By Dr. Srinivasan Chari

The Big Banking Question

The financial sector continues to transform while decentralized finance (DeFi) creates doubts about cryptocurrency’s position in banking systems. The growing number of people ask whether cryptocurrency has the potential to replace traditional banking institutions.

The current dissatisfaction with banking operations stems from restricted access and expensive fees and limited transparency [cited]. The DeFi system enables peer-to-peer transactions through smart contracts which eliminates the requirement for banking institutions to act as middlemen. The system enables any person to perform financial operations at any time from any location.

DeFi extends its influence past operational efficiency to challenge the distribution of power within financial systems. The growing DeFi sector forces traditional banks to transform their operations because they must adapt to an efficient and transparent digital economy.

The image presents an excellent representation of this transformation by showing all the interconnected elements and opportunities within decentralized finance.

How Decentralized Finance Is Changing Banking?

Traditional banking experiences significant changes through the implementation of decentralized finance which operates under the name DeFi. The main reason behind this change is the ability to eliminate middlemen from the process.

Traditional banking requires numerous intermediaries to complete transactions. Through blockchain technology and smart contracts DeFi enables users to perform direct lending and borrowing and payment transactions with each other.

Will Crypto Eliminate the Need for Banks?

The technology enables financial services to operate globally at all times. The operational hours of traditional banks remain limited in contrast to DeFi. DeFi provides users with financial autonomy by eliminating banking institutions from transactions and thus disrupts traditional banking control of financial systems.

The image demonstrates this transformation by depicting how DeFi establishes a more transparent financial system. The ongoing development of DeFi technology leads us to question how financial middlemen will evolve and what position banks will maintain in this emerging decentralized financial system.

Image1. Visual representation of Decentralized Finance (DeFi) concepts in a technological context.

| Income Level | Financial Inclusion Impact on Economic Growth |

| Low-Income Countries | 0.085% |

| Middle-Income Countries | 0.119% |

| Upper Middle-Income Countries | 0.212% |

| High-Income Countries | 0.419% |

| OECD Member Countries | 0.405% |

| Non-OECD Member Countries | 0.146% |

Impact of Digital Financial Inclusion on Economic Growth by Income Level

Can Cryptocurrency Replace Traditional Banks?

The discussion about cryptocurrencies surpassing traditional banking systems has gained significant attention because decentralized finance (DeFi) continues to make its mark. DeFi operates as a revolutionary system which eliminates financial transaction intermediaries. Smart contracts enable users to conduct business transactions without needing any intermediaries.

Users can manage their money through DeFi at any time during any day of the week because this system operates without bank restrictions on hours of operation. The combination of immediate transfers with reduced costs makes financial services more attractive to users who seek affordable and fast solutions. The path to cryptocurrency bank replacement faces two significant challenges: scalability issues and market volatility.

A financial expert stated that cryptocurrencies show promise to replace banking functions in specific use cases yet will work alongside traditional banking systems in other cases, but DeFi needs to establish trust and security and rule compliance before it can succeed. [cited]

Traditional banking remains in place despite ongoing changes in the financial industry. The decentralized finance image showcases this revolutionary network through its complex web of users and services which define the new financial era.

Image2. Visual representation of Decentralization Finance (DeFi) and its significance in modern financial technology.

Is crypto a threat to the banking industry?

BIS (2023) identifies the crypto asset system as financially unstable because of its structural weaknesses and potential risks. Our research examines the potential financial instability transmission from the crypto asset system to both traditional financial institutions and real economic sectors.

The recent past has witnessed hundreds of such occurrences. Economic agents who wish to safeguard their assets demonstrate rational microeconomic behaviour by removing deposits from struggling institutions even when rumours prove false. The banking system faces complete collapse during panic situations because it becomes unclear whether one bank or the entire banking system experiences liquidity or solvency issues. Bank runs occur. Such processes lead to the collapse of healthy financial institutions because no bank maintains sufficient liquidity to meet all investor withdrawal demands. The situation demands central banks to act as lenders of last resort by offering unlimited financial support or refinancing to stabilize financial systems experiencing liquidity crises. [Springer Nature Link]

Can DeFi replace centralized finance?

Decentralized finance possesses the capability to completely replace both banking and traditional financial systems. Crypto functions as a perfect substitute for fiat currency because it serves all three functions of value storage and exchange and measurement units.

Decentralized blockchain-based systems offer banking alternatives through their ability to process transactions quickly while providing enhanced security and reduced fees and smart contract functionality. The DeFi system already enables users to borrow money and obtain loans and seek funding for projects and process payments. And it’s just getting started.

What happens if crypto replaces banks in the future?

Many individuals believe that a digital decentralized economy which performs better than traditional banking systems will naturally replace existing financial institutions.

But will it happen? Governments together with banks maintain the highest level of power across the world. It would be unreasonable to anticipate that they will passively observe bitcoin and blockchain technology replacing their systems.

The government requires its portion and taxation obligations must be fulfilled. Most significant nations across the world have explored the possibility of their central banks creating digital versions of their national currencies. The primary motivation behind this move is to limit Bitcoin and other cryptocurrencies from expanding their market dominance.

Centralized authority plans to implement blockchain technologies for risk management to prevent business collapse. The upcoming era will not establish itself as a libertarian society without central authority.

Blockchain technology appears destined to unite traditional financial institutions such as banks and other established financial organizations. Several central banks remain uncertain about their potential role in support. The fundamental principle of Bitcoin which enables private decentralized transactions stands in direct opposition to their proposed actions.

Central bank digital currency must provide most of the advantages that DeFi systems offer in order to compete with them. The implementation of CBDC accounts by central banks could force commercial banks to operate independently because consumers might shift their funds to these accounts which would eliminate middlemen fees during transactions.

“These factors will increase the competitive pressures on commercial banks. They face the risk of disintermediation,” Barron’s reported through Morgan Stanley. [Coin Market Cap]

Conclusion – The Future of Finance

The financial sector undergoes continuous transformation thus requiring full understanding of DeFi alongside traditional banking systems. The complete elimination of banks by crypto seems unlikely yet blockchain technology will fundamentally transform the financial industry.

Banks will likely adopt DeFi features instead of replacing traditional banking systems. The financial sector will benefit from improved operational methods and reduced transaction costs and innovative technological services that appeal to tech enthusiasts.

Banks possess multiple advantages that include public trust and security measures and regulatory frameworks which maintain positive feelings among users. The combination of traditional banking with crypto technology may establish a financial system that unites both approaches to create an accessible platform for all users as depicted in the image.

Future of DeFi vs Traditional Banking Systems:

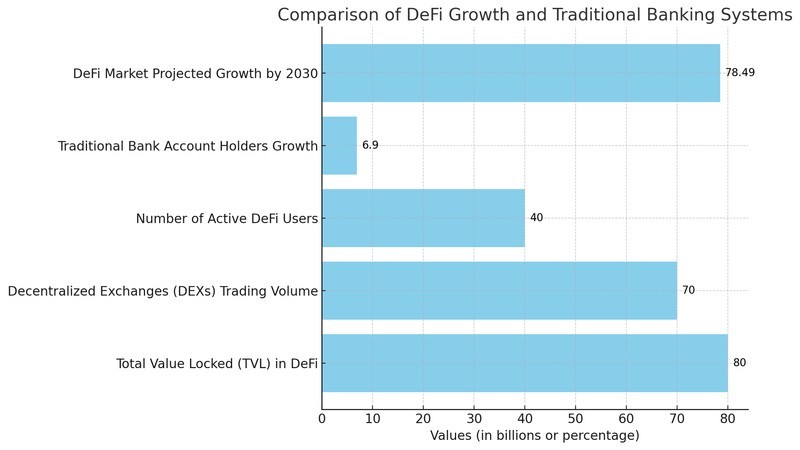

The chart demonstrates how decentralized finance (DeFi) has expanded beyond traditional banking systems. The Total Value Locked (TVL) in DeFi exceeds $80 billion, while decentralized exchanges (DEXs) contribute over 70% of trading volume. The number of active DeFi users has reached more than 40 million which demonstrates significant growth. Traditional bank account holders show a minimal 6.9% annual growth rate. The DeFi market will expand to reach $78.49 billion by 2030 according to projections. [Download the chart]

References:

- Ahmed Musa. ‘Cryptocurrency and Its Impact on Traditional Banks.’ Recorded Books, 12/16/2024

- Alena Blütener. ‘Decentralized Finance (DeFi).’ How Decentralized Applications (dApps) Disrupt Banking, Cordelia Friesendorf, Springer Nature, 8/26/2023

- American Bankers Association. Convention. ‘Proceedings of the Convention of the American Bankers’ Association.’ Wm. B. Greene, Secretary, 1/1/1916

- Springer Nature Link

- Coin Market Cap

Image References:

- Image: Visual representation of Decentralized Finance (DeFi) concepts in a technological context., Accessed: 2025. https://cdn.prod.website-files.com/615661aaff6efe75b381961c/67daf2534106a397a048f739_future-of-decentralized-finance.png

- Image: Visual representation of Decentralization Finance (DeFi) and its significance in modern financial technology., Accessed: 2025. https://www.investopedia.com/thmb/F_lMbEKfu7Bj_3QpqhvoFjOOnJw=/1500×0/filters:no_upscale():max_bytes(150000):strip_icc()/decentralized-finance-defi-5113835-3bd35e94d7414f9abd030bea7910b467.png

You need to login in order to Like

Leave a comment