Is the Wall Street launch of Ripple’s XRP coming soon? Major firms including Bitwise, 21Shares, Franklin Templeton, CoinShares, and Canary Capital, have recently introduced XRP spot ETFs on the DTCC platform, showing that the cryptocurrency market may be closer than ever to success.

The DTCC listing is an important milestone, even though it does not yet indicate SEC approval. It shows that fund managers have finished the majority of the setup and are ready to go live as soon as regulators reopen and make final judgments.

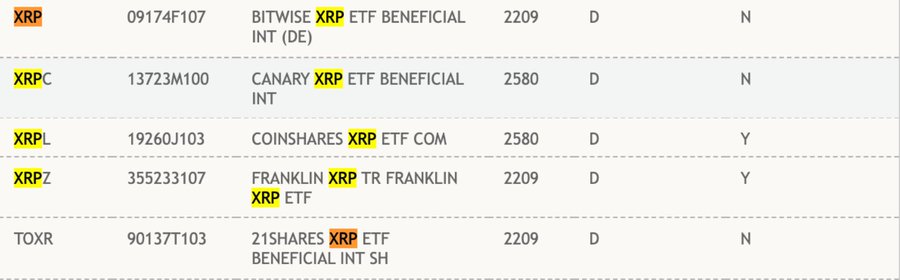

Ripple XRP ETF listing update shared by CryptoDotNews on X

Bitwise XRP ETF, 21Shares XRP ETF (TOXR), Franklin XRP ETF (XRPZ), and a number of others from CoinShares, Amplify, and Volatility Shares are among the listed ETFs. Top asset managers’ general engagement shows the increasing institutional trust in Ripple’s ecosystem.

The supply of XRP on exchanges has fallen to its lowest point since 2021, according to blockchain data. Similar to the whale buildup observed prior to the introduction of Bitcoin and Ethereum ETFs, the number of wallets holding 1–10 million XRP has reached record highs.

XRP continues to see resistance between $2.30 and $2.40 despite ETF optimism. While a failure might keep prices going sideways, a breakout above $2.40 might pave the road for $2.70.

An important turning point for Ripple is the DTCC listing of several XRP ETFs, which indicates strong investor interest and is ready for Wall Street entry. Growing whale stockpiling and decreased exchange supply suggest that XRP may be preparing for its next crypto bull run, even though SEC permission is still pending.

You need to login in order to Like

Leave a comment