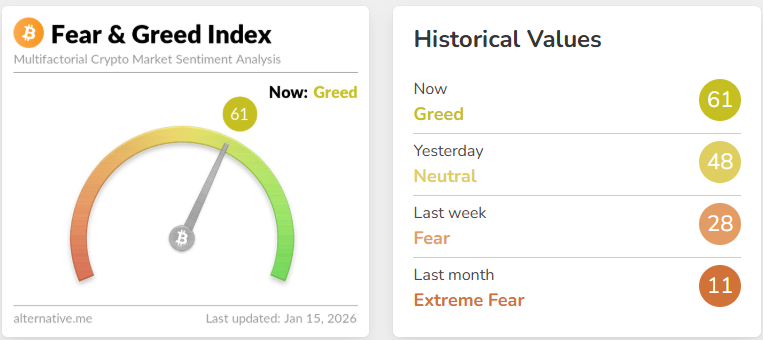

What changed in digital assets sentiment between November and January despite similar prices? The Digital Assets Fear & Greed Index entered “greed” territory for the first time since October 2025, indicating that the digital asset market is clearly recovering.

After months of fear-driven trading, the index improved to 61 on January 15, 2026. Since the $19 billion market liquidation in October, the index, which analyses sentiment in the digital currency market on a scale from 0 (extreme fear) to 100 (extreme greed), has remained in fear or extreme dread.

In November and December of that year, panic selling particularly in altcoins caused sentiment to drop into low double digits.

A massive Bitcoin (BTC) increase is directly associated with the current trend towards greed. According to CoinGecko data, Bitcoin increased from $89,799 to a two-month high of $97,704 over the last seven days.

The previous time this price level was observed was in the middle of November, when despite high prices, market sentiment was still very negative.

Additionally, market data points to strengthening fundamentals. Santiment, a blockchain analytics company, reports that over the course of three days, Bitcoin has experienced a net decline of 47,244 non-empty wallets, indicating that regular investors are leaving out of fear and impatience.

Because it implies that weaker hands are exiting the market, analysts frequently interpret this as a bullish indicator.

The supply of Bitcoin on exchanges has also decreased to a seven-month low of 1.18 million BTC, which lowers the possibility of abrupt sell-offs. Long-term holding behaviour is typically indicated by lower currency balances.

You need to login in order to Like

Leave a comment