“Max pain levels holding the key,

BTC and ETH wait to break free.”

Does a 1.05 put-to-call ratio mean Bitcoin is stuck before expiry? Crypto markets are at a crossroads as more than $2.2 billion in Bitcoin (BTC) and Ethereum (ETH) options expire on Deribit, just hours before the highly anticipated US Nonfarm Payrolls (NFP) report.

Because of this uncommon coincidence between an important macro event and the expiration of options, traders are being careful and volatility is being controlled.

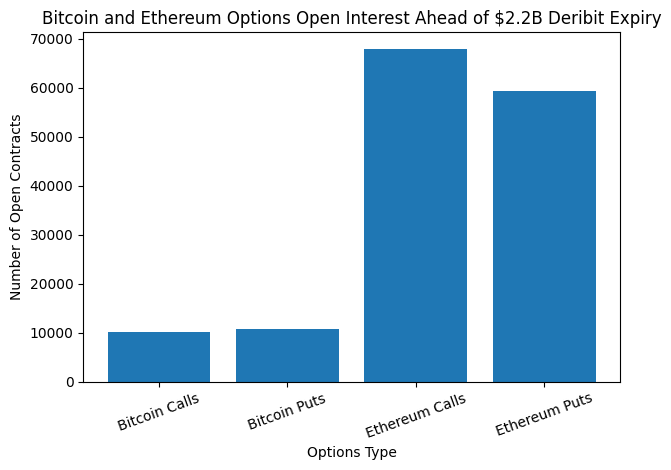

Bitcoin and Ethereum options open interest shows balanced BTC positions and higher ETH call exposure before $2.2B expiry

Bitcoin and Ethereum options open interest shows balanced BTC positions and higher ETH call exposure before $2.2B expiry

Bitcoin’s options market is nearly balanced, with 10,105 call contracts and 10,633 put contracts, for a put-to-call ratio of 1.05. Dealer hedging, which can pin prices and stifle short-term volatility prior to expiration, frequently results from this equilibrium.

Bitcoin is currently trading close to its maximum pain threshold of $90,000 at $90,985. Ethereum is currently trading at $3,113, just above its maximum price of $3,100. According to data from Deribit, ETH options make up about $396 million of the total expiry, while BTC options account for nearly $1.89 billion.

Ethereum displays a different layout. With a put-to-call ratio of 0.87, ETH options data shows 67,872 calls vs 59,297 puts, indicating greater upside exposure.

Analysts observe that dealers might have to respond swiftly to price increases if ETH remains above its maximum pain threshold following expiration.

Macro pressure is increasing beyond choices. Over the last week, the U.S. dollar index (DXY) has increased by roughly 0.5%, putting pressure on riskier assets like Bitcoin.

In December, economists predict 73,000 new jobs in the United States and a 4.5% unemployment rate.

You need to login in order to Like

Leave a comment