“Regulation brings trust, institutions bring flow crypto’s bull run still has room to grow.”

According to Greyscale Investments, the cryptocurrency market is expected to remain in a long-term bull run until 2026, fuelled by increased institutional demand and clearer worldwide rules.

According to Greyscale’s most recent study, “2026 Digital Asset Outlook: Rise of the Institutional Era”, cryptocurrency markets are about to enter a new era when consistent capital flows and practical acceptance are more important than fleeting enthusiasm.

The company thinks that stronger connections with international financial markets are taking the place of the conventional four-year cryptocurrency cycle associated with Bitcoin decreases.

The two main forces underlying this view are highlighted in greyscale. Increasing macroeconomic pressure comes first. Investors are searching for alternative sources of wealth due to the government’s high debt and continuing financial difficulties.

Due to their perceived scarcity and transparent supply, assets like Bitcoin and Ether are appealing hedges against inflation and currency concerns. In order to support its predictable supply strategy, the company has stated that the 20 millionth Bitcoin is anticipated to be mined in March 2026.

Clarity of regulations comes in second. According to Greyscale, institutions are feeling more confident about entering the market as a result of recent developments, such as the introduction of spot cryptocurrency ETFs and new stablecoin regulations.

Large investors are finding it simpler to purchase, hold, and utilise digital assets within compliant frameworks thanks to clearer laws.

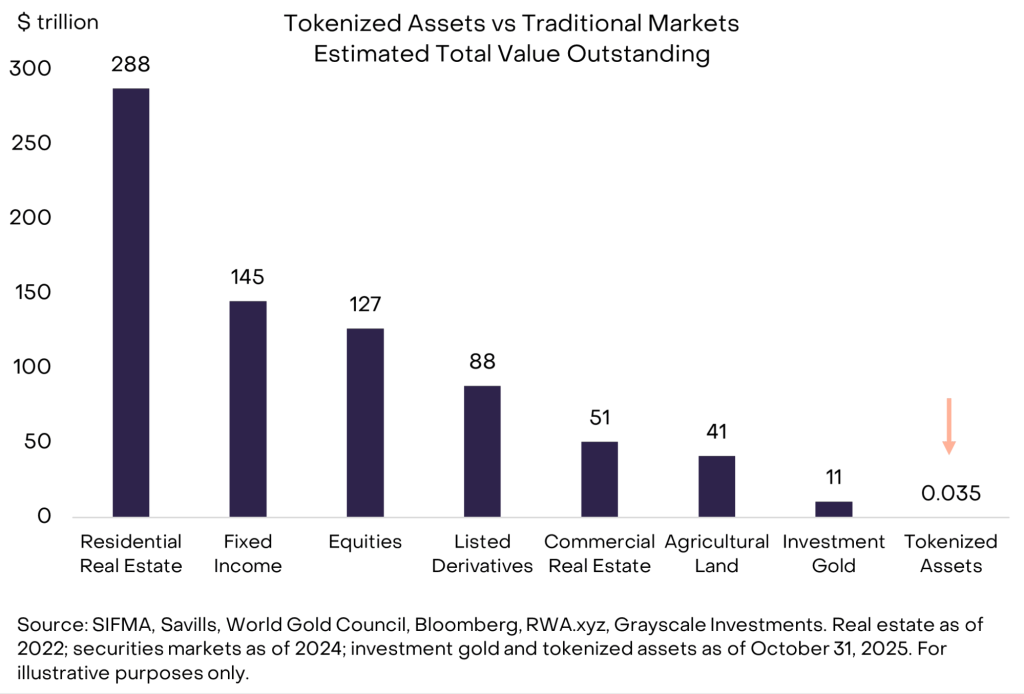

Greyscale listed ten major investment topics that will influence 2026. These include the demand for quicker and more private blockchain infrastructure, the rising DeFi lending markets, the growing significance of stablecoins in payments and settlements, the rise in asset tokenisation, and the broader use of staking.

The company also played down worries about digital asset treasuries and quantum computing, stating that they won’t have a big effect on markets next year.

You need to login in order to Like

Leave a comment