2025 saw many institutional BTC holders strengthen their portfolios with more accumulation. More corporate entities also established a Bitcoin Treasury with the hope of future appreciation.

Over 200 companies have a BTC treasury, with these reserves holding a combined 819,000 BTC, 3.9% of the total supply.

This indicates how companies are embracing Bitcoin as a store of value. However, this model started to show its flaws. NAV tightened and return ratio compressed.

The long-term goal was to create corporate fund structures to store Bitcoin as a “digital gold.” Instead, the cracked model exposed an uncomfortable truth – passive BTC holdings were no longer delivering the competitive edge institutions wanted.

The current price of Bitcoin is proof that passive Bitcoin exposure no longer holds weight, as more companies are devising sophisticated strategies to enhance returns.

As digital asset treasuries (DATs) face mounting pressure to generate yield, institutions are increasingly becoming drawn to a new phenomenon called Bitcoin Finance (BTCFi).

Institutional BTC investors are exploring Bitcoin-native yield and whether it could be the next strategic shift. DATs, such as Anchorage Digital and Mezo, have become early adopters of BTCFi, introducing a service enabling institutions to borrow against Bitcoin using the MUSD stablecoin at fixed rates.

But the strategic shift hinges on key factors like custody integration and regulatory clarity. This blog explores why institutions are pivoting to BTCFi and the challenges that institutional Bitcoin holders may face as adoption lurks.

What is BTCFi?

BTCFi, or Bitcoin DeFi, is bringing more use cases to Bitcoin, other than just stores of value. Essentially, it’s bringing decentralized finance applications to the Bitcoin ecosystem, such as lending, borrowing, earning yield, and trading.

This means users can lend and deposit Bitcoin into liquidity pools and protocols like Solv to earn interest, trade effortlessly without intermediaries, and even use their Bitcoin for collateral for loans or other financial products without selling it.

Bitcoin will no longer be a passive asset but an active one that could participate in a range of financial activities on-chain. Apart from enhancing Bitcoin’s utility, BTCFi will allow automated peer-to-peer financial services directly on the Bitcoin network, while leveraging Bitcoin’s robust security and infrastructure.

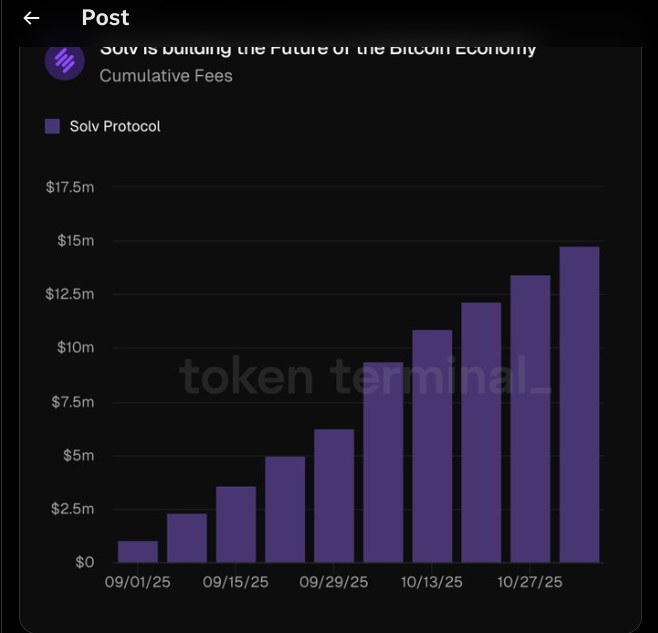

As an emerging field, BTCFi presents opportunities for innovative solutions. Reports reveal that the BTCFi market has experienced significant growth within a year.

DATs are now realizing that passive exposure may no longer be enough, seeing that NAVs are tightening, and that companies no longer have the edge over anyone in buying Bitcoin. Hence, the decision to explore Bitcoin yield.

What’s Driving the Shift from DATs to BTCFi?

The decision to pivot to BTCFi was made clear during the Digital Asset Summit 2025, where institutional holders or DATs expressed their dissatisfaction with the current BTC market performance.

From the discussions, DATs are shifting focus from speculative returns to structured deployment – one that will guarantee verifiable yield with risk controls.

According to Brian Mahoney of Mezo, companies want yields that exist in ecosystems like Ethereum and Solana, but they can’t go there yet because of the narrative they have shared with shareholders about holding Bitcoin.

“You can’t claim to be a Bitcoin-native Treasury while earning yield from ether staking.”

DATs realize that HODling Bitcoin to earn passively is no longer a sustainable business model. The pressure to generate revenue and maintain operational performance for investors is at an all-time high, which BTCFi could solve. It converts idle BTC into productive capital without compromising Bitcoin’s trust model.

Findings from The Institutional BTCFi Report say that institutions want yield on Bitcoin (not exposure to wrapped asset risks), liquidity, capital efficiency, and risk-adjusted return frameworks.

Essentially, they want the same financial leverage in the traditional treasury space, but with Bitcoin as the primary asset. BTCFi will unlock new layers of utility, such as collateralized lending, staking, on-chain yield, structured finance products, and L2 participation.

Institutional Use Cases for BTCFi

DATs are pivoting to BTCFi because of the financial mechanics it offers, not for speculation. Anchorage Digital CEO Nathan McCauley said that institutions want their Bitcoin to be productive, earn rewards, unlock liquidity, or serve as collateral.

They want infrastructure that lets them interact with the Bitcoin economy directly. Some institutional use cases for BTCFi in 2025 and beyond include:

- Borrowing Against Bitcoin While Holding: BTC-backed liquidity markets have grown in numbers in 2025, allowing institutions to use BTC as collateral in these structured, hedge markets. Institutions can preserve their long-term treasury holdings while they unlock short-term liquidity. In this scenario, BTC becomes a strategic asset and a source of liquidity.

- On-Chain BTC Yield: Bitcoin, like Ethereum, will support staking yields through Bitcoin L2s and Bitcoin-powered AVS (Actively Validated Services). Unlike early-stage yield farming in DeFi, known for its high risks, BTCFi will be an engineered, risk-managed yield model for institutions.

3. Bitcoin Lending: Bitcoin Lending will allow institutions to lend BTC to borrowers in exchange for interest payments. Already, Bitcoin is a primary reserve asset for several hedge funds and asset managers. These institutions can use BTC as collateral for leverage, corporate working capital, cross-margin loans, and yield-bearing lending pools. Corporate lenders could generate up to 8% annually in a risk-controlled BTCFi environment from these.

Early Adopter Profiles: Who is Already Experimenting with BTCFi?

The first movers are hedge funds and strategy firms, asset managers and DATs, and crypto-native funds. These groups are highly strategic capital allocators that want to dabble into BTCFi because they want clear collateral mechanics, transparent collateral rules, explainable risks, and compliance-friendly structures.

Hedge funds are seeking macro-hedged Bitcoin collateral structures and BTC-backed yield, and see BTCFi as the perfect source for scalable returns.

Bitcoin-focused treasuries or DATs are adopting BTCFi to enhance treasury performance, stabilize NAV metrics, and manage volatility. These treasuries want to evolve from simply being reserves to yield-generating engines.

Crypto-native funds and managers are embracing this shift to scale performance and rely less on the buy-and-hold model. As mentioned, Anchorage Digital and Mezo have partnered to launch Porto, a self-custody wallet that will allow borrowing against BTC using MUSD stablecoin at fixed rates on Mezo.

Clients will be able to lock up BTC to earn on-chain rewards. McCauley said that Anchorage and Mezo are enabling institutions to put Bitcoin to work without selling it, moving it to unregulated environments, or compromising custody.

BTCFi is seen as the future, and full-scale adoption is only a matter of time for companies that are yet to onboard.

Challenges to Adopting BTCFi

Future BTCFi expansion hinges on three pillars – institutional-grade custody, reporting and auditability, and risk management frameworks. These three pillars must be strong to ensure BTCFi scales institutionally. Institutional-grade custody is essential to ensure institutions don’t move BTC without enterprise policy controls, audit trails, and key-sharding.

BTCFi adoption also requires mature infrastructure to allow daily NAV reporting, slashing reports, and real-time tracking. Institutions demand these before pivoting.

However, the risk management framework is the hardest part. The DeFi space is high-risk, and frameworks around Bitcoin-secured loans are still in the early stages.

BTCFi must build frameworks that focus on counterparty risk models, collateral stress models, and liquidity depth modelling.

Upcoming regulations must clearly define DeFi rules, custody rules, tax rules, and Bitcoin-secured lending frameworks. Regulatory clarity will accelerate institutional adoption and unlock enormous demand, similar to ETFs bringing trillions into traditional markets.

When Will BTCFi Go Mainstream?

Industry leaders believe that BTCFi will go mainstream once custody matures, liquidity deepens, and regulations are established. That’s when institutions will finally be able to stake BTC derivatives, borrow and lend BTC at scale, use BTC as collateral, and issue BTC-backed financial products.

At the moment, we have trends and data supporting our claims. Venture capital flows into BTCFi in two years have risen sharply, with funds going toward liquidity layers and BTC collateral markets. Additionally, TVL has grown rapidly from $200 million to $9 billion in a year across the Bitcoin L2 ecosystem. Investors believe BTCFi will be worth $100B in the next few years.

However, adoption will be made possible if the three pillars mentioned above are ensured and structural constraints are solved. There’s still an unbelievably high risk of smart contract exploits and coding errors that L2s, bridges, and AVS are vulnerable to. Also, there’s the risk of over-leveraging. If BTC becomes rehypothecated, the system becomes fragile, leading to a DeFi lending crisis.

Final Thoughts

The next 1-2 years will mark a pivotal moment in the adoption of BTCFi among institutions if all the fundamental pieces fall into place. If regulatory clarity, risk management frameworks, and custody align, billions of institutional BTC in passive holding will be deployed productively.

Bitcoin will finally evolve from a store of value into a productive, yield-bearing asset. As institutional adoption increases, we expect billions of idle BTC to become active in the BTCFi economy through hedge funds, banks, and fintechs, and corporate treasuries or DATs.

You need to login in order to Like

Leave a comment