“When the Fed turns on the flow, markets start to glow — watch crypto rise, then steal the show.”

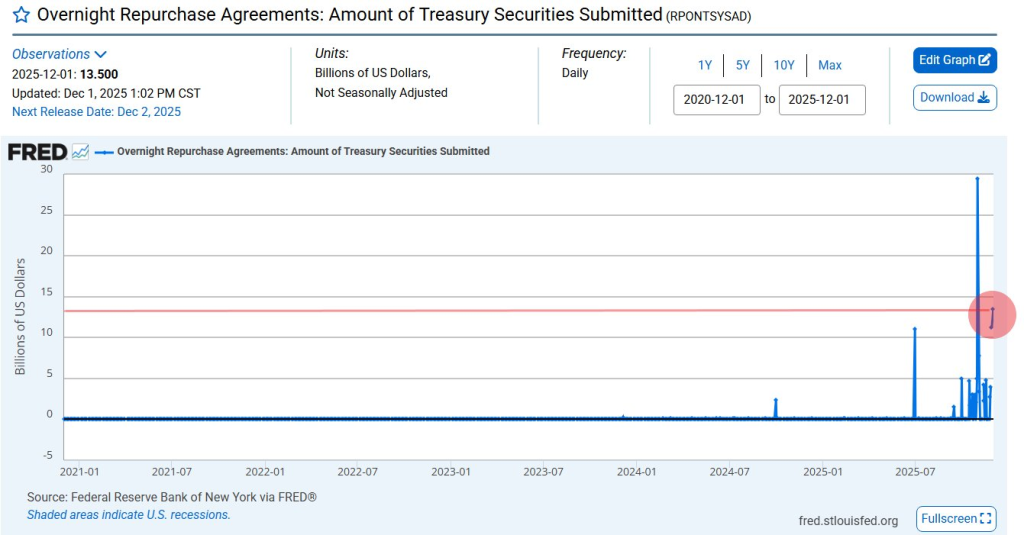

The Federal Reserve has injected $13.5 billion into the U.S. banking system through overnight repo operations, suggesting an unexpected turn towards fresh liquidity.

Wall Street and the cryptocurrency industry are taking notice of this abrupt swing, and many are wondering if a crypto rally is imminent.

Bitcoin, Ethereum, and other altcoins have historically benefited from liquidity injections, which frequently lessen financial stress and boost risk appetite. Analysts say the timing matters.

This repo rise indicates that the Fed is subtly loosening conditions to calm markets before year-end, only days after the Fed stopped quantitative tightening.

Fundstrat’s Tom Lee previously noted that liquidity “acts like fuel for Bitcoin performance.” With new funds now flowing into banks, traders believe risk assets could strengthen again, especially if December rate cuts follow.

FRED chart showing Fed overnight repos

He observes that when the Fed last paused QT, stocks gained 17% in just three weeks.

The bullish viewpoint is not shared by all analysts, though. Ted Pillows warns of an 81% possibility that the Bank of Japan (BOJ) will raise rates in December. Historically, BOJ rate hikes have been unfavourable for crypto.

Each increase in March 2024, July 2024, and January 2025 caused broad market sell-offs in Bitcoin and the wider crypto ecosystem.

Lee anticipates improved market conditions entering January based on this historical tendency, even projecting a new all-time high for Bitcoin.

However, not everyone is convinced. Some analysts warn this may be a temporary patch, not a full policy turn. If inflation prints higher or global tightening returns, risk assets, including crypto, could face pressure.

You need to login in order to Like

Leave a comment