Why This Matters for Traders?

Bitcoin traders who want to start trading need to understand the distinction between spot trading and derivatives trading. The distinction between spot and derivatives trading affects your entire market interaction particularly for new crypto investors.

The process of spot trading involves immediate Bitcoin transactions at market prices because you gain full ownership of the asset. The value of derivatives trading contracts depends on Bitcoin price movements because they are based on these price fluctuations.

The trading process allows you to predict Bitcoin price movements without requiring ownership of the digital currency. The distinct nature of these trading methods leads users to ask two fundamental questions about spot trading for beginners in crypto and the relative safety of spot trading compared to bitcoin derivatives. The situation establishes the need for ample comprehension.

Traders who recognise these concepts can select trading methods that bring into line with their risk tolerance and investment targets. The unpredictable nature of the crypto market makes the selection of fitting trading methods decisive for investors.

The capability to comprehend these concepts aids traders to make informed decisions while monitoring their exposure to risk.

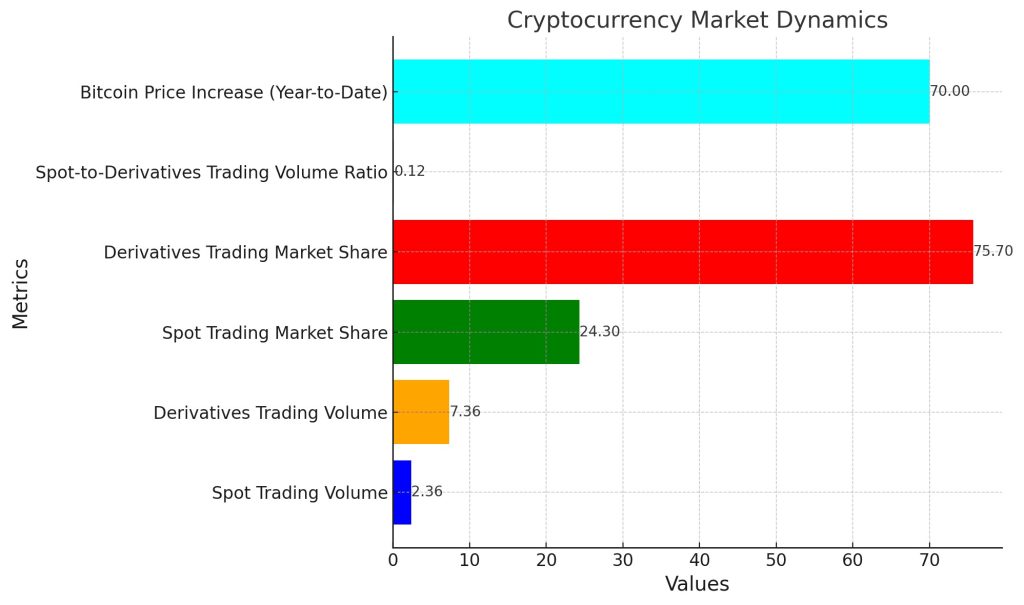

The chart displays cryptocurrency market behaviour through a comparison between spot trading and derivatives trading activities. The data discloses that derivatives trading activities surpass spot trading activities in terms of volume and market participation. The low spot-to-derivatives trading volume ratio indicates a rising trend in derivatives trading which matches the major Bitcoin price appreciation throughout this year. The market shows increasing trader risk tolerance through this development.

What Is Spot Trading in Crypto for Beginners?

New cryptocurrency users need to understand trading basics because spot trading differs from derivatives trading. Spot trading allows users to purchase or sell Bitcoin immediately at current market prices while receiving actual cryptocurrency ownership.

You can purchase one Bitcoin at the current price of $65,000. The Bitcoin becomes your property after making the purchase at that price. You maintain full control over your Bitcoin because you can store it or transfer it to others or sell it at any time. [cited]

The process of spot trading requires exchanging financial assets for immediate receipt of the assets. New traders often start with spot trading because they receive their assets immediately. The system eliminates complex elements and dangerous leverage risks which derivatives trading presents. New traders who focus on buying real assets can understand market behaviour without facing excessive price volatility.

Spot Trading vs Derivatives Trading Explained

The process of spot trading requires traders to buy and sell assets such as stocks or currencies or commodities at their present market value while transactions complete rapidly. The process of spot trading allows investors to gain direct ownership of the assets they purchase.

The value of derivatives trading contracts stems from underlying assets but investors do not need to possess these assets. The main trading instruments under derivatives include futures and options and forwards and swaps.

The main distinctions between spot trading and derivatives trading exist between these two financial activities.

| Feature | Spot Trading | Derivatives Trading |

| Asset Ownership | Direct ownership of the underlying asset | Contracts based on the asset’s value, no direct ownership |

| Settlement | Immediate or within two business days (T+2) | Future date, based on contract terms |

| Leverage | Generally no leverage | Often involves leverage, magnifying potential gains and losses |

| Profit Potential | Primarily from price appreciation (buy low, sell high) | From both price increases and declines (long or short) |

| Risk Profile | Lower risk, maximum loss limited to initial investment | Higher risk due to leverage and complexity |

| Strategy Focus | Simple buy-and-hold, long-term investing | Short-term speculation, hedging, advanced strategies |

| Market Complexity | Straightforward | Involves contracts, margin calls, liquidation risks |

Key points to be considered

- The basic nature of spot trading makes it accessible to new traders because it allows direct ownership of assets while keeping risks minimal.

- The trading of derivatives provides users with flexibility through hedging options and leverage potential for increased returns but demands advanced market knowledge and effective risk control.

- Derivatives trading often charges lower fees than spot trading, but specific exchange rates determine these costs. [Link1]

What Are Bitcoin Derivatives?

The trading of cryptocurrencies is dependent heavily on derivatives as they allow traders to create multiple strategies and protect their investments from market risks.

The major mechanisms of Bitcoin derivatives include futures and options and perpetual swaps which function as financial contracts.

The financial instruments enable traders to predict Bitcoin price movements without requiring actual Bitcoin ownership. The trading system allows users to predict price movements in either direction through long or short positions.

The market volatility attracts investors who seek to benefit from price fluctuations. The use of derivatives requires traders to work with leverage as their main characteristic.

The use of leverage in trading leads to both increased profit potential and higher risk of financial loss.

The trading method presents elevated risks compared to traditional spot trading operations. It is crucial to grasp this concept.

The use of derivatives for speculative trading requires advanced market knowledge and risk management skills to achieve potential high returns. [cited]

The strategic benefits of Bitcoin derivatives attract numerous experienced traders who use them for their trading activities. A side-by-side chart would help explain the complex differences between trading approaches.

Difference Between Spot and Derivatives Market

The spot market requires instant asset transactions for immediate delivery and payment, but derivatives markets operate through contracts whose value stems from underlying assets with future settlement dates. The spot market enables traders to obtain physical asset ownership right away, but derivatives markets enable traders to predict price fluctuations and protect against risks through contracts that do not require asset possession.

Spot Market (Cash Market)

- Immediate Transaction: The assets get paid for and delivered right away during spot transactions occur.

- Direct Ownership: The spot market allows buyers to obtain the actual physical assets or securities which include stock shares.

- Settlement: The settlement process for trades occurs within a brief time frame which typically amounts to two business days (T+2).

- Goal: The purpose of spot market transactions is to obtain or sell assets for immediate utilization or possession.

Derivatives Market

- Future Contracts: The trading process includes futures contracts together with options and swaps.

- Underlying Asset: These contracts obtain their value from underlying assets including commodities and currencies, but traders do not need to possess these assets when they enter into the contract.

- Future Settlement: All transactions through this system will reach their conclusion at predetermined points in the future instead of happening right away.

- Goals: The main purpose of derivatives trading includes both price prediction for speculative gains and risk protection for underlying asset markets.

- Leverage: The use of leverage in derivatives trading enables investors to manage big positions through minimal capital deposits which results in increased potential profits and risks.

- Expiration: Derivatives contracts usually include fixed expiration dates that trigger settlement or closure of the contracts. [Link2]

Benefits of Spot vs Bitcoin Futures Trading

The comparison between Bitcoin spot trading and Bitcoin futures trading includes their respective advantages and necessary factors to consider.

The process of Bitcoin spot trading allows traders to purchase and sell Bitcoin for immediate delivery because they receive the actual asset.

The process of futures trading requires traders to exchange Bitcoin contracts at predetermined prices which will become valid at specific dates in the future.

The following section presents the main advantages of each trading method.

Spot trading benefits

- The most basic trading method exists for beginners because it requires no complicated contracts or leverage systems.

- The actual Bitcoin ownership allows traders to store their assets for extended periods while enabling them to move funds between accounts and use them in decentralized finance (DeFi) platforms.

- The absence of leverage in spot trading limits investment risks to the amount deposited which makes it appropriate for risk-averse investors.

- The investment strategy of Bitcoin spot trading allows users to maintain their assets throughout market fluctuations with the goal of achieving long-term value growth.

Futures trading benefits

- The ability to control bigger Bitcoin positions through smaller initial investments (margin) enables traders to achieve greater profit potential.

- The trading system enables users to generate profits from market price increases and decreases through long and short position trading.

- The strategy enables users to safeguard their existing Bitcoin assets from potential market value decreases.

- The futures market provides better liquidity because it handles more trading activity which enables fast trade execution.

Important Considerations

- The main difference between spot trading and futures trading lies in their capital requirements because spot trading demands full payment at the time of purchase but futures trading requires only a margin deposit.

- The process of futures trading requires traders to understand market behavior and leverage management techniques and risk control methods.

- The selection between these two methods depends on how much risk you can handle and what your investment goals are and your level of trading experience.

- The use of futures trading with leverage results in amplified market gains and losses which also increases the possibility of receiving margin calls and facing liquidation. [Link3]

Is Spot Trading Safer Than Bitcoin Derivatives?

The cryptocurrency market offers spot trading as a safer option than Bitcoin derivatives trading for new investors.

Key Differences in Safety and Risks

- The process of spot trading lets users purchase Bitcoin directly for ownership of the cryptocurrency. The value of underlying cryptocurrencies serves as the basis for derivatives trading but users do not gain ownership of the assets.

- The risk exposure in spot trading remains restricted to your initial investment because it does not use leverage. The use of leverage in derivatives trading including futures and options creates substantial market risks because it boosts both gains and losses. The market can trigger automatic position closure through liquidation when your position faces adverse market movements.

- The basic nature of spot trading makes it more accessible to new investors because it operates with straightforward principles. The complex nature of derivatives trading requires users to understand futures options and perpetual swaps as well as market behavior and margin requirements and funding rate mechanics.

- The main way to earn profits through spot trading depends on purchasing assets at lower prices before selling them at higher values. Derivatives trading enables users to generate profits from market price movements through long and short trading strategies.

- The cryptocurrency market volatility affects both spot trading and derivatives trading because it causes sudden price fluctuations which may result in financial losses.

The two trading methods share common risks which affect both spot trading and derivatives trading.

The main risks associated with spot trading include:

- The fast price movements in the market can result in financial losses when you sell your assets at lower prices.

- The lack of liquidity in less popular cryptocurrencies makes it challenging to find immediate buyers or sellers at your preferred price.

- The security of your assets becomes vulnerable when you store them on exchange platforms because hackers and account thieves can access your funds.

The main risks of derivatives trading include:

- The use of leverage in trading creates a high risk of liquidation when market conditions turn against your position which can result in major financial losses.

- The trading system requires traders to understand multiple contracts and their associated margin rules and funding rate mechanisms.

- The financial instability of your exchange and liquidity providers creates a risk to your funds because you depend on them for trading operations.

- The cryptocurrency market entry for beginners and long-term investors finds spot trading as their most suitable option because it provides a basic and secure method of investment. The use of leverage in derivatives trading creates substantial market risks that make it offers advanced trading capabilities and potentially higher returns. [Link4]

Why Traders Choose Bitcoin Derivatives Over Spot?

The growing number of traders selects Bitcoin derivatives instead of spot trading because these instruments provide better flexibility and higher profit potential through leverage and advanced risk management tools.

Advantages of Bitcoin Derivatives Trading

The ability to control bigger positions with minimal capital through leverage enables traders to maximize their investment returns. A trader can use 10x leverage to manage $10,000 worth of crypto assets by starting with only $1,000.

The risk management capabilities of derivatives enable traders to protect their investments through price movement protection like insurance policies.

Through derivatives traders can predict future market price movements in both rising and falling markets to generate profits from market volatility without requiring ownership of the underlying asset.

The derivatives market provides better liquidity which enables traders to execute trades quickly and obtain tighter price spreads.

The trading platform supports complex derivative strategies which include options spreads and futures arbitrage, but these options are unavailable in spot trading markets.

The continuous operation of crypto derivative markets enables traders can participate in market activities throughout the day and night because these markets stay open 24/7.

Through Bitcoin derivatives traders can access price movements without needing to possess or handle actual cryptocurrency assets.

Spot vs. Derivatives

Spot trading provides a basic system for asset ownership with reduced risk which makes it appropriate for new investors and long-term investors. The trading of derivatives requires advanced knowledge because it involves leverage and high-risk levels while providing sophisticated methods for professional traders.

| Parameter | Spot Trading | Derivatives Trading |

| Ownership | Direct ownership of Bitcoin | Contracts tracking Bitcoin’s price; no direct ownership |

| Risk | Lower risk; limited to initial investment | Higher risk due to leverage and volatility |

| Complexity | Straightforward; good for beginners | High complexity; requires understanding of contracts, margins, etc. |

| Strategy | Primarily buy-and-hold (HODLing) and simple buy/sell | Hedging, speculation, leverage, arbitrage, long/short positions |

| Liquidity | High | High |

Recent Market Developments

- The combined spot and derivatives trading volume reached $9.72 trillion during August 2025 according to CoinDesk.

- The spot trading market receives less trading volume than the derivatives market in the crypto sector.

- The regulated Bitcoin options market achieved more than $4 billion in open interest during Q2 2025.

- The total crypto derivatives market volume achieved $8.94 trillion during 2025.

- The combination of features in Bitcoin derivatives attracts advanced traders who need complex instruments to handle cryptocurrency market volatility. [Link5]

Conclusion

The process of understanding spot trading versus derivatives trading becomes essential for anyone who wants to manage Bitcoin price fluctuations effectively.

Spot trading allows you to acquire Bitcoin immediately at the market price. The process remains straightforward while providing minimal risk exposure.

But derivatives trading? The system allows traders to generate substantial profits through leverage and advanced trading methods.

The potential for greater profits in derivatives trading comes with elevated risks which affect beginners who lack understanding of contract mechanics.

New traders should focus on spot trades because they provide an easier learning experience with reduced risk exposure.

The analysis supports spot trades as an excellent choice for new investors because they offer straightforward understanding and lower risk exposure which suits long-term investment strategies.

Experienced traders choose derivatives because they enable short-selling and market protection through their advanced trading features. The distinction between these two trading methods requires absolute understanding from traders.

The financial goals of traders along with their skill level determine their ability to make effective trading decisions effectively.

The understanding of risks involved in both trading methods will assist you in creating your personal strategy for navigating the dynamic crypto market.

The included picture demonstrates the immediate nature of spot trading through visual representation which supports the explanation and connects to [cited].

Illustration of Spot Trade Definition and Application

References:

- Oktavia Weidmann. ‘Taxation of Derivatives and Cryptoassets.’ Kluwer Law International B.V., 6/10/2024

- Stehen Benjamin. ‘Crypto Trading For Beginners.’ A Step–by–Step Guide to Making Consistent Money from Crypto Trading (A Technical Analysis Guide), Stephen Benjamin, 3/2/2023

- Richard Barwell. ‘Teaching Secondary Mathematics as if the Planet Matters.’ Alf Coles, Routledge, 7/18/2013

- Link1

- Link2

- Link3

- Link4

- Link5

Image References:

- Image: Illustration of Spot Trade Definition and Application, Accessed: 2025. https://www.investopedia.com/thmb/8p8yZSBhDTFqn1TcMWPnUjoSoKU=/1500×0/filters:no_upscale():max_bytes(150000):strip_icc()/spottrade.asp-FINAL-1-40177b4823ab43f2878339de5a5e8dc0.png

You need to login in order to Like

Leave a comment