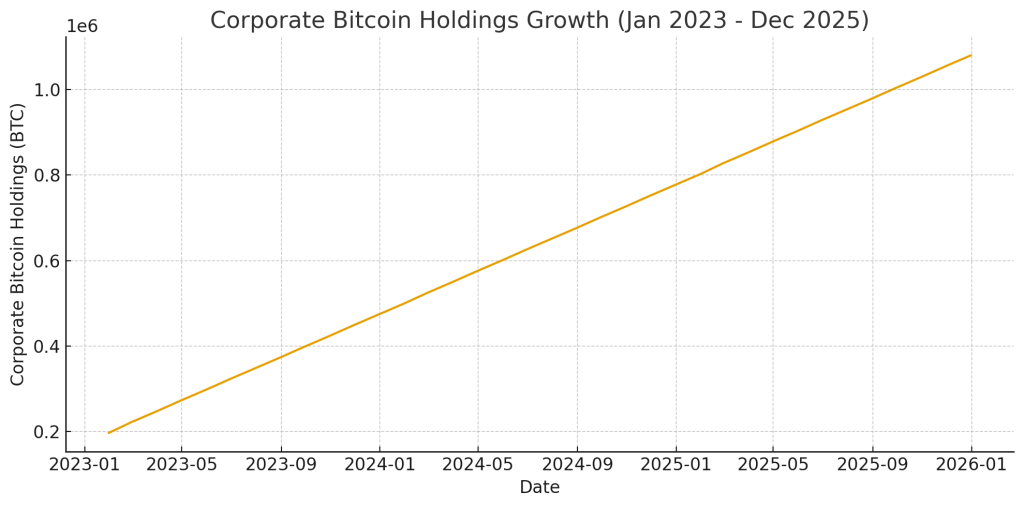

Corporate America is making a bold statement, and the figures prove it. By late 2025, corporate Bitcoin holdings had increased by an amazing 448%, from just 197,000 BTC in early 2023 to over 1.08 million BTC.

In addition to exciting investors and shocking analysts, this spike has pushed Bitcoin farther into the global financial system than it has ever been.

Bitcoin price chart from 2023 to 2025 showing growth from $16,000 to above $90,000.

What began as a delicate experiment has evolved into a corporate takeover. The number of publicly traded firms that own Bitcoin has increased from 33 to almost 80 over the past three years.

It indicates a clear and increasing level of institutional confidence. MicroStrategy, which has since changed its name to Strategy, is at the forefront of the movement and still controls the corporate Bitcoin market.

The corporation treated Bitcoin as its main treasury reserve asset, holding 660,624 BTC by December 2025.

Miners of bitcoin are also joining the movement. Hut 8 Corp increased its reserves to 13,696 BTC, a significant increase from the prior year, while Marathon Digital Holdings increased its holdings to nearly 52,850 BTC.

One of the most significant bull cycles for Bitcoin coincides with this enormous increase in business use. The price increased from over $16,000 in January 2023 to over $90,000 in late 2025, giving institutions looking for long-term value and inflation protection more confidence.

A growing corporate fear of missing out is also highlighted by this trend. Businesses that wait to enter the market may incur greater expenses and fewer chances as the supply of Bitcoin stays fixed and institutional demand keeps growing.

To put it another way, the corporate race for Bitcoin has already started, and the pioneers are leading the way.

Bitcoin might rank among the most significant treasury assets of the decade if the trend continues.

You need to login in order to Like

Leave a comment