What is a Stablecoin?

Stablecoins and Their Role in Modern Finance

Stablecoins enable the financial industry to transform because they create digital payment systems that provide fast and convenient transactions across the digital world.

In contrast to their more volatile cryptocurrency counterparts, stablecoins maintain a stable value through their peg to assets like established fiat currencies, meaning their valuation is comparatively consistent.

The system maintains inherent stability which enables risk-free transactions without the price volatility that affects other digital currencies.

Stablecoins have proven successful in delivering quick and affordable international money transfers which help both international businesses and people across the world.

Future of Money Stablecoins

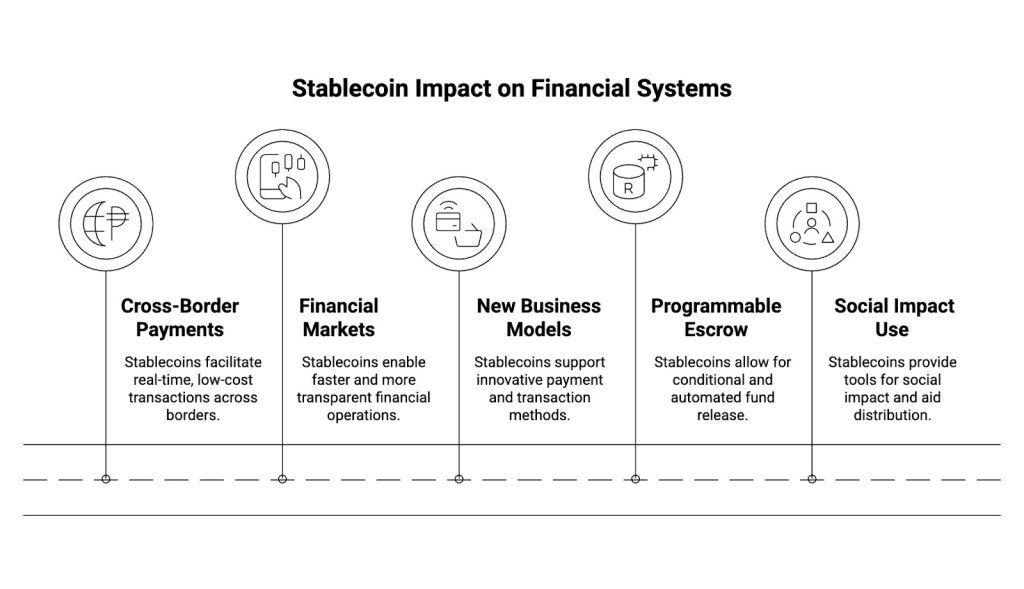

As we can see in [cited], stablecoins are definitely influencing financial models, paving the way for innovations such as smart-contract escrow and altogether novel business structures.

The new payment systems outperform traditional banking systems because they break down the fundamental operational structures of these systems.

Stablecoins have established themselves as essential drivers of monetary system transformation because they merge digital currency benefits with established financial stability features.

How Do Stablecoins Work?

Stablecoins achieve market stability through a system which links their value to reference assets during periods of market volatility.

Mechanics Behind Stablecoins:

- The system uses real-world assets such as fiat currency and gold and crypto to back the circulating supply which is stored in reserves.

- Users gain the ability to create new stablecoins through depositing collateral or by exchanging stablecoins for traditional monetary funds.

- The system operates through automated blockchain protocols which enable Smart Contracts for transparency and reserve verification through auditing processes.

The Tether minting process for new USDT coins happens when USDT demand increases because Tether creates additional coins that correspond to USD reserves at a 1:1 value ratio.

Circle publishes its 2025 Transparency Report which demonstrates that the company conducts regular monthly checks to confirm that USDC reserves equal the total number of circulating USDC tokens. [Source: Circle Transparency Report (2025)

Benefits of Using Stablecoins:

Image1. Impact of Stablecoins on Financial Systems

Stablecoins for Cross Border Payments

The Impact of Stablecoins on Payment Systems and Cross-Border Transactions

Payment systems have developed to fulfill both efficiency and transparency needs because stablecoins function as the necessary solution for this essential requirement.

Offering a decentralised option to traditional banking, stablecoins help enable near-instant, borderless transactions, cutting out those often pricey intermediaries you find with cross-border payments.

This is especially useful for remittances and global commerce, where the traditional banking fees can be just too high, and settlement times drag on.

The increasing adoption of stablecoins for international payments has become a major factor behind the increasing need for short-term U.S. government debt.

The potential of blockchain technology to transform global finance becomes evident through these developments which enhance both capital accessibility and market liquidity.

The image demonstrates market dynamics through its global market connections which show how stablecoins enable worldwide financial inclusion and international trade.

Stablecoins have evolved into essential transformational elements which go beyond their role as financial tools in modern payment systems.

Image2. Exploration of Stablecoins in Cross-Border Payments.

Stablecoins vs Traditional Banking

| Aspect | Traditional System | Stablecoin System |

| Transaction Costs | Average remittance cost: 6% of transaction value | Potential reduction to 2% of transaction value |

| Annual Savings for Developing Economies | N/A | Approximately $30 billion saved annually |

| Transaction Speed | Settlement typically takes 2-5 days | Near-instantaneous transactions |

| Market Adoption | Dominated by banks and financial institutions | Increasing integration with traditional financial infrastructure |

| Regulatory Framework | Established and well-regulated | Evolving regulatory landscape with ongoing discussions |

Impact of Stablecoins on Cross-Border Payments and Financial Systems

Are Stablecoins Safe? Regulation & Future Outlook

Regulatory Challenges and Future Outlook for Stablecoins

Stablecoins encounter multiple regulatory obstacles which will determine their long-term position in financial markets because their usage continues to expand.

Governments across the world face an ongoing challenge to comprehend digital currencies because they need to establish clear definitions about how these currencies are issued and managed and their regulatory requirements.

The United States and European Union have established new laws which demonstrate their commitment to developing standardized regulations for investor protection and market stability.

The U.S. Stablecoin Legislation requires users to track all reserves and maintain sufficient capital reserves to establish trust between users and institutions.

Stablecoins face an uncertain path forward because regulatory approaches between jurisdictions create obstacles for achieving smooth connections between established financial systems and the expanding decentralized finance (DeFi) market.

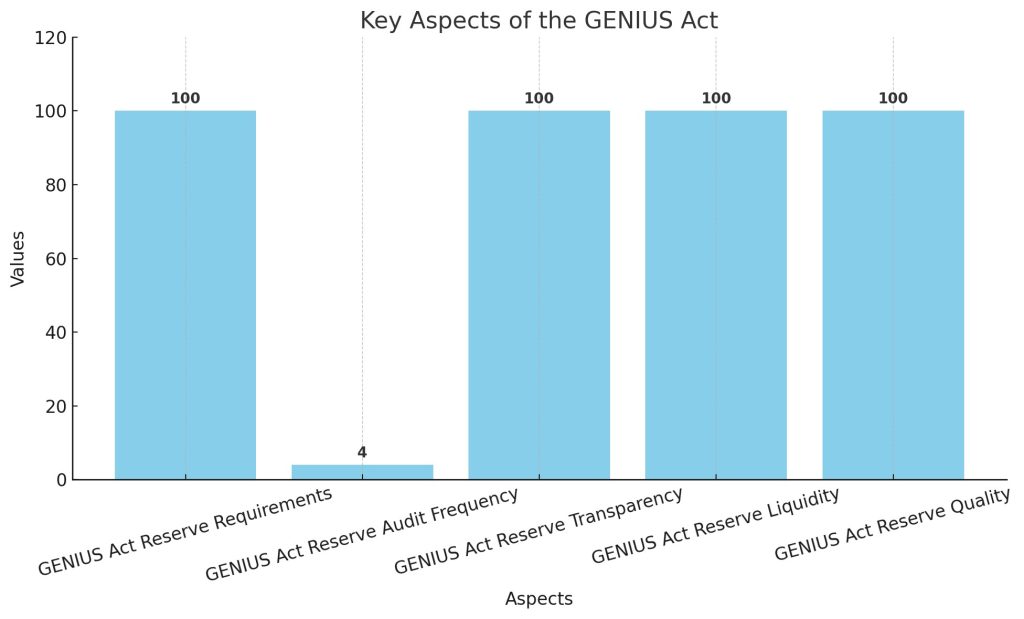

The future of stablecoins will depend on regulators finding the right balance between innovation and oversight as they modify their plans according to the image.

The bar chart shows the main elements of the GENIUS Act through its four sections which all receive a perfect score of 100. In contrast, the audit frequency is notably lower at 4. The data demonstrates the strict rules which were established to boost market stability and protect investors in stablecoins. [Download the Chart](sandbox:/mnt/data/genius_act_chart.png)

Stablecoins and Decentralized Finance

The DeFi system depends on stablecoins to maintain stability because these digital assets bring stability to its unstable environment.

DeFi Use Cases:

- The lending and borrowing operations of Aave and Compound protocols use USDC and DAI as their collateral assets.

- Users who add stablecoins to trading pairs receive fees through the liquidity pool system.

- Stablecoins enable users to achieve stable returns through DeFi investment strategies.

The total value locked (TVL) in DeFi reached more than $100 billion during 2025 because users needed stablecoin liquidity to operate.

Conclusion

Are Stablecoins a Good Investment?

Stablecoins have introduced major changes to financial operations because they transform our understanding of money usage. The system unites the fast operation of blockchain with the dependable features of conventional currencies.

The system enables users to make fast and cost-effective international money transfers. You can see this clearly in visuals, such as the image showing the effect of stablecoins on different financial areas, with a particular emphasis on getting more people included in the financial system and boosting international trade.

The new system represents a vital advancement because it operates much faster than the outdated banking system which proves to be both time-consuming and complex.

Stablecoins will probably become standard payment tools in everyday transactions when regulatory frameworks become established which will connect digital money to traditional financial systems.

Stablecoins enable stable currency exchange while establishing a foundation for money systems that will become more accessible and efficient and programmable in the future thus cementing their essential role in the developing digital economy.

References:

- Dr Anil Diggiwal. ‘The Future of Crypto: Trends, Opportunities, and Challenges.’ Blue Rose Publishers, 8/4/2023

- Yang Wang. ‘RWA Tokenisation in Web 3.0 Era.’ Shusong Ba, Springer Nature, 8/1/2025

- Fouad Sabry. ‘Circle Company.’ Exploring the Future of Digital Finance and Stablecoins, One Billion Knowledgeable, 5/26/2025

- Circle Transparency Report (2025).

Image References:

- Image: Impact of Stablecoins on Financial Systems, Accessed: 2025. https://cdn.thedefiant.io/ad_4nxcjsiwo2v1q7_zhsovrmcxhuxyduayhg816wxaxjy_hjtfxzoswueoq-3bb3fc2b-44c0-48f5-afff-fc1f5cd83ca0.png

- Image: Exploration of Stablecoins in Cross-Border Payments., Accessed: 2025. https://cdn.prod.website-files.com/65f28017eaba8cd1f912fa9f/685ebd90cfdf9bc1c5884660_axelar-knowledge-center-remittances-cross-border-payments-title-graphic-small.png

You need to login in order to Like

Leave a comment