“Liquidity flows, confidence slows — but crypto grows where fiat woes show.”

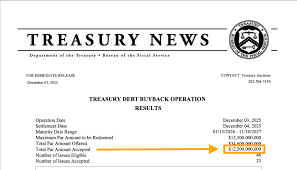

The US Treasury stunned markets with its largest-ever debt buyback of $12.5 billion, igniting heated debate in the cryptocurrency community.

According to analysts, this action may bring new liquidity into the market, suggesting that Bitcoin and other digital assets may see a brief increase in value.

In a Treasury buyback, the government takes out old bonds from the market and uses fresh money to pay for them. Traders, especially those in cryptocurrency exchanges, typically have access to more cash when there are more dollars in the system.

Because of this, some investors think that this buyback may serve as a temporary boost for altcoins like Ethereum and Bitcoin.

However, experts warn the story is not that simple. Such buybacks typically occur when the banking sector is under strain. When repo markets tightened in 2019, the Federal Reserve was forced to take action due to similar circumstances.

Therefore, the signal behind this buyback raises concerns even though liquidity may currently support cryptocurrency prices.

In the mid-term, traders may proceed cautiously. Large buybacks indicate that someone required assistance, and markets typically hold off on taking further action until they have more information.

This pause can slow momentum even if the first reaction was bullish.

Over time, the image changes significantly. Recurring dollar creation by the government gradually erodes trust in fiat money.

Due to this tendency, investors looking for non-printable assets find Bitcoin’s fixed supply more appealing.

For now, markets are watching closely. The buyback offers more liquidity, crypto feels lighter, but the question remains: Is this real fuel for a rally or a warning sign disguised as support?

You need to login in order to Like

Leave a comment