Key Takeaways

- Recent on-chain data shows a big change in the Bitcoin market. Long-term holders are not buying dips like before, which shows lower confidence.

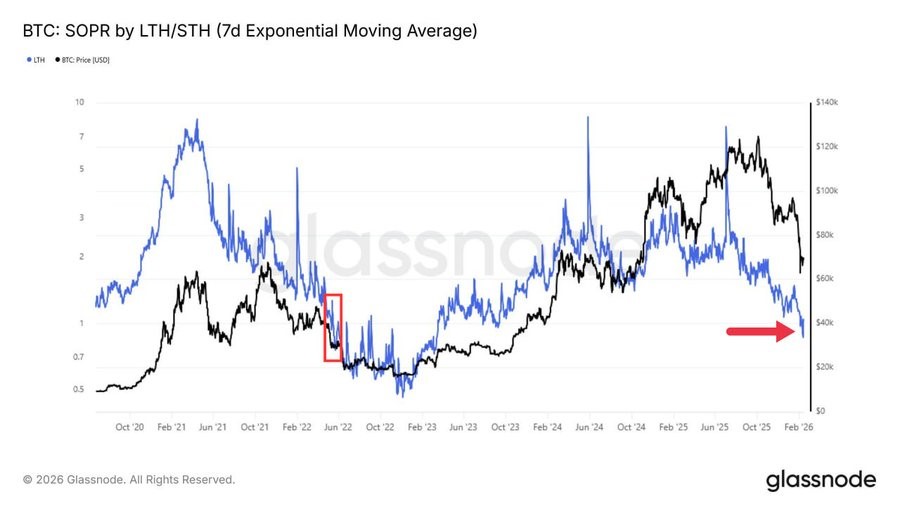

- A rare LTH SOPR drop means some experienced investors are selling at a loss. This signal last appeared during the Terra-LUNA crisis.

- Technical signals show a weak big trend, even if small buy signs appear. Experts say high interest rates, global money worries, and market doubt cause this change.

- This does not always mean a crash is coming. Markets move in cycles. New investors should stay calm, do research, understand risks, and invest only money they can afford to lose.

NO DIP SUPPORT, EXPECT MARKET REPORT

A rare Bitcoin signal just flashed red after two years of calm. Is this a warning sign smart investors shouldn’t ignore? The Bitcoin market has changed strongly, according to recent on-chain data. Unlike in the past, long-term holders, or LTHs, are not purchasing when the price declines.

These holders are those who hang onto their coins for an extended period of time. When prices drop, they typically remain composed. When prices drop, they purchase more coins. This frequently aids in the market’s recovery.

BTC Chart Overview

Technical Analysis

- The Relative Strength Index shows the market is calm. It does not look too strong or too weak. This tells us buyers and sellers are almost equal right now.

- The MACD shows a small buy signal. This means the price may try to move up. Buyers are slowly coming back into the market.

- But the long moving averages show a sell signal. This means the bigger trend still looks weak. The price is still under strong resistance, and sellers still have control.

- The market may move slowly. It may try to go up, but strong growth is not clear yet. Traders should stay careful. The trend still needs more strength to change.

However, things have changed since then.

A Rare Signal In The BTC Market

LTH SOPR is one significant signal. It indicates whether long-term holders make money when they sell their coins. This number was higher than 1 for over two years. Accordingly, the majority of long-term holders were making money when they sold.

It now fell. 1. This indicates that some seasoned investors are losing money when they sell their currencies.

It doesn’t happen very often. Long-term holders haven’t ceased purchasing drops like this since the 2022 Terra-LUNA crisis. Fear swept over the cryptocurrency market at that moment. Prices dropped quickly. Even powerful holders started to exercise caution.

Why Are Long-term Holders Suddenly Acting Differently?

Market Experts agree for a few easy reasons:

- High interest rates – People can earn safe money in banks and bonds, so they buy less crypto.

- World money worries – Slow business growth and big debts make people careful.

- Market doubt – After big price jumps, some investors take profit or stop their losses.

Conclusion

Is this just a small pause, or a big change coming for Bitcoin? This does not necessarily portend a major collision. Markets may slow down before rising once more. However, weak dip purchasing indicates a decline in market confidence.

You need to login in order to Like

Leave a comment