The financial sector underwent a significant transformation through Decentralised Finance (DeFi) which began as peer-to-peer experimentation before developing into a multi-chain system that provides advanced financial solutions.

The new DeFi 2.0 framework addresses previous system weaknesses by focusing on improving liquidity management and scalability and user interface performance.

The upcoming DeFi phase will establish a dependable financial system through its implementation of Protocol-Owned Liquidity and enhanced cross-chain operations.

The fundamental transformation proves interoperability needs exist because it allows complete operational integration between different blockchain systems which leads to enhanced operational performance and unified access to multiple platforms.

The visual representation in [cited] shows how different blockchain systems connect to each other which demonstrates the new DeFi innovations.

Overview of Decentralized Finance (DeFi) and its evolution from DeFi 1.0 to DeFi 2.0

The progression from DeFi 1.0 to DeFi 2.0 has enabled developers to develop enhanced decentralized financial systems. The first stage of DeFi 1.0 operated through basic blockchain-based lending and borrowing systems.

The system faced three main problems because of unstable liquidity levels and high transaction fees and unfunctional yield production which damaged user trust and participation.

The new developments in DeFi 2.0 aim to solve previous problems through enhanced capital management and improved security and better blockchain network connectivity.

The development of Protocol-Owned Liquidity and authentic yield models works to establish enduring financial stability and system integration. The development of DeFi 2.0 has brought about a complete overhaul of financial systems to create an enhanced reliable framework which will serve as the base for building future financial systems.

Advantages of DeFi 2.0 Over DeFi 1.0

- Sustainable Yields: The system eliminates unlimited token generation because DeFi 2.0 operates through actual revenue distribution.

- Protocol-Owned Liquidity: Protocols that control liquidity help create more stable financial systems which become less vulnerable to system failures.

- Cross-Chain Functionality: Users can perform operations between different Layer-1 and Layer-2 networks.

- Improved Capital Efficiency: Users can stake their assets while borrowing and using them through LSDs.

- Reduced Gas Fees: The operation of Layer-2 systems leads to major decreases in transaction expenses.

- Enhanced Security: The system contains sophisticated auditing systems together with protected bridges and oracles which work to minimize potential security threats.

Top DeFi Projects to Watch for the Future

The following projects will lead decentralized finance into its future development stage.

- Aave V4 – Unified liquidity + AI-driven risk systems

- Uniswap X – Intent-based trading + MEV-resistant swaps

- Frax Finance – LSDs + stablecoins + advanced tokenomicsSynthetix V3 – Modular derivatives and RWA collateral

- Curve V2/V3 – Efficient stablecoin and crypto liquidityThorchain operates as a native chain swap system which enables users to perform exchanges without requiring any wrapped assets.

- StarkNet & zkSync – Next-gen ZK-powered DeFi ecosystems

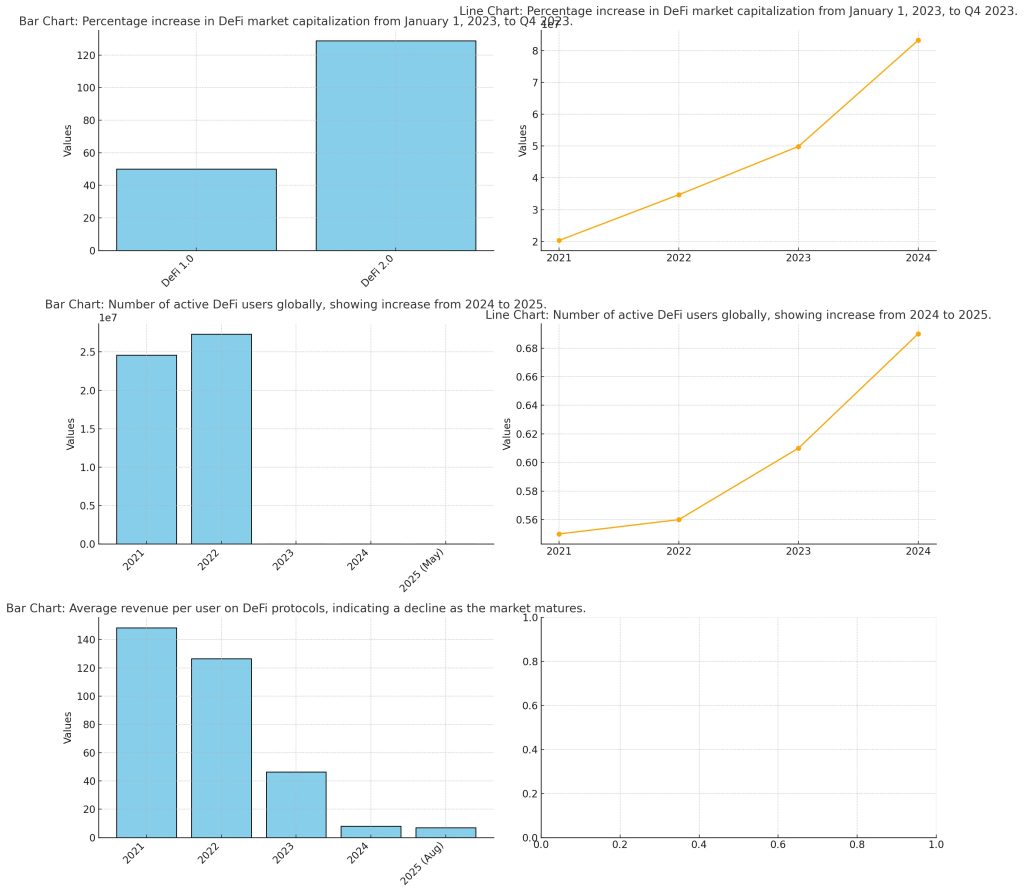

The charts show different metrics which demonstrate DeFi market growth and user interaction patterns throughout time: 1. The bar chart shows that DeFi market capitalization grew from DeFi 1.0 to DeFi 2.0 through a major expansion. 2. The line chart shows user adoption growth through continuous increases in total DeFi users from 2024 until 2024. 3. The bar chart shows a minimal user base expansion through its numbers which demonstrate growth between 2024 and 2025. 4. The line chart shows user penetration growth through its display of rising user numbers against worldwide population statistics. 5. The bar chart demonstrates that DeFi protocol average revenue per user has decreased because the market has reached maturity while users now distribute their activities across various platforms.

What is DeFi 2.0?

Understanding DeFi 2.0

The financial framework of Decentralised Finance or DeFi continues to develop through DeFi 2.0 which represents its current advanced stage.

The new DeFi 2.0 framework addresses all major weaknesses from DeFi 1.0 by implementing better liquidity management and reduced transaction costs and enhanced network connectivity between different chains.

The new economic models of DeFi 2.0 include Protocol-Owned Liquidity (POL) which enables protocols to maintain stability through their own liquidity management instead of depending on short-term external liquidity sources.

The implementation of advanced risk management systems with liquid staking platforms enables better capital optimization which introduces new asset capabilities to DeFi platforms.

The ability of platforms to interact with each other through interoperability creates a unified DeFi ecosystem by enabling smooth platform connections. The image displays essential elements which power blockchain operations and create interoperability and demonstrate DeFi 2.0 functionality.

What is DeFi Crypto?

The decentralized financial platforms of DeFi crypto operate through their native digital assets which function as tokens.

These cryptos perform multiple essential functions which include:

- Governance voting

- Liquidity provisioning

- Reward distribution

- Collateral for borrowing

- Fuel for on-chain transactions

Key attributes and improvements of DeFi 2.0 over its predecessor, including sustainable yields and protocol-owned liquidity

The development of Decentralised Finance (DeFi) into its second version brings essential changes to its construction and operational framework which address fundamental issues from DeFi 1.0.

The core operation of DeFi 2.0 depends on permanent yield generation because it uses actual protocol earnings instead of creating tokens for short-term financial benefits.

The new system maintains financial stability in DeFi by reducing token distribution risks which previously caused economic instability. The Protocol-Owned Liquidity (POL) system provides better stability because protocols keep their funds under complete control instead of depending on outside liquidity providers.

The system improvements from these changes create a stronger ecosystem which leads to increased user trust and extended user engagement time.

The DeFi 2.0 platform provides advanced features which create a stable financial system that supports Web3 development through its development of a fully decentralized financial network.

The blockchain system architecture reveals its core elements because these components allow all system components to operate as a single unit.

| Protocol | Sustainable Yield (%) | Protocol-Owned Liquidity (%) |

| Uniswap | Not specified | Not specified |

| Aave | Not specified | Not specified |

| Compound | Not specified | Not specified |

| SushiSwap | Not specified | Not specified |

| Yearn Finance | Not specified | Not specified |

| Curve DAO | Not specified | Not specified |

| MakerDAO | Not specified | Not specified |

| Synthetix | Not specified | Not specified |

| Balancer | Not specified | Not specified |

DeFi 2.0 Protocols: Sustainable Yields and Protocol-Owned Liquidity

How Does DeFi 2.0 Work?

The second generation of DeFi technology expands upon the first version through better liquidity management and enhanced capital utilization and multiple blockchain network connectivity.

- Protocols acquire their liquidity through bonding systems and veToken ownership and fee-based mechanisms.

- Users who stake their assets receive liquid staking derivatives (LSDs) which include stETH and rETH to enable simultaneous earning and borrowing capabilities.

- The system operates through automated processes and algorithmic bots which control interest rates and maintain pool stability and prevent liquidation events.

- The DeFi contracts enable different blockchain networks to link through cross-chain bridges and interoperability platforms.

- The technology at Layer 2 enables faster transaction processing while simultaneously reducing gas expenses.

The system creates an environment which enables users to access better flexibility and security and improved operational efficiency.

The Role of Interoperability in DeFi

The core transformative element of DeFi 2.0 requires interoperability to function because it enables Decentralised Finance (DeFi) known as DeFi 2.0. Different blockchain networks enable asset exchange through communication which establishes a financial network that connects multiple blockchain platforms instead of operating as independent systems [cited].

The implementation of interoperability technology in DeFi 2.0 systems leads to better operational performance. The system enables users to move assets between different chains while it finds the most efficient routes that combine multiple yield opportunities to reduce expenses.

The ability to transfer assets and liquidity between platforms and protocols allows developers to build new composability features and improve system operational speed.

The image shows all necessary elements for blockchain ecosystem success through its basic design structure. Most DeFi projects achieve innovation and adaptability through their use of interoperable frameworks.

The revolutionary change brings about a complete transformation of financial services operations.

How Interoperability is Changing Defi Projects by Enabling Cross-chain Functionality and Liquidity Sharing

The current development of Decentralised Finance (DeFi) shows that various blockchain networks will establish better connections to enhance their combined worth. DeFi platforms achieve interoperability which enables users to access liquidity across different blockchain networks.

The system allows users to execute transactions between different ecosystems through one interface which removes the requirement for centralised exchanges.

The system provides users with a single yield interface through its ability to connect different blockchain networks. The removal of blockchain network silos becomes possible through interoperability which enables protocols to work better together while improving composability and reducing transaction costs through enhanced routing optimization.

The article [cited] demonstrates the essential components of an interoperable system which shows how standardized security measures and DeFi solutions work together to advance this evolutionary process.

Best DeFi Platforms for Staking and Yield Farming

The following platforms offer users their most dependable advanced yield generation solutions.

- Lido Finance enables users to stake their Ethereum and other Proof of Stake network assets through a liquid staking system.

- Aave allows users to lend their assets while borrowing from others through its built-in risk management system.

- Users can access the best stablecoin liquidity and perform low-slippage swaps through Curve Finance.

- Yearn Finance operates automated vaults which perform yield optimization tasks through automated systems.

- Users can stake their assets through AMM staking on Uniswap to obtain concentrated liquidity and LP incentives.

- PancakeSwap offers users high yield staking options and farming opportunities on the BNB Chain.

- Frax Finance provides users with LSDs and stable assets and real-yield models.

The two platforms function as core elements which support both DeFi 1.0 and DeFi 2.0 systems.

How DeFi Is Evolving in the Web3 Ecosystem?

Web3 operates through DeFi as its financial backbone which enables:

- Metaverse payments

- AI agent payments

- DAO treasury management

- Supply-chain tokenization

- NFT rental and collateral markets

- Play-to-earn and GameFi economies

- Decentralized identity & reputation scoring

The sector shows different patterns of development.

- ZK-proofs will protect user privacy during their DeFi platform activities.

- AI agents will perform independent trading operations and insurance services and risk assessment tasks.

- Omnichain smart contracts will replace isolated dApps.

Users will obtain access to blockchain-based traditional financial assets worth more than trillions of dollars through tokenized asset integration.

Conclusion

The development of Decentralised Finance started as experimental work which evolved into a reliable system that provides financial solutions to people across the world. The DeFi 2.0 transition allows developers to build an interconnected financial system through improved technology and better connectivity which meets user needs for stability and operational efficiency.

The development of DeFi requires two essential elements which are Protocol-Owned Liquidity and sustainable yield models to establish trust-based long-term user relationships.

The different elements required to build a blockchain ecosystem prove that a complete framework exists for achieving this vision according to [cited].

The priority focus on automation and security and capital efficiency will enable DeFi to expand its user base within crypto while establishing itself as a fundamental element of worldwide financial systems for both seasoned investors and new market participants.

The implications of DeFi 2.0 and interoperability for the future of decentralized finance and its integration into the global financial system

The financial sector needs DeFi 2.0 as its fundamental development to achieve digital transformation through blockchain network interoperability.

The second phase of DeFi development introduces enhanced liquidity management systems which use protocol-backed liquidity to create lasting solutions for the problems that DeFi 1.0 failed to resolve.

The financial system achieves unity through blockchain network interoperability which enables smooth financial transactions between different networks.

Future of Decentralized Finance in Crypto

The creation of crypto technology enables financial innovation which will transform global financial systems through decentralized finance adoption. The future of decentralized finance will establish market stability and innovation through its complete integration with the worldwide financial system.

The future of DeFi will bring a stronger financial system because it combines its advantages to create a better system that scales up and provides equal services to all users.

The blockchain ecosystem interoperability illustration in [cited] shows all necessary elements required to build an operational blockchain system.

The upcoming development of DeFi will be determined by these predicted patterns.

Key future trends:

- Cross-chain liquidity unification

- AI technology will integrate with DeFi systems to create improved risk modelling capabilities

- RWA tokenization (real-world assets like treasury bills, equities, and real estate)

Decentralized identity (DID) systems enable DeFi platforms to perform KYC-compliant operations through their deployment.

Smart contracts achieve privacy protection through their operations because ZK-proofs provide this capability.

The operation of non-custodial trading bots runs automatically because users do not need to share their account funds for access.

Financial institutions will access on-chain finance through their operations which follow all necessary compliance regulations.

Image1. Illustration of Key Components in an Interoperable Blockchain Ecosystem

References:

- Disha Expets. ‘Topic-wise Solved Papers for IBPS/ SBI Bank PO/ Clerk Prelim & Mains (2010-16) Reasoning.’ Disha Publications, 1/3/2017

- ‘NFT Staking Strategies.’ Unlocking Passive Income Opportunities in the Digital Age, Barrett Williams, Barrett Williams, 4/28/2025

- Robert H. Deng. ‘Handbook of Blockchain, Digital Finance, and Inclusion, Volume 3.’ Web3, AI, Privacy and Greentech, David Lee Kuo Chuen, Academic Press, 4/25/2025

- CARTER. ‘Decentralized Finance (DeFi) Unleashed.’ The Future of Money A Deep Dive Into DeFi Protocols, Staking, Lending, and Liquidity Pools, Amazon Digital Services LLC – Kdp, 3/18/2025

- Arash Habibi Lashkari. ‘Understanding Cybersecurity Management in Decentralized Finance.’ Challenges, Strategies, and Trends, Gurdip Kaur, Springer Nature, 1/9/2023

- Spulbar, Cristi Marcel. ‘Financial Digital Assets and the Financial Risk Modeling of Portfolio Investments.’ Popescu, Andrei Dragos, IGI Global, 3/26/2025

- Henry Hallam. ‘Introduction to the Literature of Europe in the Fifteenth, Sixteenth, and Seventeenth Centuries.’ Thomas Y. Crowell, 1/1/1880

Image References:

- Image: Illustration of Key Components in an Interoperable Blockchain Ecosystem, Accessed: 2025. https://cdn.prod.website-files.com/64c231f464b91d6bd0303294/672f9c6fdd6d74d0f30e31f5_670e5ef1d6db9a1203576f66_AD_4nXcSSSOAmh8ThFiSAnf6b88y_6fu97IiiNqBmFo4pB_dCxpR7lXN3jwbTMHqVbcWYP86cFiXt9MGqi5jonA014tGMnSSqUc98oACAnhstsknzYBYFXHqUvNW2H86-invHbEgKColqf-BMuAhH780bMP2qZM6.png

You need to login in order to Like

Leave a comment