Good news to users! Singapore High Court has given Zettai Pte. Ltd, the parent company of popular Indian crypto exchange WazirX, the greenlight for its corporate restructuring plan. The significant development is paving the way for the exchange to not only work towards financial stability but repay users after last year’s colossal $234 million theft.

WazirX has been buzzing online, but not for the right reasons. It has faced liquidity issues and an operational crisis in recent times. The restructuring approval couldn’t have come at a better time, but for both WazirX stakeholders and the broader crypto industry in Asia, the approval carries greater implications.

As the crypto market continues its path to institutional maturity, WazirX’s court approval could set a precedent for other exchanges currently facing financial hurdles. We shall break it down why the restructuring scheme matters.

WazirX’s Role in Asian Cryptocurrency Market and the Controversies

WazirX grew to become India’s largest cryptocurrency exchange and one of the largest in Asia after its establishment in 2018. Cumulative volume hit $45 billion during peak market activity between 2021 and 2022.

Its popularity skyrocketed in 2019 after the launch of its automated Peer-to-Peer (P2P) system that ultimately solved banking barriers. That’s not all – it formed a strategic partnership with Binance in an attempt to gain global exposure.

However, the years that followed didn’t favor the exchange once known as the shining star in crypto, with liquidity constraints and declined trading activity topping the list of problems.

CREBACO research revealed that India’s crypto trading volume declined significantly up to 70% year over year due to high taxation and evolving regulations involving new banking laws and broader market uncertainty.

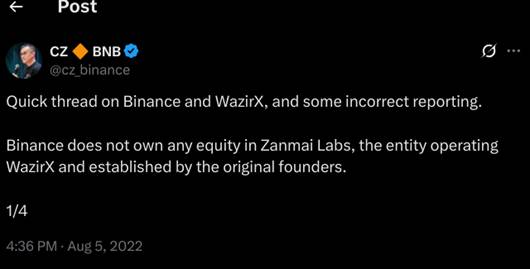

Apart from trading and regulations, WazirX found itself in another fiasco when the talk of who owned the exchange came up. Everyone, including users and media, believed Binance owned WazirX given that both platforms were deeply involved.

However, Binance founder denied owning any stake in WazirX or any of its associates – a statement that was disputed by Nischal Shetty, one of the founders of WazirX.

The whole Binance issue was followed by a financial investigation in August 2022, which alleged that WazirX had ties with some Chinese-owned illegal online betting applications.

This led to the freezing of WazirX’s bank assets valued at $8 million dollars. The back and forth between the exchange and Binance and the allegations of money laundering caused a flurry of panic and eventually instability, but that wasn’t everything.

The $234 Million Hack

The $234 million hack of 2024 finally put a nail on the coffin. On July 18, 2024, WazirX witnessed a significant security breach when it lost approximately 50% of its asset on the Ethereum wallet address amounting to INR 1900 ($234 million) to malicious actors.

According to Crystal Intelligence, the breach happened due to a sophisticated attack that involved altering the needed signatures to authorize transactions from a hot wallet to the one in the attacker’s possession. The hacker succeeded in manipulating several signatories to modify a smart contract.

WazirX added that the compromised hot wallet was managed by Liminal’s digital asset custody and that the wallet infrastructure was secured with multiple signatures. Although the exchange did freeze trading and withdrawal activity, the funds were drained and dispersed using Tornado Cash.

A year later, users affected by the hack are upset by India’s slow and decisive action. Others are desperate to regain access to their locked portfolio. This put WazirX in a difficult position and needed to act swiftly or they would lose even more users.

Why WazirX Needed Restructuring

The decision to restructure stemmed from a need to improve liquidity constraints, adapt to tightening compliance and regulatory requirements, and of course, ramp up efforts to clear users’ debts following last year’s large theft.

Even before the theft, the exchange had faced a significant downturn in finance and structure, which needed to be addressed sooner than later. Otherwise, it’d fade into obscurity, just like FTX did a few years ago.

In detail, this is what restructuring can do for WazirX:

1. Repay Victims of the $234 Million Hack

The court’s approval on October 13 will allow the exchange to move ahead with a court-supervised recovery process. WazirX will implement a transparent settlement framework for creditors and users. Several outlets have reported that users may not recover 100% of the losses. Only a substantial amount can be recovered under the approved plan.

Payment may also include part liquid payment and tokens that represent the remaining claims spread over time. That means users will get cash-equivalent and payments quickly while others will get tokens that the company wants to redeem through revenue generation and assets recovery. According to WazirX, the first wave of payouts will be in stablecoin.

2. Legal Protection and Operational Continuity

The Singapore approval enables WazirX to resume operations without creditor disruption. Note that the plan to restructure won a gargantuan backing from affected account holders, with 95.7% of participating scheme creditors voting in favor. That means the vote came from at least 143,000 creditors representing approximately $196 million. Users’ funds will remain accessible, and all trading activities will operate normally.

3. Stabilization

WazirX has been hit by crises, from the acquisition saga to alleged money laundering involving Chinese-owned illegal online betting applications. The issues, which happened within a short time, caused panic among users, leading to panic selling and withdrawal requests on the platform. When things like this happen, trading volume and revenue will plunge, but that’s not the worst of it all. Users’ trust will fall sharply, and that’s what happened.

The approval will give WazirX some space to implement business stabilization measures and address key issues that will enable them to move forward. Also, the court’s approval will provide clarity amid ongoing scrutiny from financial authorities.

WazirX’s Restructuring Serves as a Wake Up Call to Other Exchanges

The ripple effect caused by WaziriX’s debacle sent a chill throughout the Indian crypto community. Many Indian users, especially the newcomers, lost confidence in WazirX and even in the broader crypto market. It was a wake-up call that even the biggest and most trusted platform can be vulnerable to regulatory scrutiny and operational risk.

Before now, India’s regulatory environment has been full of uncertainties. After the Supreme Court lifted the banking ban on crypto in 2020, the new government didn’t enact a comprehensive regulation, forcing many crypto exchanges including WazirX to operate in grey areas. For example, the KYC and AML rules were comparatively weak, but WazirX was accused of not implementing the same KYC adequately in its alleged money laundering case involving the Chinese.

Fast forward to 2023, India’s current crypto environment has been strengthened by tightening regulation with the introduction of the Prevention of Money Laundering Act (PMLA). This means all cryptocurrency exchanges will enact full KYC for its users, integrate transaction monitoring and wallet tracking framework, and improve reporting standards.

WazirX’s restructuring will not only meet these improved regulatory obligations but potentially make it evolve into a more compliant exchange and perhaps, reposition itself as the most trusted exchange in Asia.

What’s Next for WazirX

The crypto exchange will move swiftly to implementing the restructuring plan based on the timetable. That starts with the gradual payout to the first batch of users affected by last year’s hack. However, WazirX will still need to coordinate with payment processors and regulators to ensure a smooth process.

Additionally, WazirX will look forward to fully complying with AML and compliance systems, enhancing financial transparency, rebuilding broken partnerships, and exploring opportunities for expansion.

The Singapore court’s approval signals maturity in the crypto ecosystem, and WazirX stands to benefit from this if it successfully implements its restructuring plan. The industry is watching closely to see how the exchange evolves in the next couple of months.

You need to login in order to Like

Leave a comment