A Shocking Crypto Breach

The crypto market experienced major instability during July and August 2025 after CoinDCX India’s leading exchange suffered a security breach. The theft of $44 million from operational wallets at the exchange triggered widespread concerns about cryptocurrency exchange security.

CoinDCX Internal Wallet Breach Crypto

The largest cryptocurrency exchange in India CoinDCX suffered a sophisticated cyberattack which resulted in a loss of $44.2 million on July 19, 2025. The attackers successfully accessed an operational wallet which they emptied during a short period of time. The security system at CoinDCX protected all customer assets from the attack.

The largest cryptocurrency exchange in India CoinDCX suffered a sophisticated $44.2 million hack during July 19, 2025.

The attackers successfully accessed an operational wallet to steal all its funds during a brief time period. The security design of CoinDCX protected all customer assets from any potential threats.

The news about the hack became public after 17 hours when ZachXBT used his Telegram channel to warn users about the possible breach.

Sumit Gupta as CoinDCX CEO issued a statement on X to explain that their internal operational account for liquidity management was compromised but assured customers their assets remained protected.

The CoinDCX hack incident has been traced back to North Korean state-sponsored hacking group Lazarus Group which operates as an aggressive cybercrime organization that attacks cryptocurrency exchanges.

The crypto community expressed disappointment about CoinDCX’s delayed disclosure because the company promotes itself as transparent yet it took more than 18 hours to reveal the $44 million hack. The community expressed their disappointment through comments which stated “Your exchange operates under the promise of community transparency yet it took 18 hours to reveal the $44 million hack.” [Link1]

Yet the good news is – User funds remained safe during the attack because protective measures functioned properly but the incident demonstrated how cyberattacks can discover alternative vulnerabilities. The hackers targeted CoinDCX internal systems by implementing sophisticated methods to access wallets which handled liquidity and settlement operations.

The security of exchanges remains a major concern because the current monitoring systems fail to detect cross-chain transactions properly. The security of operational wallets remains uncertain because they receive less protection than user accounts.

The security breach forces all crypto industry participants to evaluate their protection systems which leads to enhanced monitoring and improved infrastructure development. The tracking of funds between wallets and compromised destinations would reveal the exact nature of the security breach.

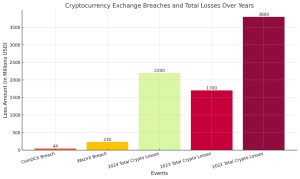

Image1. CoinDCX Hack Results in $44 Million Loss

CoinDCX Operational Account Hack Explained

The CoinDCX security breach occurred through a highly organized attack which took place between July 16 and 19 of 2025. Gupta identifies the breach as a complex server attack which the exchange documented in its incident report.

The attacker gained access to operational liquidity provisioning funds through a breach of our liquidity infrastructure system.

ZachXBT who has revealed major crypto scams throughout the past years has tracked the money flow in this case. The attacker received one ether from Tornado Cash before transferring some stolen funds from Solana to Ethereum through a bridge transaction according to ZachXBT on his Telegram channel.

The Tornado Cash laundering crypto mixer processed $7 billion worth of transactions since 2019 while serving as the funding source for this attack.

Attackers conducted a test transaction worth 1 USDt on July 16 during their thorough reconnaissance phase. The test transaction indicates that hackers spent time studying the exchange system and its liquidity network before launching their attack.

Security experts including Deddy Lavid from CyVers believe the attackers gained backend access through exposed credentials although the exact attack method remains unknown.

The CoinDCX security and operations teams collaborate with leading cybersecurity specialists to identify vulnerabilities while tracking stolen funds and implementing security fixes. [Link2]

CoinDCX $44M Hack Analysis

The security breach at CoinDCX demonstrates two major problems: weaknesses in cryptocurrency exchanges and sophisticated methods used by attackers. The attackers exploited smart contract vulnerabilities and cross-chain weaknesses to steal $44 million from CoinDCX operational accounts which handle financial management and transaction settlement.

The attackers used tiny transactions that were difficult to detect which demonstrated their sophisticated approach to hacking and raised doubts about the effectiveness of current security measures. The wallet system at CoinDCX protected user funds during this incident because it separates operational funds from customer assets.

A visual representation of the money transfer process from the operational wallet to hacker-controlled addresses at [cited] would provide clear evidence of the attack method. The incident demonstrates the urgent need for enhanced cryptocurrency monitoring systems and improved security measures for all digital currencies.

CoinDCX Hack Solana to Ethereum Bridge

The assets underwent a systematic transfer process from Solana to Ethereum through portions that ranged between 1,000 to 4,000 Solana units.

The cryptocurrency passed through multiple relay points before reaching two separate wallets which contained:

A Solana wallet contains 155,830 SOL worth $27.6 million that has not been accessed since the theft.

The attackers stored most of the stolen funds in an Ethereum wallet which held approximately 4,443 ETH worth $15.7 million.

The attackers managed to hide the hack because they used authorized operational access to perform big fund transfers which avoided security system alerts.

Lavid explained that the compromised account operated independently from user wallets yet its administrative access enabled big fund transfers which did not activate security alerts. [Link3]

| Incident Date | Total Loss | Affected Account | Customer Funds Impact | Recovery Bounty | Attack Method | Funds Movement | Suspected Attacker |

| July 19, 2025 | $44 million | Internal operational account used for liquidity provisioning | None | Up to 25% of recovered funds, potentially up to $11 million | Sophisticated server breach | Stolen funds bridged from Solana to Ethereum | Lazarus Group (North Korea) |

| July 2025 | $142 million | Multiple crypto exchanges, including CoinDCX and GMX | Varies by exchange | Varies by exchange | Various, including social engineering and server breaches | Varies by incident | Varies by incident |

CoinDCX $44M Hack Analysis

CoinDCX Security Breach – How It Happened

The CoinDCX breach exposed critical vulnerabilities in cryptocurrency exchange operational infrastructure which became evident through the attack. The attackers exploited operational backend systems which manage liquidity and transaction settlement functions instead of targeting user wallet accounts directly.

The hackers exploited weak monitoring of cross-chain transfer operations to execute their attack. The attackers performed small fund transfers to stay under detection thresholds. The attackers used this method to extract funds until someone discovered the theft. The unauthorized system access at CoinDCX resulted in $44 million being exposed from an operational account according to the company.

The incident demonstrates that exchanges need to establish enhanced security measures for their core backend systems. The security failure of core backend systems created both operational risks for the exchange and doubts about the overall security strength of cryptocurrency systems.

The chart shows the financial damages from current cryptocurrency exchange breaches together with the complete losses that occurred during the previous three years. The data shows that 2022 experienced the greatest financial losses at 3.8 billion USD followed by 2023 and predicted losses for 2024. The combined losses from CoinDCX and WazirX breaches remain low compared to industry-wide totals which demonstrate the necessity for enhanced security systems in the sector.

Conclusion – A Wake-Up Call for Crypto Security

The CoinDCX breach serves as a warning about how cyber threats against cryptocurrency exchanges continue to evolve. The incident demonstrates that attackers no longer require direct access to user wallets to conduct their operations.

The current cyber threat landscape shows hackers targeting operational accounts because they contain large amounts of money while taking advantage of weak points in cross-chain bridges. The security requirements for exchanges have become more critical because attackers now target internal systems which receive insufficient monitoring.

Exchanges that operate like CoinDCX need to separate user funds from operational funds to minimize risks while they resolve their current security problems. The incident at CoinDCX has triggered a broader industry discussion about implementing robust security measures throughout the entire cryptocurrency sector.

The image demonstrates the critical need to address security vulnerabilities in crypto systems.

Image2. Cybersecurity Incident: CoinDCX Hacked

References:

- Nilesh Jain. ‘Introduction To Cyber Security.’ Dr. Priyank Singhal, Crown Publishing, 5/3/2025

- Link1

- Link2

- Link3

Image References:

- Image: CoinDCX Hack Results in $44 Million Loss, Accessed: 2025. https://fullycrypto.com/wp-content/uploads/2025/07/CoinDCX-Hacked-for-44-Million-746×511.png

- Image: Cybersecurity Incident: CoinDCX Hacked, Accessed: 2025. https://akm-img-a-in.tosshub.com/indiatoday/images/story/202507/coindcx-hacked-232248478-16x9_0.png?VersionId=duS0O.E40ZNLS2_gglWvzQKPj76cH3SP&size=690:388

You need to login in order to Like

Leave a comment