Bitcoin (BTC) fell below $88,000 on Monday as traders became wary ahead of a large $28.5 billion Bitcoin and Ethereum options expiry later this week on the digital currency exchange Deribit.

| Bitcoin Price (BTC) | Dropped below $88,000 after briefly trading above $90,000 |

| Ethereum Price (ETH) | Fell below $3,000 during U.S. trading session |

| Market Sentiment | Cautious and volatile ahead of major options expiry |

| Options Expiry Value | $28.5 billion worth of BTC and ETH options |

| Total Open Interest | $52.2 billion |

| Short-Term Trend | Bearish to sideways |

Bitcoin lost steam during the U.S. trading session after momentarily rising past $90,000 earlier in the day. Ethereum (ETH) declined as well, returning to below $3,000.

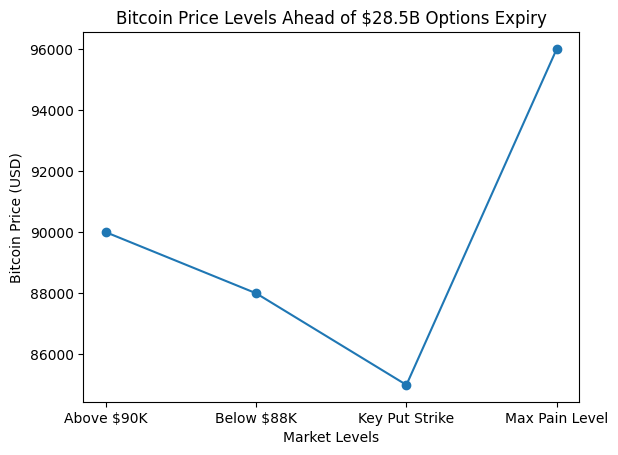

Bitcoin price levels ahead of the $28.5 billion Bitcoin and Ethereum options expiry on Deribit

As investors are ready for one of the biggest options expiries of the year, the decline illustrates the growing unpredictability in the cryptocurrency market.

Some stocks connected to cryptocurrencies continued to do well despite the decline in digital assets. Following the announcement of a 15-year AI data centre lease agreement with Fluidstack, Hut 8 (HUT) led advances.

Benchmark analyst Mark Palmer’s price target hike helped the stock rise more than 16%.

Although they both lost prior gains when cryptocurrency prices dropped, Coinbase (COIN) and Robinhood (HOOD) both saw increases in trading. Strategy (MSTR) saw a brief increase before modestly declining.

Jean-David Pequignot, Chief Commercial Officer of Deribit, claims that the impending expiration amounts to more than half of the exchange’s $52.2 billion in open interest.

He pointed out that the “max pain” level of Bitcoin is approximately $96,000, which is the price at which option sellers have the greatest potential to profit.

With almost $1.2 billion in open positions, there is also a lot of interest in the $85,000 put strike. If sales rise, this could put further pressure on pricing to decline.

Short-term traders are concentrating more on protection, although long-term bullish bets are still present.

You need to login in order to Like

Leave a comment