The Crypto Safety Dilemma

The cryptocurrency industry of 2025 is rapidly transforming while people wonder about methods to protect their digital assets from theft and scams. People must carefully consider between using cold wallets and hot wallets to store Bitcoin and Ethereum because of this situation.

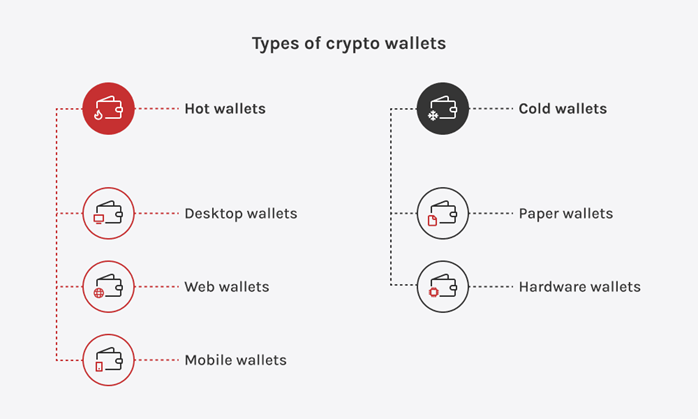

The convenience of dot wallets makes them suitable for traders, but their constant online status makes them vulnerable to hacker attacks through phishing and malware. Cold wallets protect your crypto assets through offline storage methods including hardware and paper because your private keys remain hidden from internet exposure.

The contrast between these two options demonstrates the importance of developing an effective security strategy for your assets when you plan to store them for an extended period. The decision between wallet types requires a thorough understanding of their security mechanisms as illustrated in the table which presents their structural elements and vulnerabilities.

Difference Between Cold and Hot Crypto Wallets

The basic differences between wallet types in cryptocurrency require understanding for navigating the constantly changing digital currency market. Hot wallets enable users to access their digital money through internet-based apps and web pages while providing simple usage and quick transaction capabilities.

The convenience of hot wallets comes with specific security risks. The analysis reveals that “Hot wallets function as software programs which maintain private keys on internet-connected devices thus making them vulnerable to hacking and phishing threats.”

Cold wallets offer better security because they store private keys offline through hardware or paper storage which protects your assets from cyber threats. The fundamental distinction between online and offline storage makes cold wallets the preferred choice for investors who want to protect their crypto assets for extended periods.

The visual representation illustrates wallet structure and operation to demonstrate why security stands as the top priority for cryptocurrency management.

Are Cold Wallets Safer Than Hot Wallets for Bitcoin?

The cryptocurrency industry requires advanced secure storage solutions because cyber threats and sophisticated hacking methods are becoming more prevalent. Cold wallets operate offline to provide an effective protection against cybercriminals thus minimizing unauthorized access and theft risks.

Hot wallets remain online at all times which makes them vulnerable to malware and phishing attacks but cold wallets protect private keys from online threats in general. Cold wallets provide advantages to long-term holders and institutional investors who possess substantial Bitcoin amounts because of their security features.

Hot wallet risks vs cold wallet benefits

The main drawback of cold wallets is that users must take extra precautions to protect their physical storage from loss or damage. Cold wallets are generally safer but users must develop secure practices to minimize risks from physical storage which creates a complex situation in the cold wallet versus hot wallet debate in most cases.

Why cold wallets are better for crypto security?

The bar chart displays zero financial losses for both cold wallets and hot wallets. The security effectiveness of cold wallets in protecting assets from cyberattacks becomes evident through this comparison because hot wallets remain more exposed to threats.

Top cold wallets for crypto safety

1. Tangem Wallet

- Tangem Wallet represents a non-custodial hardware wallet solution which grants users complete authority over their private keys. The Tangem Wallet uses NFC-enabled smart cards as an alternative to traditional hardware wallets which removes seed phrase requirements and strengthens security measures. The company behind Tangem has successfully expanded its cryptocurrency and blockchain network offerings throughout time to serve users at all experience levels.

Supported blockchains and platforms:

- Tangem Wallet provides support for 80+ networks including Ethereum, Bitcoin, Binance Smart Chain, and Polygon as well as additional prominent networks. Users can manage thousands of cryptocurrencies on a single card through the detailed asset list found on Tangem’s official website.

- The wallet operates through a mobile application compatible with both iOS and Android devices

Google rating

The application holds a 4.7/5 rating according to August 2025 metrics.

Pros:

- The NFC-enabled smart card design provides users with an easy-to-use interface which makes the product accessible to all skill levels.

- The security features of Tangem include EAL6+ CC and patented smart backup technology and non-updatable firmware which establish it as a security leader.

- The wallet provides extensive asset support by allowing users to manage a wide range of cryptocurrencies and networks through its single platform.

Cons:

- The Tangem Wallet exists as a mobile application only because the platform does not have desktop or web versions.

- The requirement for NFC-capable smartphones limits accessibility to users who do not have compatible devices.

- The Tangem Wallet combines security features with convenience through its NFC smart card technology which provides cryptocurrency storage solutions. Users should evaluate the platform’s restrictions together with their device compatibility requirements before deciding to use the service.

2. Trezor

- The non-custodial hardware wallet Trezor was developed by SatoshiLabs to support more than 1,800 different cryptocurrencies. Users can perform security-enhanced tasks through the touchscreen interface while a recovery seed backup serves as their protection. Users can connect the device through USB to desktop applications and it supports multiple third-party wallet platforms.

- Supported blockchains and platforms:

- Users can operate Trezor hardware wallets through Windows, macOS, Linux, Android, web browsers and multiple operating systems.

Google rating

4.7/5 (as of August 2025).

Pros:

- User-friendly interface.

- Open-source firmware.

- Strong security features.

Cons:

- The product does not support wireless connectivity.

- The product costs more than certain competing alternatives in the market.

3. Ledger

The Nano X hardware wallet from Ledger provides non-custodial cryptocurrency storage for more than 5,500 different digital assets since its 2019 launch. Users can access their assets through the Ledger Live mobile application which operates with Bluetooth connectivity on both iOS and Android devices. Private keys receive protection through a CC EAL5+ certified secure element built into the device.

Google rating

The platform holds a 4.6/5 rating in August 2025 according to available data.

Pros:

- The platform allows users to manage a broad selection of supported cryptocurrencies.

- The device enables Bluetooth connectivity to let users access their assets from mobile devices.

- The system features strong security measures that protect user data.

Cons:

- Some competitors offer products at lower price points than the current market offerings.

- The closed-source nature of the firmware could raise concerns for particular users.

- Security issues affecting the platform have led to negative public perception

4. Ellipal

Since its 2019 introduction the Ellipal Titan operates as a non-custodial hardware wallet that works in isolation from all network connections including Wi-Fi and Bluetooth and USB. Users can access over 10,000 cryptocurrencies across various blockchain networks through its touchscreen interface. The device verifies and signs transactions using QR codes as its main authentication method.

Google rating

4.2/5 (as of August 2025).

Pros:

- The security system works completely air-gapped to protect users’ assets.

- The platform provides extensive support for multiple cryptocurrencies.

- The hardware device uses metal materials for its construction.

Cons:

- The system operates without real-time connectivity because it needs users to scan QR codes.

- The SafePal S1 hardware wallet is bulkier than most other devices in its class.

5. SafePal

The SafePal S1 represents a non-custodial hardware wallet which supports more than 10,000 different cryptocurrencies since its 2019 release. The device includes a built-in camera to read QR codes and functions without network access to boost security measures. Users manage the device through the SafePal mobile application which operates on iOS and Android platforms.

Google rating

4.5/5 (as of August 2025).

Pros:

- Affordable price point.

- Air-gapped security with QR code transactions.

- Compact and portable design.

Cons:

- Smaller screens may limit ease of use.

- Firmware updates can be complex for some users.

- The evaluation of cold wallets focuses on security capabilities alongside cryptocurrency support and user interface features and platform device support.

Conclusion – Your Security, Your Responsibility

Digital currency users face major security challenges because cybercriminals continuously improve their methods which forces users to take control of their protection. Users need to understand the distinction between hot and cold wallets when examining the available wallet options in 2025.

Hot wallets provide instant transaction access to your money yet expose you to phishing and malware risks as shown in the image that organizes these wallets. Cold wallets store assets offline which makes them resistant to hacking attempts.

The comparison demonstrates that users must evaluate their requirements and risk tolerance before selecting a security approach. Selecting a wallet requires more than personal preference because users must understand their responsibility to defend their digital assets.

The message demonstrates that cryptocurrency safety depends on users being vigilant while taking proactive measures.

Types of Crypto Wallets: Hot and Cold Wallets

References:

· S. Rakesh Kumar. ‘Blockchain Security in Cloud Computing.’ K.M. Baalamurugan, Springer Nature, 8/12/2021

· Arif Ismail. ‘Regulating the Crypto Ecosystem.’ The Case of Unbacked Crypto Assets, Parma Bains, International Monetary Fund, 9/26/2022

· Colin L. Read. ‘The Bitcoin Dilemma.’ Weighing the Economic and Environmental Costs and Benefits, Springer Nature, 10/15/2022

· Tangem

Image References:

· Image: Types of Crypto Wallets: Hot and Cold Wallets, Accessed: 2025. https://innowise.com/wp-content/uploads/2025/06/Types-of-crypto-wallets.png

You need to login in order to Like

Leave a comment