“PLAY, TRADE. AND EARN, IT’S A NEW CONCERN. NFTs WITH UTILITY NOW TAKE THEIR TURN!”

Is 2026 the Year NFTs Move From Speculation to Institutional-Grade Assets? Animoca Brands, a global leader in blockchain gaming and digital assets, has acquired Somo, a firm that creates digital collectibles and games, marking a watershed event in the NFT sector.

With the acquisition, speculative NFTs give way to tradable, utility-driven digital assets, making 2026 the “Year of Utility Tokens.”

Animoca is able to incorporate playable and interoperable NFTs throughout its ecosystem thanks to Somo’s robust IP portfolio and active user base, which includes products like Somo Battleground.

Cross-platform interaction and community growth are important KPIs that institutional investors increasingly monitor as markers of NFT adoption, according to TechFlowPost.

According to Yat Siu, co-founder of Animoca, “2026 is the year NFTs move from speculation to tangible utility.” “Our vision of NFTs as useful, tradable assets with practical applications is reflected in our acquisition of Somo.”

The NFT market, which has been volatile for a long time, is showing early indications of a structural recovery.

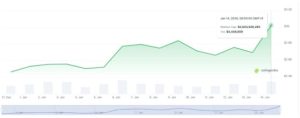

Prediction market activity and NFT trading volume have increased, according to Dune Analytics, indicating a rise in trust in regulated, utility-based tokens.

Animoca’s larger plan includes RWA (real-world asset) projects in collaboration with Standard Chartered and Fosun Wealth, as well as aspirations to list on the Nasdaq through a $1 billion reverse merger with Currenc Group.

These actions demonstrate the company’s dedication to institutional-grade compliance and the integration of blockchain-based ownership with traditional finance.

You need to login in order to Like

Leave a comment