Freedom is fine, but safety must stay—markets win when protection leads the way.

DeFi is growing, but so is the movement to control it. Over 5 million active wallets engage with DeFi protocols each month, and global decentralised finance systems have handled over $100 billion in value this year.

At the same time, losses from cryptocurrency-related breaches and exploits exceeded $2 billion over the previous 12 months, creating serious worries about investor safety.

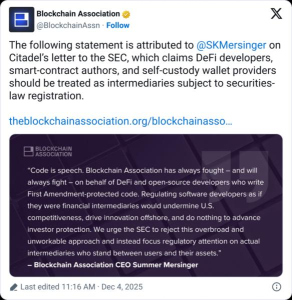

The massive Wall Street firm Citadel Securities has now intervened, pleading with the U.S. Securities and Exchange Commission (SEC) to deny DeFi regulatory leniency.

Citadel warned the SEC in a letter that the market might suffer if decentralised finance platforms were given exemptions. The company maintained that DeFi ought to be subject to both exchange and broker-dealer regulations.

Citadel claims that a “free pass” for decentralised finance might erode market surveillance, equitable access, and investor protection, all essential components of financial supervision.

This caution draws attention to the escalating conflict between blockchain-based systems and conventional finance. DeFi developers contend that the community, not institutions, controls their platforms, which are governed by code.

However, Citadel feels that the system should not be exempt from regulation because, despite its decentralisation, it still has an impact on actual investors, trade, and money flows.

The SEC has been exploring the application of current market regulations to DeFi. Citadel’s most recent initiative increases the demand for more regulation and more transparent enforcement.

This discussion may influence how digital banking develops for investors, affecting everything from platform functionality to user safety.

The battle between Wall Street institutions and Web3 innovators is still ongoing as the use of cryptocurrency increases.

The future of decentralised finance may depend on regulation, regardless of whether the SEC agrees with Wall Street’s demand for discipline or DeFi’s call for flexibility.

You need to login in order to Like

Leave a comment