“Liquidity matters more than ever. When ADA holders use highly illiquid pools, they risk losing millions, regardless of market conditions or stablecoin prices.”

On Sunday, a five-year Cardano holder accidentally cleaned away more than $6 million in ADA via a high-slippage swap, making one of the most stunning DeFi blunders recorded on the Cardano network this year.

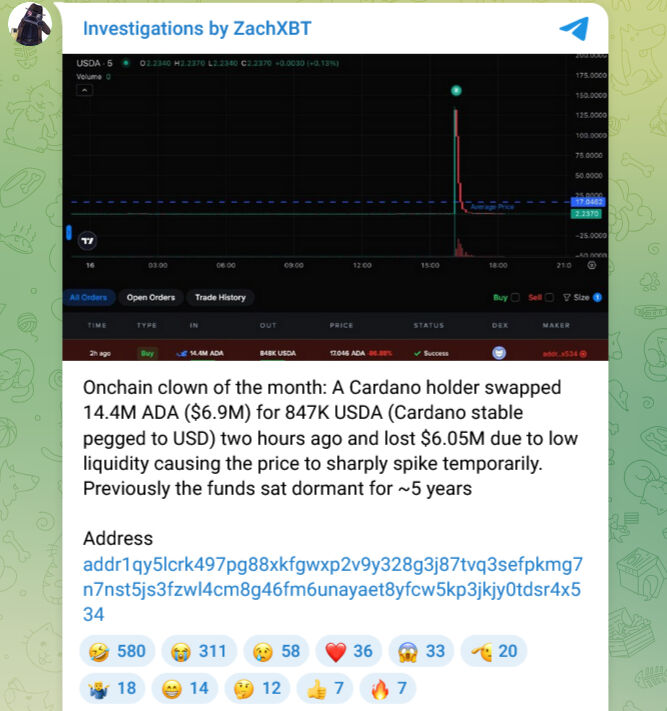

On January 12, 2025, the long-inactive wallet “addr..4×534” converted ADA into the USDA stablecoin via a thin-liquidity pool on a Cardano DEX, which SundaeSwap identified as an illiquid USDA trading pool.

Data showing a test swap followed by a $6M ADA loss in an illiquid USDA pool

According to blockchain analyst ZachXBT, the user traded 14.4 million ADA, worth $6.9 million, for only 847,695 USDA, resulting in a shocking loss of $6.05 million.

According to on-chain statistics, the user executed the multimillion-dollar transaction just 33 seconds after making a tiny test swap of 4,437 ADA at 4:06 pm UTC.

The abrupt action was even more peculiar because the wallet had been inactive since September 13, 2020.

According to CoinGecko, the trade drained the order book due to the pool’s incredibly low liquidity, driving USDA’s price to $1.26 until it eventually dropped back to $1.04.

With a market capitalisation of over $17 billion and a 24-hour trading volume close to $400 million, ADA was trading at about $0.48 at the time of the exchange, underscoring the disparity between the pool’s small liquidity and ADA’s enormous market.

The market capitalisation of USDA, which is issued by Anzens, is only $10.6 million. The trader had never held USDA before, according to blockchain records, raising the possibility of a fat-finger error.

According to experts, the incident highlights a developing issue in DeFi. One analyst said on X, “Large swaps in illiquid pools can destroy value instantly.”

The Cardano whale’s loss shows a simple truth: in DeFi, liquidity is king. Every trader, big or small, must double-check the pool before hitting swap. Although DEX activity has increased in the Cardano community, liquidity is still low in comparison to other chains.

The occurrence comes after previous significant cryptocurrency accidents, including Paxos’ unintentional minting of 300 trillion PYUSD last month, which serves as a reminder that even small mistakes can cause market turbulence.

You need to login in order to Like

Leave a comment