FAST GAINS TEASE, BUT LOSSES DON’T FREEZE.

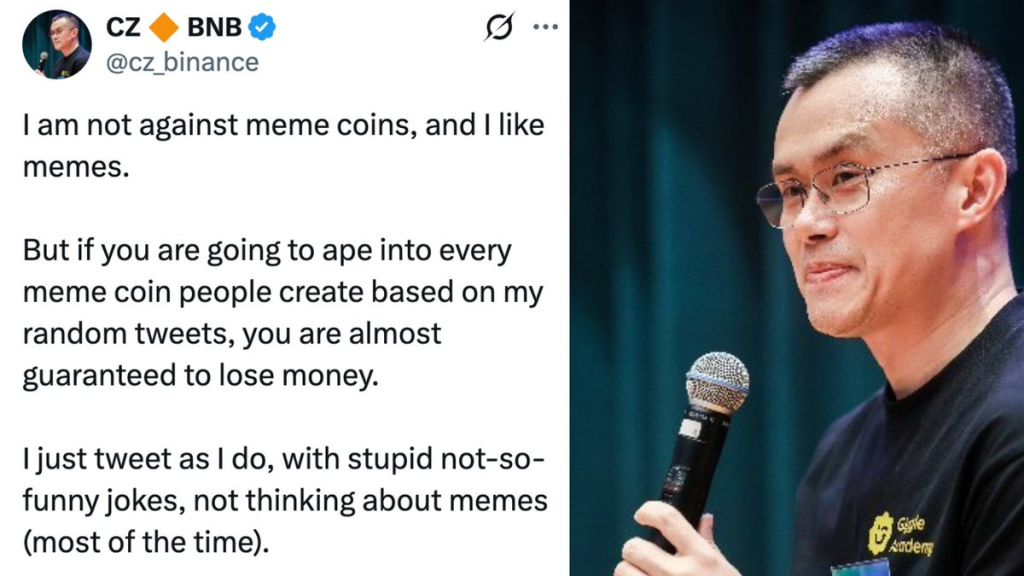

With Most Meme Coins Fading Fast, Are Traders Ignoring the Red Flags? The former CEO of Binance, Changpeng Zhao, also referred to as CZ, has cautioned cryptocurrency traders about the risks associated with careless meme coin trading.

Investing in meme coins made in reaction to his informal social media posts can result in significant losses, he warned.

Investing in meme coins made in reaction to his informal social media posts can result in significant losses, he warned.

On his official X (previously Twitter) account, CZ stated that he frequently tweets in jest and does not mean for his remarks to be interpreted as investing advice.

He emphasised that losing money is nearly a given if you “ape into” every meme coin associated with his posts.

Meme coins are digital currencies that draw inspiration from jokes, viral trends, and internet culture.

The capitalisation of the entire meme coin market has occasionally surpassed $100 billion, and daily trading volumes have reached several billions of dollars. The industry is extremely speculative and fragile, despite sporadic large gains.

Many meme coins struggle to endure long after introduction, according to recent data.

Investor risk is increased by the fact that about 60% of new tokens are active for less than 24 hours and that much less have formal contract audits.

The community for digital currencies is still struggling with the extreme volatility and risk of meme currencies when CZ issues this warning.

The majority of new meme coins have no real use and are susceptible to fraud or abrupt price drops, even if some tokens, like Dogecoin and others, have historically produced significant profits.

You need to login in order to Like

Leave a comment