The FINRA findings indicate that U.S. investors are becoming more cautious, particularly with regard to cryptocurrencies, due to growing worries about risk, fraud, and influencer-driven advice.

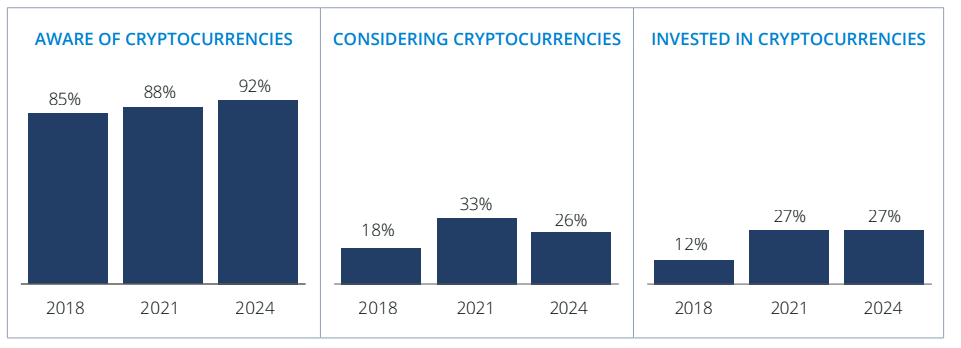

Even though 27% of people still possess digital assets, just 26% are thinking about purchasing them, a significant decrease from 33% in 2021.

Once the strongest supporters, younger investors now exhibit the biggest retreat, indicating a change in perspective from enthusiasm to caution.

According to a new FINRA Foundation survey, fewer Americans are considering purchasing cryptocurrencies, despite the fact that the number of people who actually own them has remained stable.

Investors in the United States: Results from the FINRA Foundation’s National Financial Capability Study, which polled 2,861 American investors, provide new information about how investor behaviour, market shifts, and technology are influencing the current financial environment.

According to Jonathan Sokobin, Chair and Chief Economist of the FINRA Foundation, the study demonstrates how market conditions and demographic changes are altering investor sentiment.

He stated that the study will assist businesses, financial specialists, and legislators in better directing and safeguarding investors.

Younger investors under 35 also demonstrated an important decline in interest, indicating a change in attitude among an audience that was previously thought to be a key force behind demand for digital assets.

According to Gerri Walsh, president of the FINRA Foundation, the findings show that less seasoned investors have knowledge gaps.

She emphasised the importance of thorough investor education by stating, “They still struggle with risk assessment, which can leave them exposed to mistakes.”

You need to login in order to Like

Leave a comment