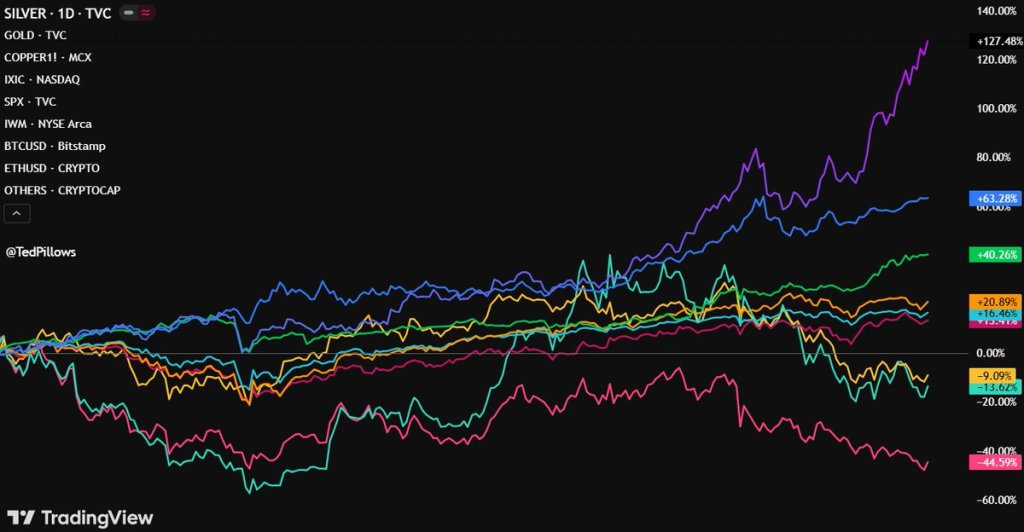

Do you know that 2025 delivered a brutal reality check for crypto investors? As silver hit record highs and stocks climbed steadily, the crypto market collapsed, pushing Bitcoin, Ethereum, and altcoins into one of the deepest downturns in history.

One of the biggest falls in the history of the cryptocurrency industry has occurred as of late December 2025, with altcoins down about 44.5% year to date.

| Assets | 2025 YTD Return |

| Bitcoin (BTC) | -9.09% |

| Ethereum (ETH) | -13.62% |

| S&P 500 | +16.4% |

| Silver | +127.4% |

| Gold | +63.2% |

For the first time among major asset classes, Bitcoin ended last in 2025 as Ethereum plunged more than 13% and Bitcoin fell close to 9%.

Commodities, on the other hand, controlled the markets. Strong industrial demand, supply constraints, and a spike in safe-haven purchases caused silver to rise more than 127%, reaching all-time highs.

Due to central bank purchases and anxiety about the state of the world economy, gold also recorded an amazing 63% rise. These increases unmistakably demonstrate a change in investor inclination towards tangible assets in 2025.

Given the instability, equity markets remained resilient. The S&P 500 increased 16%, providing consistent returns for long-term investors, while the Nasdaq climbed over 20% due to a resurgence of interest in artificial intelligence businesses.

The flip of the cryptocurrency market happened quickly. Most gains were wiped out by a late-year sell-off after reaching highs earlier in the year.

AI tokens and meme coins were among the altcoin sectors that lost the most, with several projects losing between 50% and 85% of their value.

The current stage is referred to by market analysts as a “capitulation moment”, when long-term investors reevaluate risk and poor projects withdraw.

Although there have been previous downturns in cryptocurrency, 2025 stands out as one of its most difficult years.

You need to login in order to Like

Leave a comment