“WHEN FEAR IS GONE, MARKETS MOVE ON.”

Does the SEC’s approach to digital asset supervision change as a result of this? The Zcash Foundation inquiry has been formally closed by the U.S. Securities and Exchange Commission (SEC) without any enforcement action.

The ruling concludes a multi-year regulatory investigation into digital asset distribution activities that started in August 2023 when the SEC submitted a subpoena.

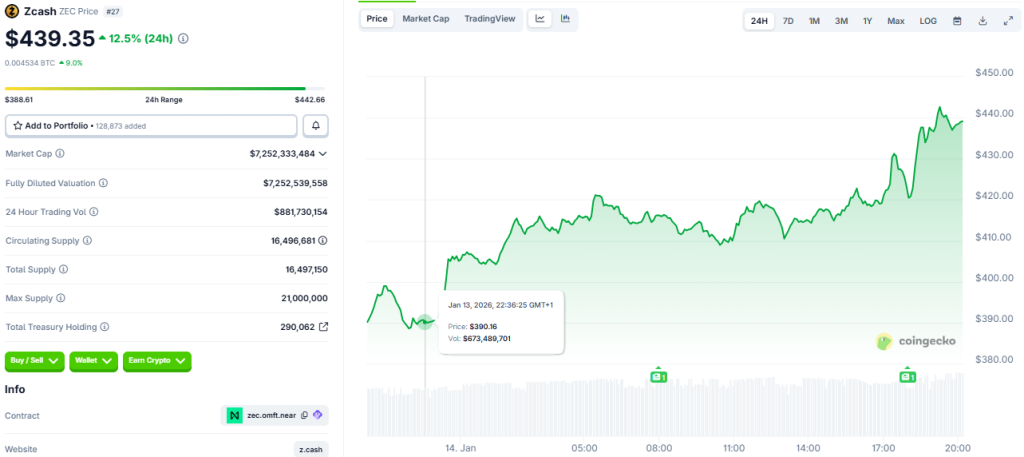

According to market data, the price of Zcash ($ZEC) increased by more than 12% in a single day after the announcement, reaching over $437.

Despite general market volatility, ZEC’s value has almost doubled over the last three months, outperforming many major cryptocurrencies. Following the removal of the regulatory overhang, investor confidence has been restored, as seen by the sharp move.

The Zcash Foundation, a nonprofit organisation with headquarters in the United States that aids in the creation of the Zcash privacy protocol, stated that it completely collaborated with authorities during the inquiry.

The company highlighted its long-standing dedication to responsible innovation, compliance, and openness in privacy-focused financial infrastructure.

Citing usual procedure, an SEC representative declined to comment on the specifics of the probe. Under the case title “In the Matter of Certain Digital Asset Offerings,” the investigation was started while former SEC Chair Gary Gensler was in office. Enforcement priorities have changed since then.

The SEC has closed investigations into numerous blockchain and DeFi enterprises and withdrawn a number of high-profile digital currency cases under current Chair Paul Atkins.

The Foundation said that the Zcash network is still stable and completely decentralised despite recent organisational changes within the larger Zcash ecosystem. The protocol still functions independently of any one business or leadership team.

You need to login in order to Like

Leave a comment