SEPT 17: FED RATE CUT DECISION + POWELL SPEECH

The Federal Reserve is expected to reduce rates widely, but the true attention of the market will be to Jerome Powell’s press conference. If Jerome Powell gives a hint about further rate reduction possibilities, risk assets, particularly crypto and altcoins, may rise with increased liquidity expectations, On the contrary, a more defensive approach may cut down enthusiasm. Currently all eyes on 17th sep 2025.

SEPT 18: US Initials Jobless claims and discussion

The Labor market figures continue to be an important gauge of economic strength. A softer jobs market can support the Fed’s dovish trajectory, while better-than-anticipated claims can test the rate-cut story. Short-term market volatility is expected around release.

SEPT 19: $4.9 TRILLION OPTIONS EXPIRY, BOJ RATE CUT DECISION

This Thursday sees one of the year’s biggest options expiries. Almost $5 trillion in contracts are about to be expired, and that tends to drive short-term volatility as positions are rolled or unwound. Historically, this type of event has caused chaos in equities and crypto markets.

ALT will explode if Powell signals more cuts, sources say.

At the same time, the Bank of Japan is also due to make a critical call. An unexpected rate cut might soften the yen and send shockwaves through global FX markets, introducing a new level of uncertainty. It’s good fun watching what’s going to happen over the next few days.

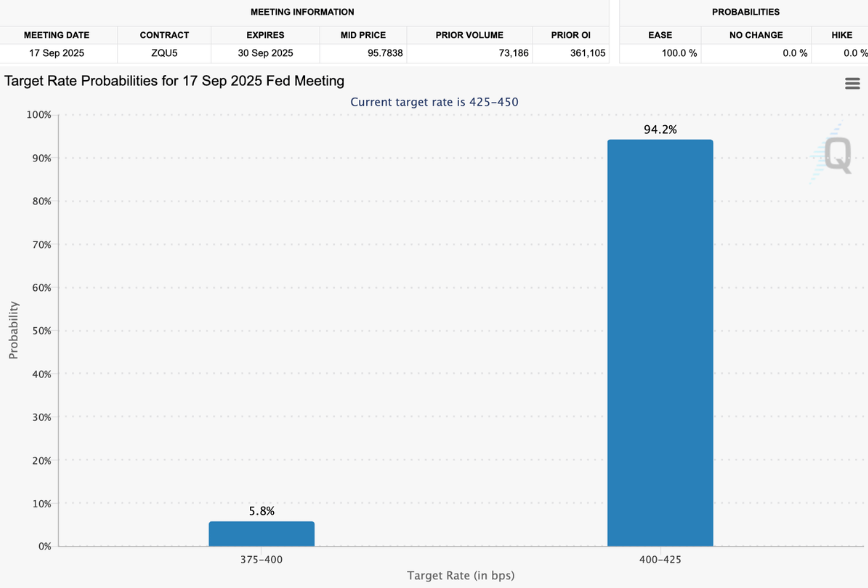

As per the Chart the PROBABILITY OF RATE CUTS THIS WEEK PUMPED TO 100%

What This Means for Markets

If Powell suggests more cuts: liquidity-sensitive assets (altcoins, growth stocks) might experience explosive upwards. If options expiry takes over the headlines: stocks and crypto may experience short-term selling pressure before levels out. And If both catalysts are on the same page: we might see violent swings, with whipsaw price action across several asset classes.

Trading Outlook

Crypto traders: Monitor BTC dominance. A dovish Fed might push capital into alts, but volatility related to options might cause shakeouts to ensue first. Equity traders: Be prepared for choppy conditions through Thursday. Positioning ahead of expiry will be crucial. FX traders: Monitor USD/JPY — changes in BoJ policy may have spillover effects on global risk sentiment.

Bottom Line

One of the most important weeks of the quarter, this one comes with the Fed, employment data, a record options expiry, and the BoJ all lined up. Sharp moves, quick reversals, and giant opportunities are to be expected. Remain agile, keep risk under control, and expect

Volatility.

You need to login in order to Like

Leave a comment