“Crypto offers speed and efficiency, but banks must guard against risk to keep their ratings strong,” Fitch noted.

US banks with big cryptocurrency exposure may receive unfavourable rating analyses, according to a warning from Fitch Ratings. Although crypto integrations can increase fees, yields, and operational efficiency, the international credit rating agency noted that they also pose dangers to banks’ reputational, liquidity, operational, and compliance.”

According to Fitch’s assessment, banks can improve customer service and gain from quicker payments and smart contracts by investigating stablecoin issuance, deposit tokenisation, and blockchain technology.

The agency emphasised that a bank’s risk profile and business model could be adversely affected by concentrated crypto exposure.

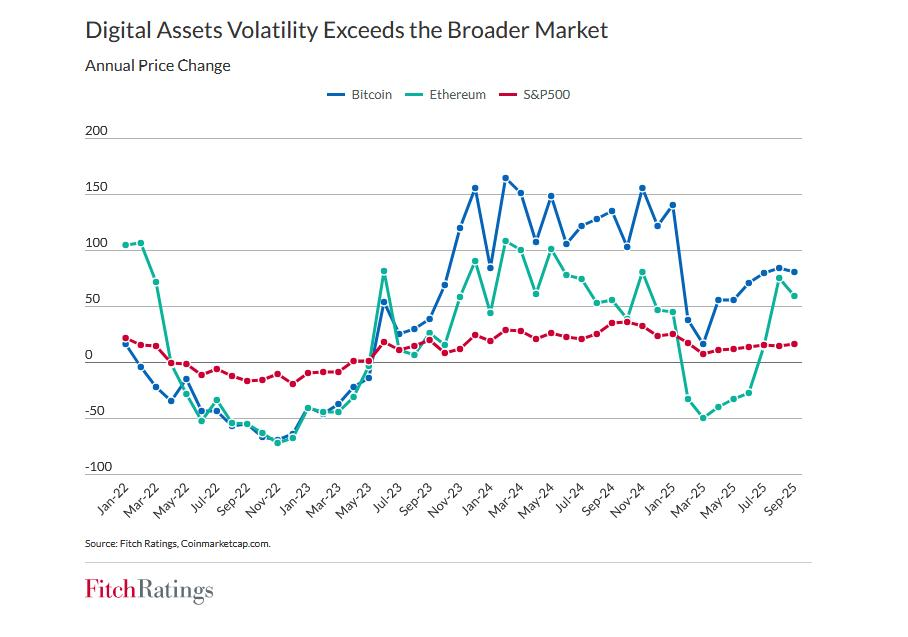

“To fully realise the benefits of digital assets, banks must manage the volatility in cryptocurrency values, the identities of digital asset owners, and ensure strong protection against loss or theft,” according to Fitch.

Major US banks like JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo are continuing to increase their involvement in cryptocurrency at the time of the article.

Concerns over systemic risks from the expanding stablecoin market were also voiced by Fitch, especially if adoption reaches a level that might have an impact on the Treasury market.

Banks still struggle to strike a balance between innovation and risk management, but US regulatory advancements are contributing to a safer bitcoin environment. According to Fitch’s cautions, rating pressure on cryptocurrency-heavy banks may have an effect on investor confidence, financing costs, and bank expansion.

You need to login in order to Like

Leave a comment