When billions exit in days, it’s not routine volatility — it’s a signal that the ETF era is entering its most decisive stress test yet.”

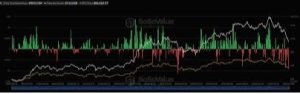

Spot Bitcoin ETFs saw a huge $903 million daily withdrawal on Thursday, the second-largest single-day withdrawal since their introduction in January 2024, shaking the U.S. Bitcoin ETF market with one of its most violent sell-offs so far.

The market experienced a brief flash of optimism with $75.4 million in inflows just one day before the abrupt flood of redemption pressure that obliterated it.

Now, November has become a historic month for ETF anxiety. If redemption patterns continue, this month might be the worst outflow month ever for U.S. spot Bitcoin ETFs.

With total outflows reaching $3.79 billion, surpassing February’s previous record of $3.56 billion.

BlackRock’s iShares Bitcoin Trust (IBIT), which has lost $2.47 billion in November alone—an astounding 63% of all monthly outflows—is at the forefront of the decline.

According to Ki Young Ju of CryptoQuant, IBIT recorded nearly $1.02 billion in redemptions this week alone, making it its biggest weekly outflow in history.

Not far behind, $1.09 billion has been taken out of Fidelity’s Wise Origin Bitcoin Fund (FBTC) this month, including $225.9 million this week.

Together, IBIT and FBTC accounted for 91% of all outflows from U.S. spot Bitcoin ETFs in November, pushing liquidity out of the market at a record rate.

The cryptocurrency market is currently facing one of its most significant turning points in 2025, with volatility increasing and investor sentiment changing quickly.

You need to login in order to Like

Leave a comment